GBP/USD climbs past 1.2950 as traders brace for Trump’s tariff announcement

- Trump to announce new tariffs at 20:00 GMT; plan may include 20% duties on nearly all US trade partners.

- UK hopes for exemption amid balanced trade ties; GBP rallies on optimism and cautious risk-on mood.

- Strong ADP and Durable Goods data fail to lift USD ahead of key NFP and Powell speech later this week.

The Pound Sterling (GBP) advances early during the North American session against the US Dollar (USD) as traders await United States (US) President Donald Trump's tariff announcement, which could potentially spur a global economic slowdown. At the time of writing, GBP/USD trades at 1.2950, up 0.22%.

Sterling gains 0.22% despite strong US data as market focus shifts to potential 20% reciprocal tariffs on global trade

At 20:00 GMT, Donald Trump is expected to announce the imposition of reciprocal tariffs on trading partners in the White House Rose Garden. Although the percentage of duties applied to US trade partners is unknown, The Washington Post mentioned that Trump’s aides were considering a plan of approximately 20% from nearly every country.

This could potentially derail the United Kingdom (UK) economy, but the British remain hopeful that the imposed duties could be revised as the UK has a more balanced trading relationship with the United States.

Data-wise, strong US job figures, revealed earlier, failed to boost the Greenback. The ADP National Employment Change in March showed that companies added 155K to the workforce, more than the 105K forecast and up from 84K jobs created in February.

Other data showed that Durable Goods Orders in February exceeded estimates of 0.9% and expanded 1% MoM.

This week's highlights include Trump’s announcement, followed by Thursday’s Initial Jobless Claims and the ISM Services PMI. On Friday, traders will be eyeing the Nonfarm Payrolls figures and Federal Reserve Chair Jerome Powell's speech.

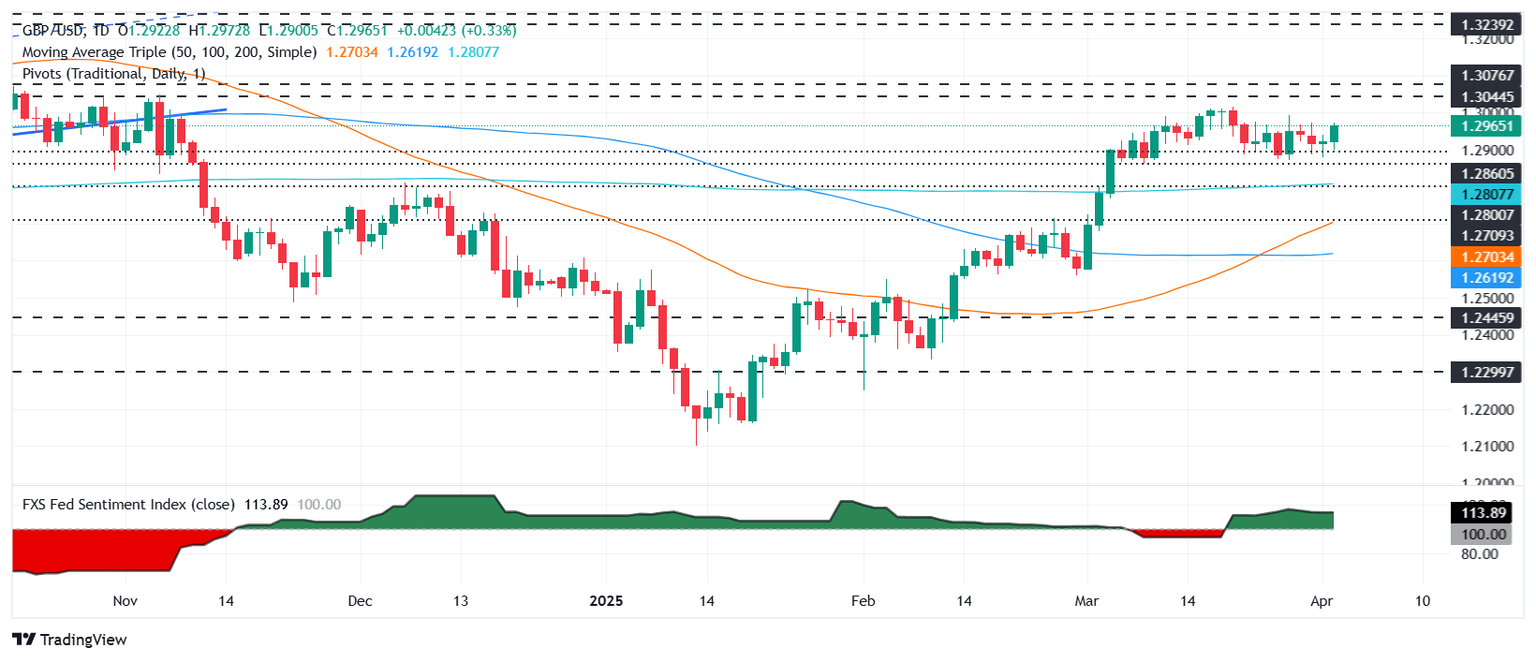

GBP/USD Price Forecast: Technical outlook

GBP/USD climbs to a fresh two-day high, an indication that buyers are stepping in, with them eyeing the next key resistance seen at the March 27 peak of 1.2991. If cleared, 1.3000 is up next, followed by the current year-to-date (YTD) high of 1.3014, before eyeing last year’s November high of 1.3047.

Conversely, a drop below 1.2900 could send GBP/USD falling to fresh four-day lows beneath 1.2878, with sellers eyeing a test of the 200-day Simple Moving Average (SMA) at 1.2806.

British Pound PRICE This week

The table below shows the percentage change of British Pound (GBP) against listed major currencies this week. British Pound was the strongest against the Swiss Franc.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.23% | -0.22% | 0.17% | 0.02% | -0.20% | -0.34% | 0.32% | |

| EUR | 0.23% | 0.11% | 0.46% | 0.29% | 0.11% | -0.08% | 0.60% | |

| GBP | 0.22% | -0.11% | 0.33% | 0.22% | -0.00% | -0.16% | 0.53% | |

| JPY | -0.17% | -0.46% | -0.33% | -0.17% | -0.35% | -0.49% | 0.05% | |

| CAD | -0.02% | -0.29% | -0.22% | 0.17% | -0.19% | -0.36% | 0.30% | |

| AUD | 0.20% | -0.11% | 0.00% | 0.35% | 0.19% | -0.16% | 0.49% | |

| NZD | 0.34% | 0.08% | 0.16% | 0.49% | 0.36% | 0.16% | 0.66% | |

| CHF | -0.32% | -0.60% | -0.53% | -0.05% | -0.30% | -0.49% | -0.66% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.