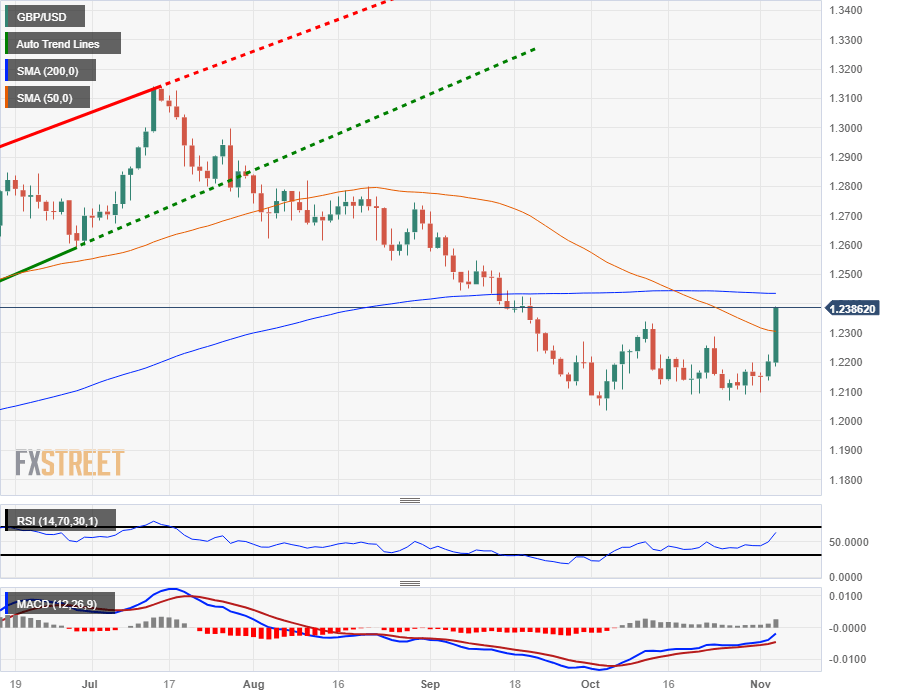

Pound Sterling Price News and Forecast: GBP/USD consolidates in a range below 1.2400 mark

GBP/USD consolidates in a range below 1.2400 mark, near six-week top set on Friday

GBP/USD soaring into 1.24, set for its best trading day since March

The GBP/USD is climbing into the 1.2400 handle to cap off a trading week that saw the pair mostly flounder around the averages.

After US Nonfarm Payrolls (NFP) came in well below expectations the Pound Sterling (GBP) climbed 1.6% from Friday's opening bids near 1.2190, and the GPB/USD is up almost 2.5% from the week's lows of 1.2095. Read More...

Pound Sterling rallies on improved market sentiment

Author

FXStreet Team

FXStreet