GBP/USD clings to minimal gains at around 1.2550s, ahead of US CPI

- GBP/USD stays on the front foot ahead of a busy economic docket in the US and the UK.

- If US inflation rises above forecasts, traders could expect a “hawkish” message by the Fed on Wednesday.

- The Federal Reserve and the Bank of England are expected to keep rates unchanged in their last monetary policy meetings.

The Pound Sterling (GBP) recovered some ground against the US Dollar (USD) amidst a session characterized by mixed market sentiment, ahead of crucial monetary policy decisions of the US Federal Reserve (Fed) and the Bank of England (BoE). The GBP/USD trades at 1.2558, registering minuscule gains of 0.10%.

US inflation is expected to print mixed figures in headline and core CPI

GBP/USD price action remains subdued as traders are awaiting the release of US inflation figures on Tuesday. The Consumer Price Index (CPI) in November is estimated to tick higher on monthly figures, from 0% to 0.2%, while annually based is estimated to dip from 3.2% to 3.1%. Excluding volatile items, the so-called core CPI is foreseen to climb in monthly data from 0.2% to 0.3%; an annually to remain unchanged at 4%.

If US inflation data comes higher than expected, that could prevent the Fed from adopting a dovish stance, and it might reinforce their hawkish stance, which market players have mainly ignored. Interest rate probabilities for 2024 project the Fed will slash rates by 100 basis points, from around 5.25% - 5.50% to 4.25% -4.50%.

Across the Atlantic, central bank rate cuts is also the financial markets narrative. Market participants expect the BoE would cut rates, but the question is when? The swaps markets foresee 75 basis points of rate cuts for the next year, though traders expect the UK central bank would be the last of the three major, between the European Central Bank (ECB) and the Fed, to ease monetary policy.

On Thursday, the BoE is expected to hold rates unchanged and reinforce their higher for longer stance.

Simon Harvey, Head of Analysis at Monex, noted, “For GBP/USD, this is unlikely to be a game changer, with the focus instead on dollar dynamics given the release of US CPI on Tuesday and fresh economic projections from the Fed on Wednesday.”

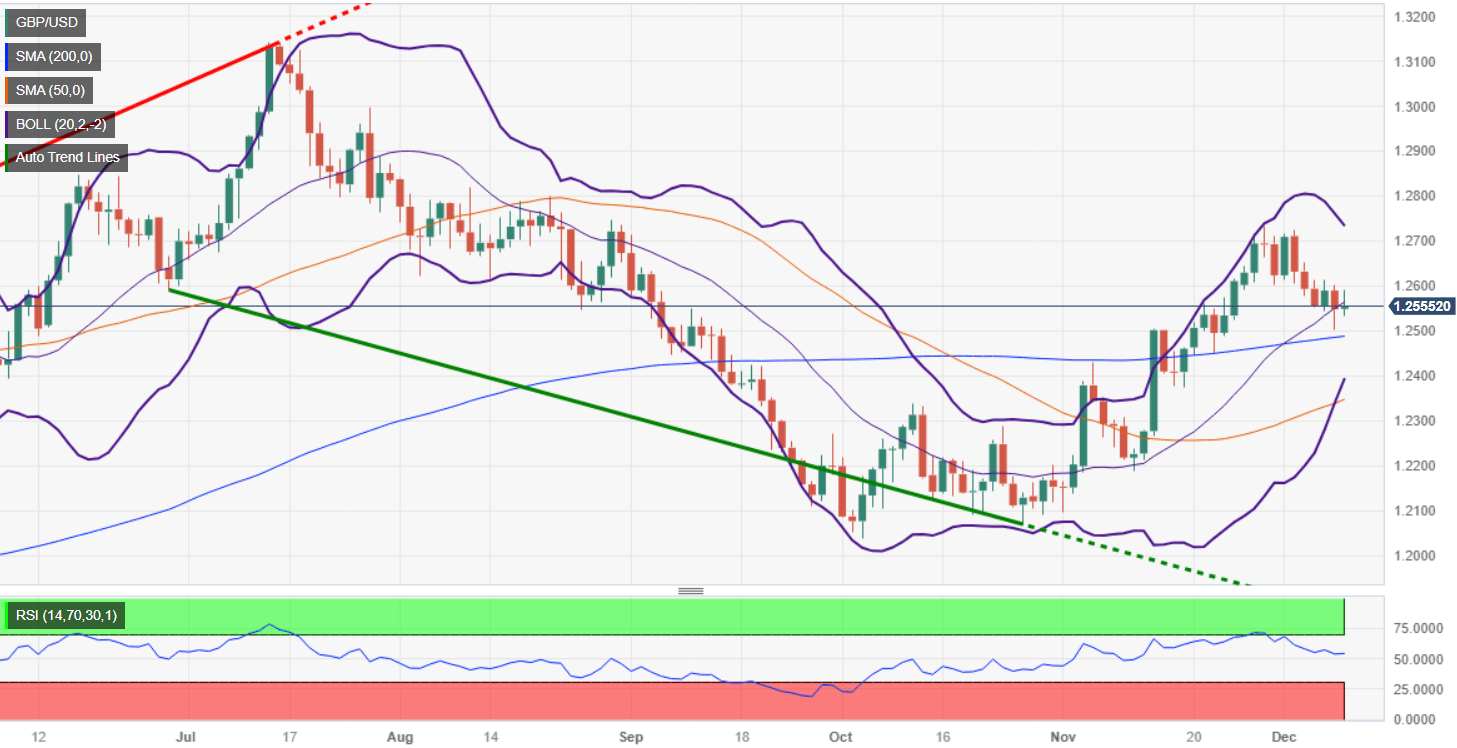

GBP/USD Price Analysis: Technical outlook

The daily chart portrays the pair extending its losses after peaking at around 1.2730s toward the end of November 2023. Since then, the GBP/USD has dropped more than 1%, though it has been trading within the 1.2486-1.2600 range for the last eight days. A breach of the top of the range will expose November’s monthly high of 1.2733, which could pave the way to retest a six-month-old resistance trendline. IF surpassed, 1.2800 would be up for grabs. On the other hand, a bearish resumption is likely if sellers push the exchange rate below 1.2500, exposing the 200-day moving average (DMA) at 1.2488, followed by the 100-DMA at 1.2460, ahead of the 50-DMA at 1.2347.

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.