GBP/USD dips to 1.3457 as Fed turmoil boosts US Dollar rebound

- GBP/USD slides despite Trump’s firing of Fed Governor Lisa Cook, fueled by fears about the Fed’s independence.

- Fed cut odds at 89% for September, but Powell keeps the door open to policy adjustment if labor weakens.

- UK factory inflation hit a two-year high, with markets pricing a 96% chance that the BoE will keep rates unchanged.

GBP/USD drops over 0.16% on Wednesday as the US Dollar (USD) continues to recover some ground, courtesy of the White House's threats to the independence of the Federal Reserve (Fed), which triggered a rise on the long end of US Treasury bond yields. The pair trades at 1.3457 after slipping from a daily peak of 1.3482.

Sterling softens as Fed independence fears lift US yields; BoE seen holding rates steady on inflation risks

There is a mixed market mood due to rumors that US President Donald Trump fired Fed Governor Lisa Cook, allegedly over allegations of mortgage fraud. Initially, the US Dollar weakened, but it has so far recovered, as depicted by the US Dollar Index (DXY), which tracks the performance of the US Dollar’s value against a basket of six currencies, up 0.24%, at 98.45.

Despite this, the Greenback’s recovery could be short-lived as the Fed Chair Jerome Powell opened the door to “adjust” interest rates. If the labor market continues to deteriorate and inflation eases, it is almost certain that the central bank will reduce interest rates at the September meeting.

Fed odds of a 25 basis points (bps) rate cut at the September meeting are at 87.2%, according to the FedWatch tool.

Across the pond, the British factory gate inflation rose to a two-year peak of 1.9% YoY in June, as revealed by preliminary data on Wednesday. So far, Sterling seems poised to post gains over the month, up around 1.5% against the US Dollar, and is set to extend its gain as recently released data suggests that the Bank of England (BoE) could pause its easing cycle.

Bank of England Monetary Policy Committee member Catherine Mann said that “A more persistent hold on Bank Rate is appropriate right now, to maintain the tight-but-not-tighter monetary policy stance needed to lean against inflation persistence,” on Tuesday.

Expectations that the BoE would keep rates unchanged are at 96%, according to the Prime Market Terminal Interest Rate Probability tool.

Ahead in the week, traders will be watching the release of US GDP figures, Initial Jobless Claims for the previous week, and remarks by Fed Governor Christopher Waller.

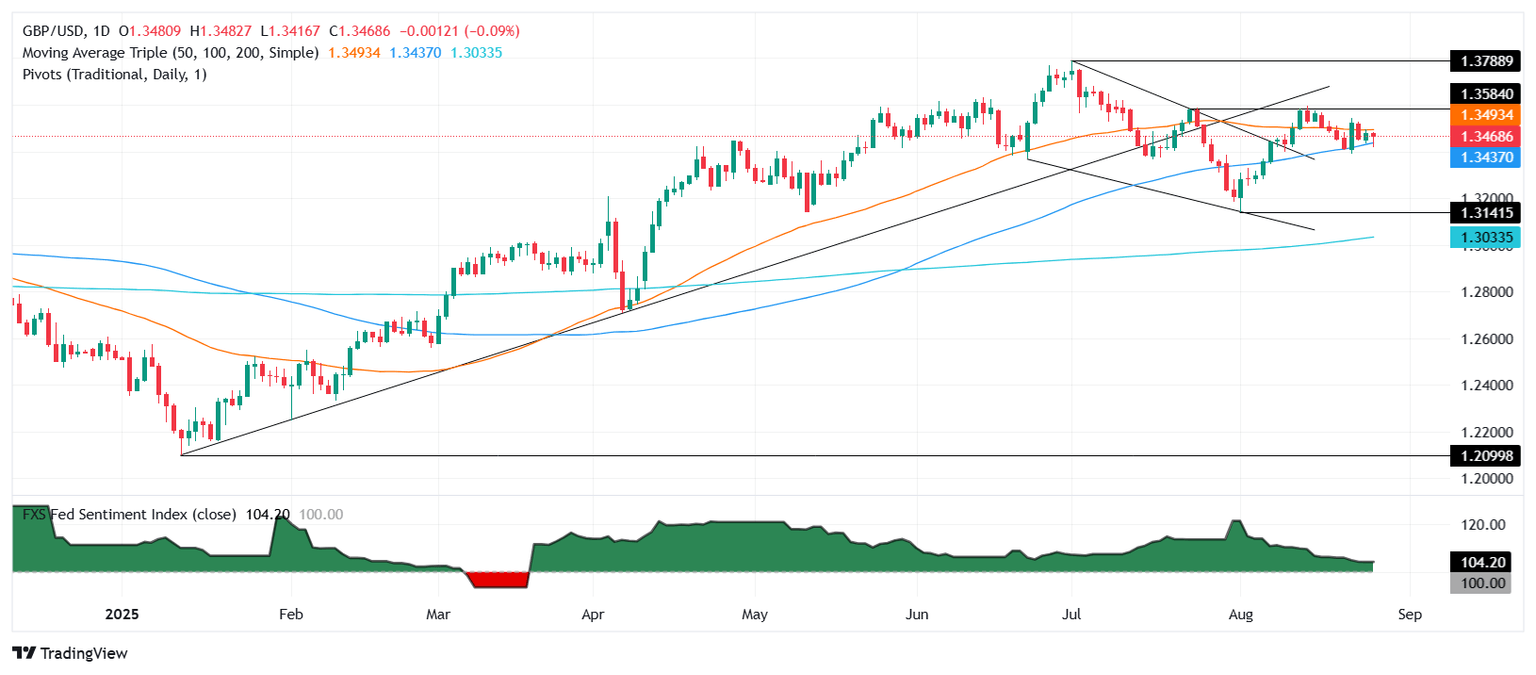

GBP/USD Price Forecast: Terminal outlook

The GBP/USD pair remains consolidated, unable to break the 50-day Simple Moving Average (SMA) at 1.3490, which is hindering a test of the 1.35 handle. From a momentum standpoint, the Relative Strength Index (RSI) is flat, indicating a lack of catalyst that could increase volatility in the pair.

On the upside, GBP/USD could test 1.3500, followed by the August 27 peak of 1.3544 and 1.3600. Conversely, if the pair slides below 1.3450, the next area of interest would be the 20-day SMA at 1.3432, followed by 1.3400 and the 100-day SMA at 1.3369.

Pound Sterling Price This week

The table below shows the percentage change of British Pound (GBP) against listed major currencies this week. British Pound was the strongest against the Euro.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 1.01% | 0.36% | 0.59% | 0.03% | 0.01% | 0.41% | 0.25% | |

| EUR | -1.01% | -0.64% | -0.45% | -0.97% | -0.92% | -0.61% | -0.75% | |

| GBP | -0.36% | 0.64% | 0.04% | -0.33% | -0.33% | 0.05% | -0.11% | |

| JPY | -0.59% | 0.45% | -0.04% | -0.51% | -0.55% | -0.11% | -0.22% | |

| CAD | -0.03% | 0.97% | 0.33% | 0.51% | 0.00% | 0.41% | 0.22% | |

| AUD | -0.01% | 0.92% | 0.33% | 0.55% | -0.00% | 0.38% | 0.22% | |

| NZD | -0.41% | 0.61% | -0.05% | 0.11% | -0.41% | -0.38% | -0.16% | |

| CHF | -0.25% | 0.75% | 0.11% | 0.22% | -0.22% | -0.22% | 0.16% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.