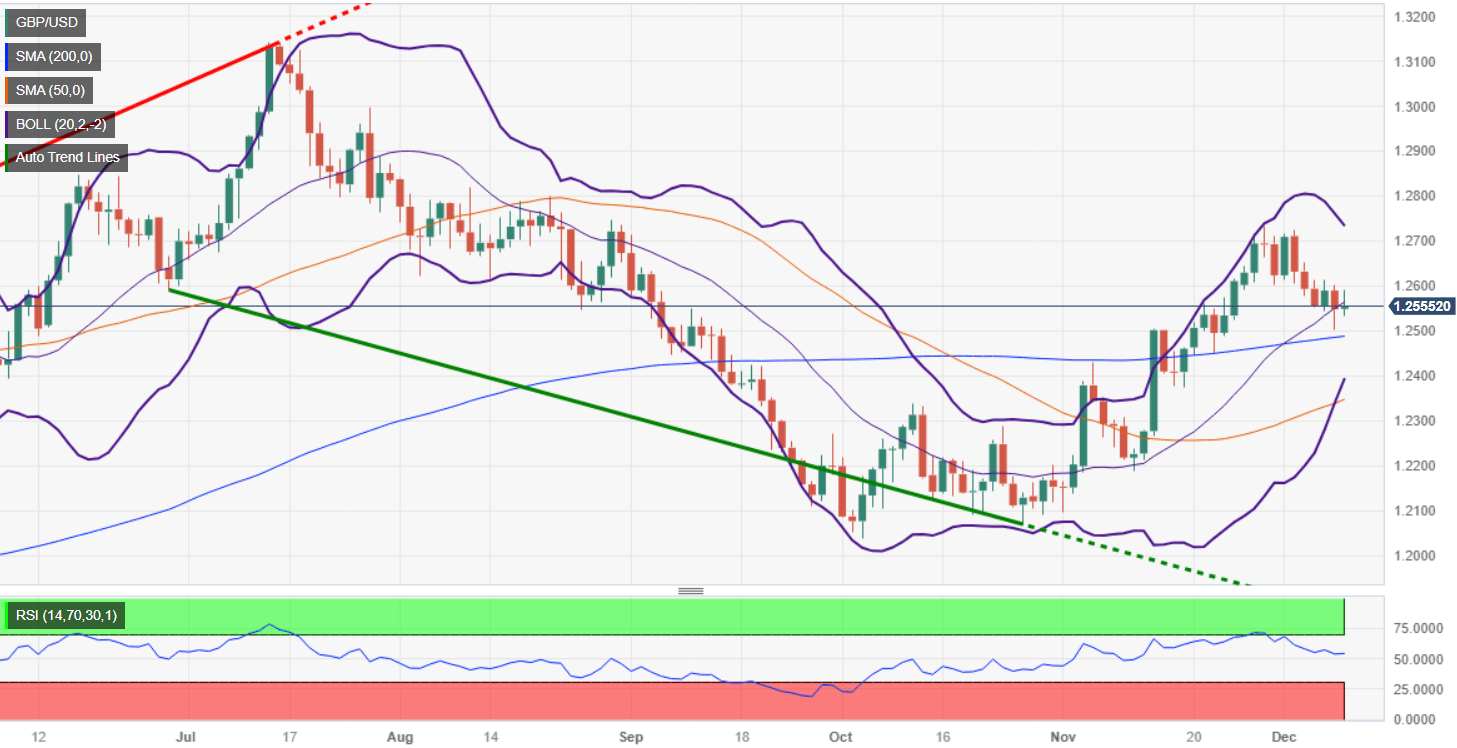

GBP/USD clings to minimal gains at around 1.2550s, ahead of US CPI

The

Pound Sterling (GBP) recovered some ground against the US Dollar (USD) amidst a session characterized by mixed market sentiment, ahead of crucial

monetary policy decisions of the US Federal Reserve (Fed) and the Bank of England (BoE). The GBP/USD trades at 1.2558, registering minuscule gains of 0.10%.

Read More...

GBP/USD ticks up above 1.2550 as US Dollar recovery stalls

The Sterling is trimming some losses on Monday’s European session, with the US Dollar losing upside momentum. The broader bearish trend, however, remains active, with investors cautious ahead of key UK data and major central banks’ decisions.

Read More...

GBP/USD Price Analysis: The key contention level is seen at 1.2500

The GBP/USD pair remains under pressure below the mid-1.2500s during the early European session on Monday. Investors are in a cautious mood ahead of the key events in the US and UK

this week. The Federal Open Market Committee (FOMC) rate decision on Wednesday and the Bank of England (BoE) rate decision on Thursday will be in the spotlight this week and could trigger volatility in the market. The major pair currently trades near 1.2539, losing 0.07% on the day.

Read More...

-638378745953562042.png&w=1536&q=95)