Pound Sterling Price News and Forecast: GBP/USD dips to 1.3457 as Fed turmoil boosts US Dollar rebound

GBP/USD dips to 1.3457 as Fed turmoil boosts US Dollar rebound

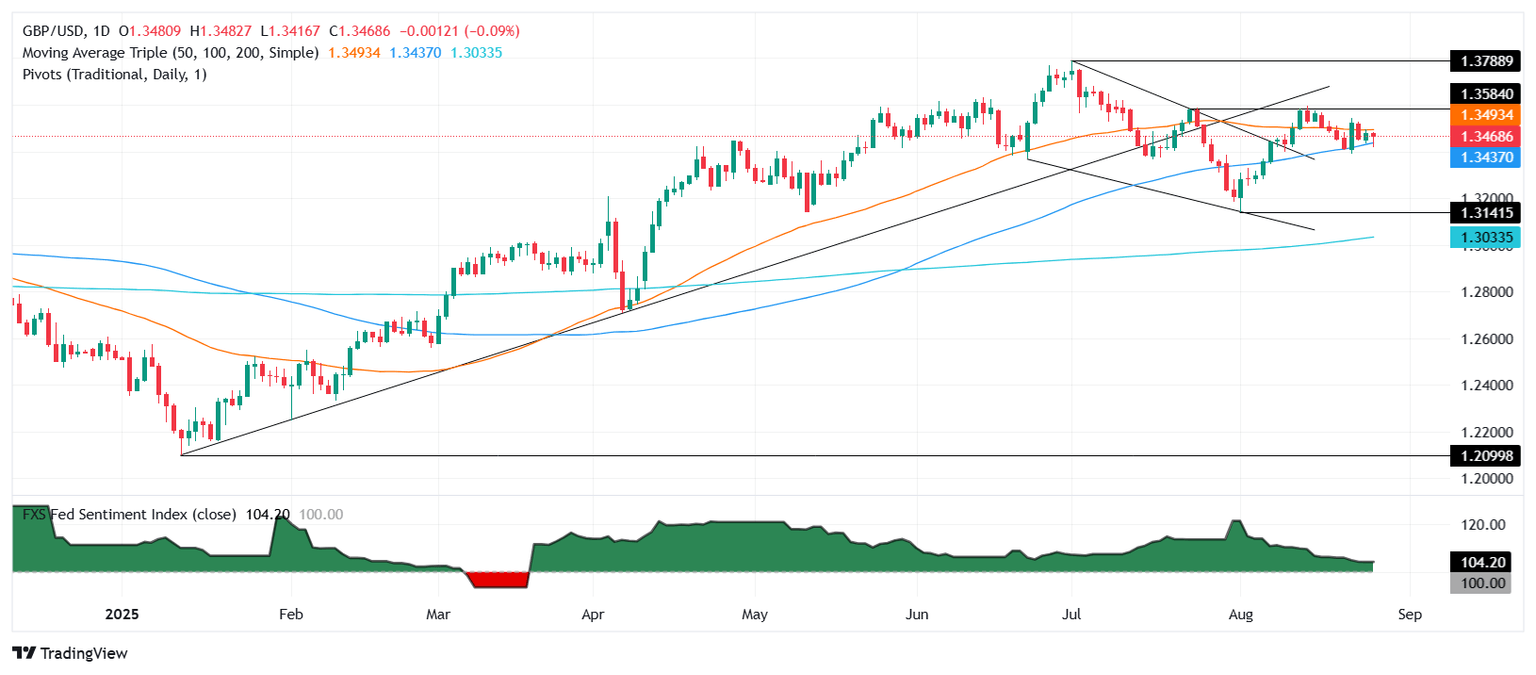

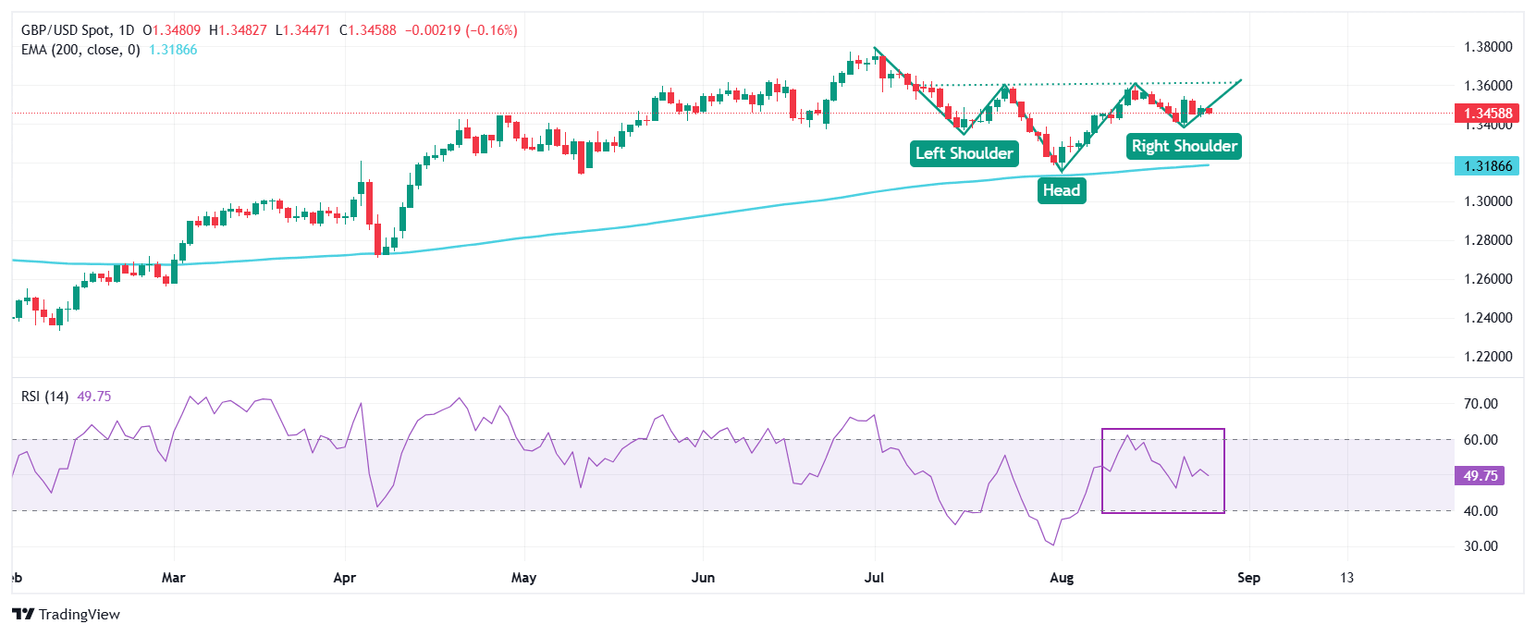

GBP/USD drops over 0.16% on Wednesday as the US Dollar (USD) continues to recover some ground, courtesy of the White House's threats to the independence of the Federal Reserve (Fed), which triggered a rise on the long end of US Treasury bond yields. The pair trades at 1.3457 after slipping from a daily peak of 1.3482. Read More...

Pound Sterling dips against US Dollar after Fed Cook's lawsuit

The Pound Sterling (GBP) trades lower to near 1.3440 against the US Dollar (USD) during the European trading session on Wednesday. The GBP/USD pair falls as the US Dollar gains slightly, following the announcement from Federal Reserve (Fed) Governor Lisa Cook that she will file a lawsuit against her termination by United States (US) President Donald Trump. Read More...

GBP/USD falls to near 1.3450, upside appears on fading BoE rate cut bets

GBP/USD retraces its recent gains from the previous session, trading around 1.3450 during the Asian hours on Wednesday. The pair may regain its ground as the Pound Sterling (GBP) receives support from the dampened likelihood of further Bank of England (BoE) rate cuts, driven by persistent inflationary pressures. Inflation in the UK economy has been accelerating at a faster pace in recent months. Read More...

Author

FXStreet Team

FXStreet