Pound Sterling Price News and Forecast: GBP/USD clings to bullish stance

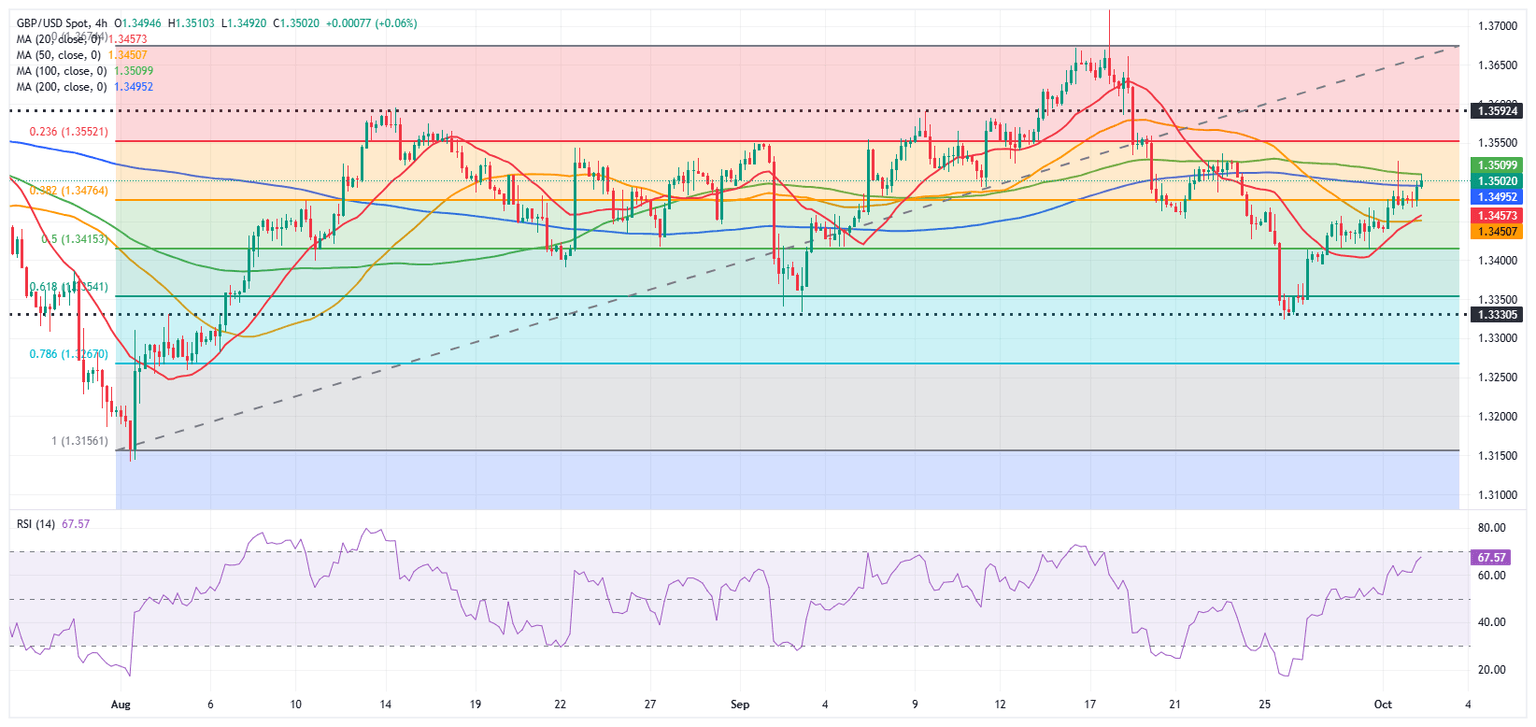

GBP/USD Forecast: Pound Sterling clings to bullish stance

GBP/USD preserves its bullish momentum in the European session and trades near 1.3500 following four consecutive days of gains. The pair's near-term technical outlook suggests that the bullish bias remains intact, while markets remain focused on political developments in the US.

The selling pressure surrounding the US Dollar (USD) persisted midweek as markets reacted to the uncertainty created by the shutdown of the federal government. Following a second round of voting on Wednesday, lawmakers failed to come to terms on restoring the government funding. Read more...

The Pound faces challenges: Weak data and external pressures mount

The GBP/USD pair is trading near 1.3445 on Wednesday, with the pound closing September with its first monthly decline against the US dollar since July.

Short-term price action remains under pressure from the looming US government shutdown, which threatens to delay the release of key US macroeconomic data, injecting uncertainty into the market. Read more...

GBP/USD Forecast: Pound Sterling looks to build on weekly gains

GBP/USD continues to stretch higher and trades above 1.3470 in the European session on Wednesday, after posting modest gains on Monday and Tuesday. The pair's technical outlook highlights a bullish stance as market participants keep a close eye on US politics.

The broad-based selling pressure surrounding the US Dollar (USD) helps GBP/USD extend its weekly uptrend. During the Asian trading hours, the USD weakened against its rivals as the US federal government has officially shutdown after Republicans and Democrats failed to come to terms on accepting a funding bill. Read more...

Author

FXStreet Team

FXStreet