Pound Sterling dips against US Dollar after Fed Cook's lawsuit

- The Pound Sterling slides to near 1.3430 against the US Dollar on Wednesday.

- Fed’s Cook announces that she will file a lawsuit against her termination by US President Trump.

- BoE’s Mann expressed a hawkish stance on interest rate guidance.

The Pound Sterling (GBP) trades lower to near 1.3440 against the US Dollar (USD) during the European trading session on Wednesday. The GBP/USD pair falls as the US Dollar gains slightly, following the announcement from Federal Reserve (Fed) Governor Lisa Cook that she will file a lawsuit against her termination by United States (US) President Donald Trump.

At the time of writing, the US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, rises to near 98.60.

On Tuesday, Fed Cook’s lawyer said in a statement, “His [Trump] attempt to fire her, based solely on a referral letter, lacks any factual or legal basis. We will be filing a lawsuit challenging this illegal action,” Reuters reported.

Regardless of the outcome of the lawsuit filed by Fed Governor Cook, market experts believe that Trump’s attempt to politicize the Fed is a big threat to the US Dollar’s dominance. "Investors will naturally start to increasingly question the independence of the Fed, which would result in a steeper yield curve and a weaker dollar,” analysts at ING said, Reuters reported.

Experts also believe that the entry of one more of Trump’s guys into the rate-setting committee would strengthen the bid for more interest rate cuts in the near term.

Pound Sterling trades stably as BoE's Mann calls for tight monetary policy stance

- The Pound Sterling trades broadly stable, on a calm day, on Wednesday, as Bank of England (BoE) Monetary Policy Committee (MPC) member Catherine Mann has argued in favor of holding interest rates at their current levels for a longer period, as inflation is proving to be persistent, until any downside risks to economic growth materialize.

- "A more persistent hold on Bank Rate is appropriate right now, to maintain the tight - but not tighter - monetary policy stance needed to lean against inflation persistence persisting," Mann said on Tuesday in a speech at a conference to mark the Bank of Mexico's (Banxico) 100th anniversary, Reuters reported.

- In the last three months, inflation in the United Kingdom (UK) has been accelerating at a faster pace. In July, the headline Consumer Price Index (CPI) rose at an annual pace of 3.8%, the highest level seen in almost 18 months.

- In the policy meeting earlier this month, the BoE reduced interest rates by 25 basis points (bps) to 4%, with a slim majority, and guided a “gradual and careful” monetary policy expansion.

- Going forward, the GBP/USD pair will be influenced by the US Personal Consumption Expenditures Price Index (PCE) data for July, which will be released on Friday. The core PCE inflation data, which is closely tracked by Fed officials as it excludes volatile food and energy items, is expected to have grown at an annual pace of 2.9%, faster than the prior release of 2.8%.

- According to the CME FedWatch tool, there is an 87% chance that the Fed will cut interest rates in the September monetary policy meeting.

Technical Analysis: Pound Sterling forms inverse Head and Shoulder pattern

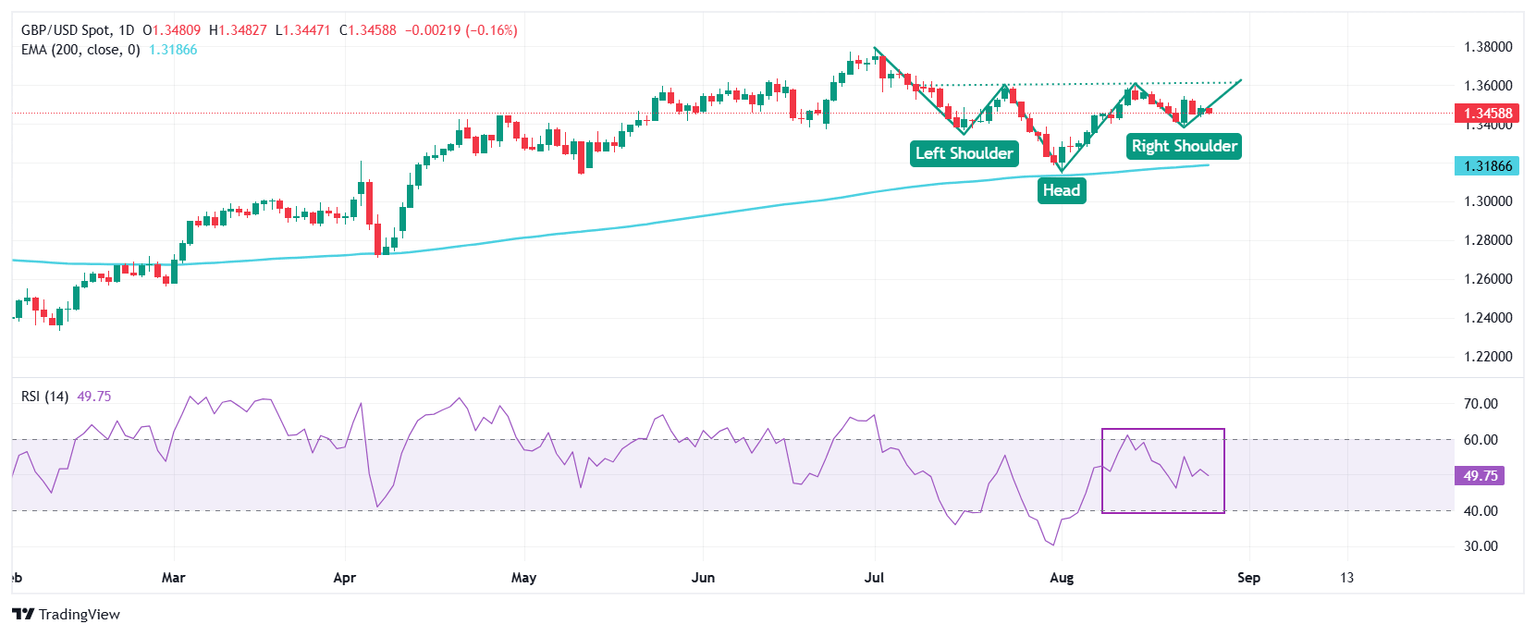

The Pound Sterling falls to near 1.3440 against the US Dollar on Wednesday. The overall trend of the GBP/USD pair is bullish as it remains above the 200-day Exponential Moving Average (EMA), which trades around 1.3186.

The Cable is also forming an inverse Head and Shoulder (H&S) chart pattern, which leads to a bullish reversal after a corrective or downside move. The neckline of the H&S pattern is placed around 1.3580.

The 14-day Relative Strength Index (RSI) oscillates inside the 40.00-60.00 range, suggesting a sharp volatility contraction.

Looking down, the August 11 low of 1.3400 will act as a key support zone. On the upside, the July 1 high near 1.3790 will act as a key barrier.

US Dollar FAQs

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022. Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.