Pound Sterling Price News and Forecast: GBP/USD could see further gains as the US Dollar may struggle

GBP/USD moves below 1.3000, downside seems limited as US Dollar remains vulnerable

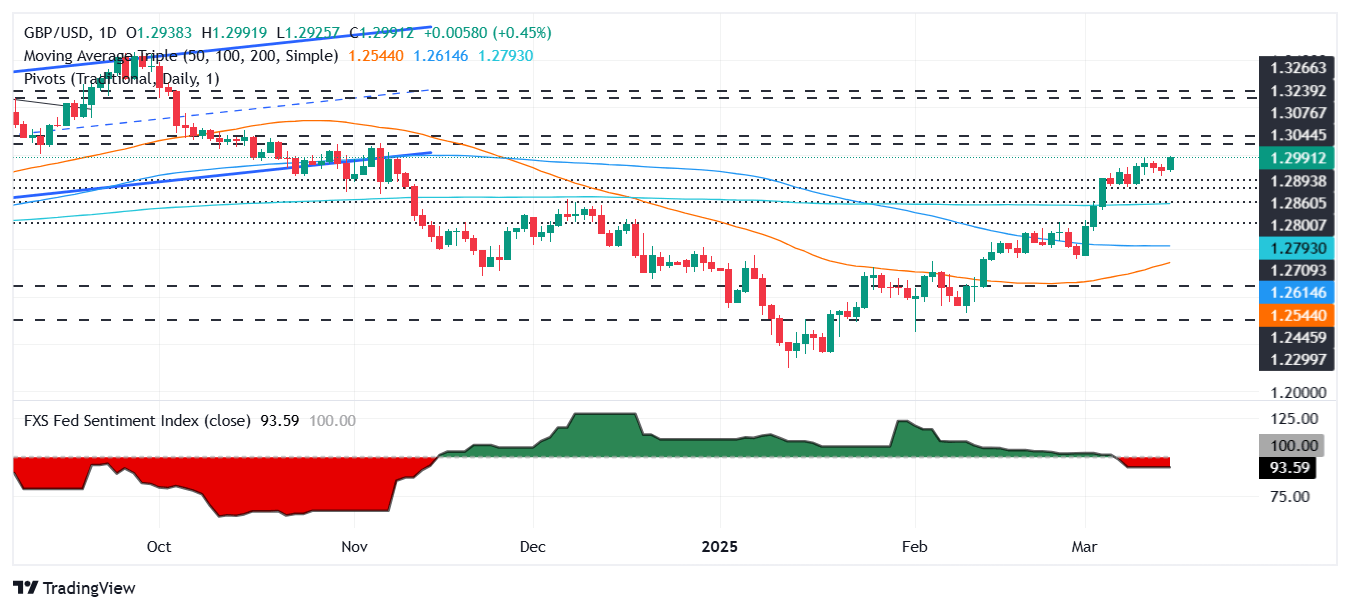

GBP/USD retreats after gaining in the previous session, hovering around 1.2970 during Asian trading on Tuesday. The pair faces pressure as the US Dollar (USD) attempts to recover losses from the last two sessions. However, downside movement may be limited, as the Greenback remains vulnerable amid rising trade tensions and growing economic concerns in the United States (US).

The US Dollar Index (DXY), which tracks the USD against six major currencies, trades positively around 103.50 at the time of writing. However, the US Dollar could further lose ground as weak US economic data and Trump’s tariff threats add to investor uncertainty. Read more...

GBP/USD nears multi-week highs, eyes on 1.3000

The Pound Sterling advances as the Greenback weakens, testing last week's high of 1.2987. Investors eye crucial monetary policy decisions by the US Federal Reserve (Fed) and the Bank of England (BoE). The GBP/USD trades at 1.2975, up 0.31%.

The US Dollar remains pressured as Retail Sales in February rose by 0.2% MoM, missing estimates of 0.6% and improved compared to January’s -1.2% fall. Nevertheless, other data revealed by the New York Fed showed that manufacturing activity dipped from 5.7 to -20, with input prices increasing to their highest level in more than two years, revealed the survey. Read more...

Author

FXStreet Team

FXStreet