GBP/USD nears multi-week highs, eyes on 1.3000

- GBP/USD climbs 0.31%, approaching last week's peak of 1.2987 amid broad-based US Dollar weakness.

- US Retail Sales miss forecasts; New York Fed manufacturing activity plunges, heightening recession fears and Fed easing expectations.

- Markets await crucial BoE policy meeting on Thursday; investors betting on steady rates now but pricing future cuts into 2025.

The Pound Sterling advances as the Greenback weakens, testing last week's high of 1.2987. Investors eye crucial monetary policy decisions by the US Federal Reserve (Fed) and the Bank of England (BoE). The GBP/USD trades at 1.2975, up 0.31%.

GBP/USD nears multi-week highs as disappointing US data fuels recession worries, pressuring Treasury yields

The US Dollar remains pressured as Retail Sales in February rose by 0.2% MoM, missing estimates of 0.6% and improved compared to January’s -1.2% fall. Nevertheless, other data revealed by the New York Fed showed that manufacturing activity dipped from 5.7 to -20, with input prices increasing to their highest level in more than two years, revealed the survey.

Recent data shows that the US economy continues to slow down, increasing recession fears. Therefore, traders had priced in 64 basis points of easing by the Fed, which has sent US Treasury yields plunging alongside the American Currency.

The US 10-year Treasury note yields fell four and a half bps to 4.277%. Meanwhile, the US Dollar Index (DXY), which tracks the Greenback's performance against a basket of six currencies, dropped 0.34% to 103.38.

The BoE meets on Thursday this week, and it is expected to hold rates unchanged. Despite this, interest rate futures traders estimate 50 bps of easing towards the end of 2025. After this, traders will eye next week’s finance minister Rachel Reeves update on public finances.

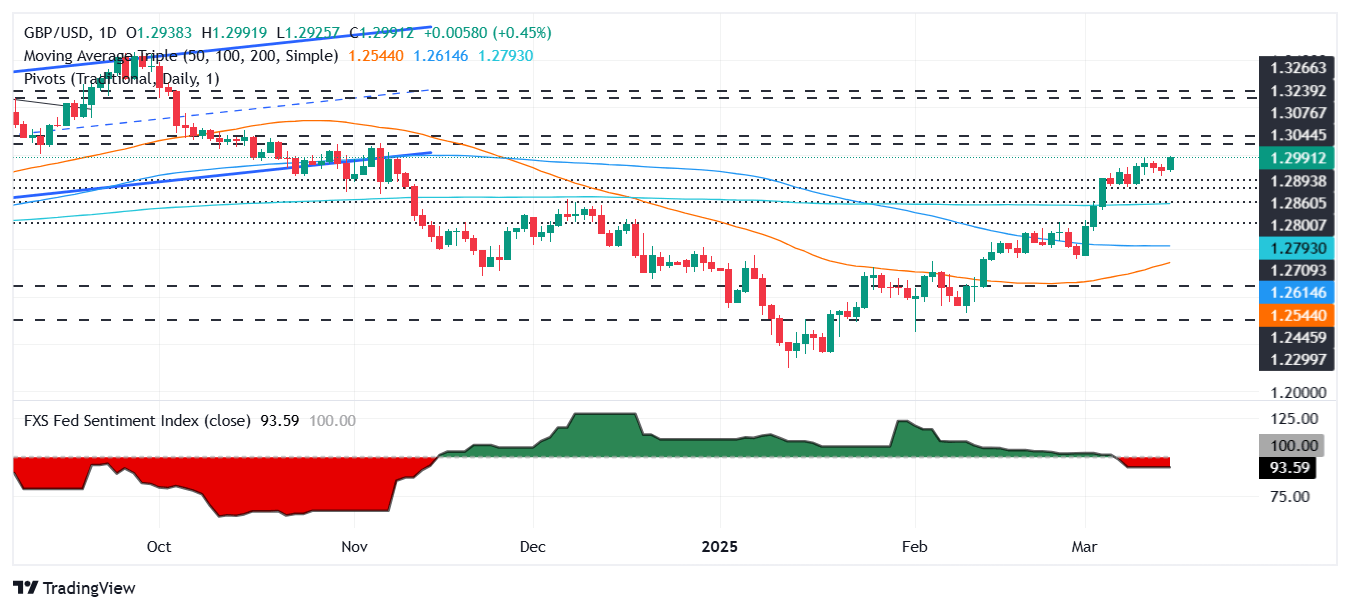

GBP/USD Price Forecast: Technical outlook

Price action suggests that the GBP/USD could test the 1.3000 figure in the near-term, after the pair cleared the 200-day Simple Moving Average (SMA) at 1.2793. If the pair exceeds 1.3000 it will be poised th challenge the November 6 swing high at 1.3047, ahead of 1.3100.

Conversely, if GBP/USD struggles at 1.3000, the pair could drop to 1.2911 March 17 daily low, followed by the March 10 through at 1.2861.

British Pound PRICE Today

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the strongest against the US Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.43% | -0.41% | -0.15% | -0.58% | -0.65% | -1.14% | -0.55% | |

| EUR | 0.43% | -0.09% | -0.10% | -0.13% | -0.35% | -0.72% | -0.13% | |

| GBP | 0.41% | 0.09% | 0.31% | -0.26% | -0.27% | -0.64% | -0.11% | |

| JPY | 0.15% | 0.10% | -0.31% | -0.43% | -0.71% | -0.94% | -0.52% | |

| CAD | 0.58% | 0.13% | 0.26% | 0.43% | -0.27% | -0.56% | -0.51% | |

| AUD | 0.65% | 0.35% | 0.27% | 0.71% | 0.27% | -0.35% | 0.23% | |

| NZD | 1.14% | 0.72% | 0.64% | 0.94% | 0.56% | 0.35% | 0.58% | |

| CHF | 0.55% | 0.13% | 0.11% | 0.52% | 0.51% | -0.23% | -0.58% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.