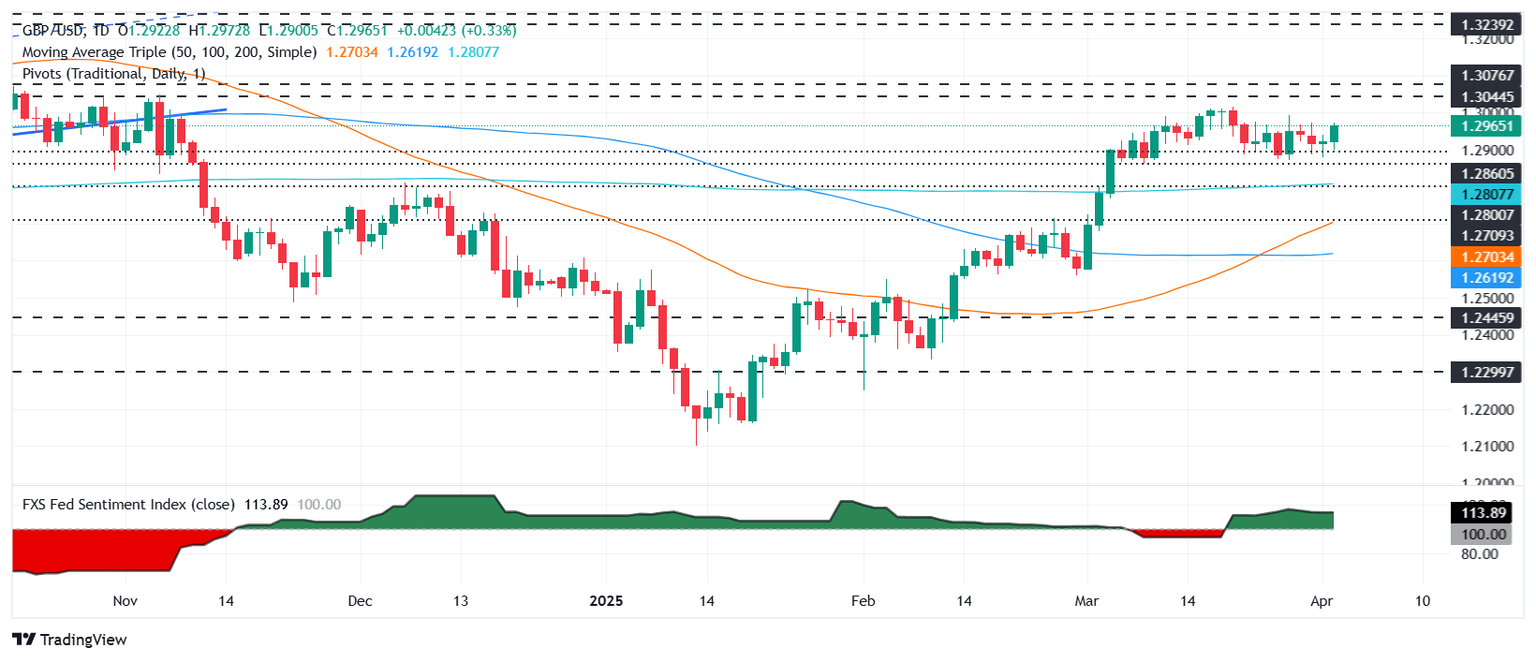

Pound Sterling Price News and Forecast: GBP/USD climbs past 1.2950

GBP/USD climbs past 1.2950 as traders brace for Trump’s tariff announcement

The Pound Sterling (GBP) advances early during the North American session against the US Dollar (USD) as traders await United States (US) President Donald Trump's tariff announcement, which could potentially spur a global economic slowdown. At the time of writing, GBP/USD trades at 1.2950, up 0.22%. Read More...

Pound Sterling rises against US Dollar while investors await Trump's tariff plan

The Pound Sterling (GBP) rises to near around 1.2950 against the US Dollar (USD) in Wednesday’s North American session. The GBP/USD pair gains as the US Dollar faces selling pressure ahead of the release of a detailed reciprocal tariff plan by United States (US) President Donald Trump later in the day. The US Dollar Index (DXY), which gauges the Greenback's value against six major peers, drops to near 104.00. Read More...

GBP/USD flat lines above 1.2900 mark as traders await Trump’s tariffs announcement

The GBP/USD pair struggles to capitalize on the overnight bounce from the vicinity of the 1.2870 support zone, or a multi-week low touched last Thursday, and oscillates in a narrow band during the Asian session on Wednesday. Spot prices currently trade around the 1.2915-1.2920 region, nearly unchanged for the day, as traders keenly await US President Donald Trump's reciprocal tariffs announcement before placing fresh directional bets. Read More...

Author

FXStreet Team

FXStreet