Pound Sterling Price News and Forecast: GBP/USD bears take a brief pause ahead of UK CPI

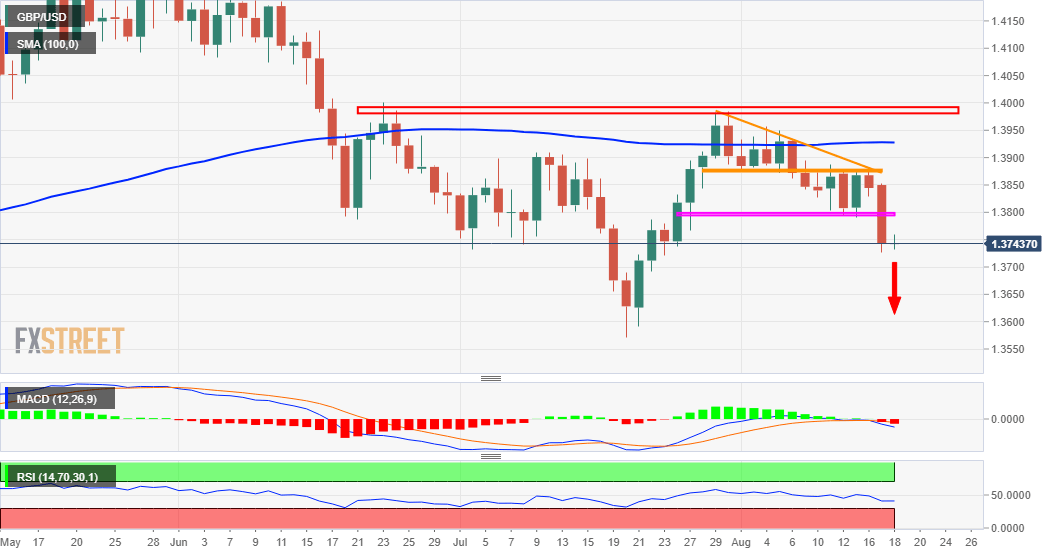

GBP/USD Forecast: Dead-cat bounce points to further falls, Fed minutes could pummel the pound

No mercy in the summer – the safe-haven dollar has been gaining ground and the pound has been suffering from weak data. That has resulted in a mere "dead-cat bounce" for GBP/USD, following its sharp drop below 1.38. It is now trading at the lowest since late July.

Britain reported an annual inflation rate of 2% in July, softer than 2.3% that was projected and implying no rush from the Bank of England to tighten its monetary policy. The news joins stubbornly high coronavirus cases in Britain, where improvement has stalled. Read more...

GBP/USD Outlook: Bears take a brief pause ahead of UK CPI, FOMC minutes

The GBP/USD pair witnessed aggressive selling on Tuesday and dived to over three-week lows, recording the heaviest fall since June despite a mostly upbeat UK jobs report. In fact, the unemployment rate unexpectedly edged lower to 4.7% during the three months to June from 4.8% previous. This was accompanied by strong wage growth data, showing that Average Earnings including Bonuses improved from 7.4% to 8.8% during the reported period. However, the number of people claiming unemployment-related benefits fell 7.8K in July as against the previous month's print of -114.8K. Read more...

GBP/USD Price Analysis: Attempts a bounce from a critical daily support line

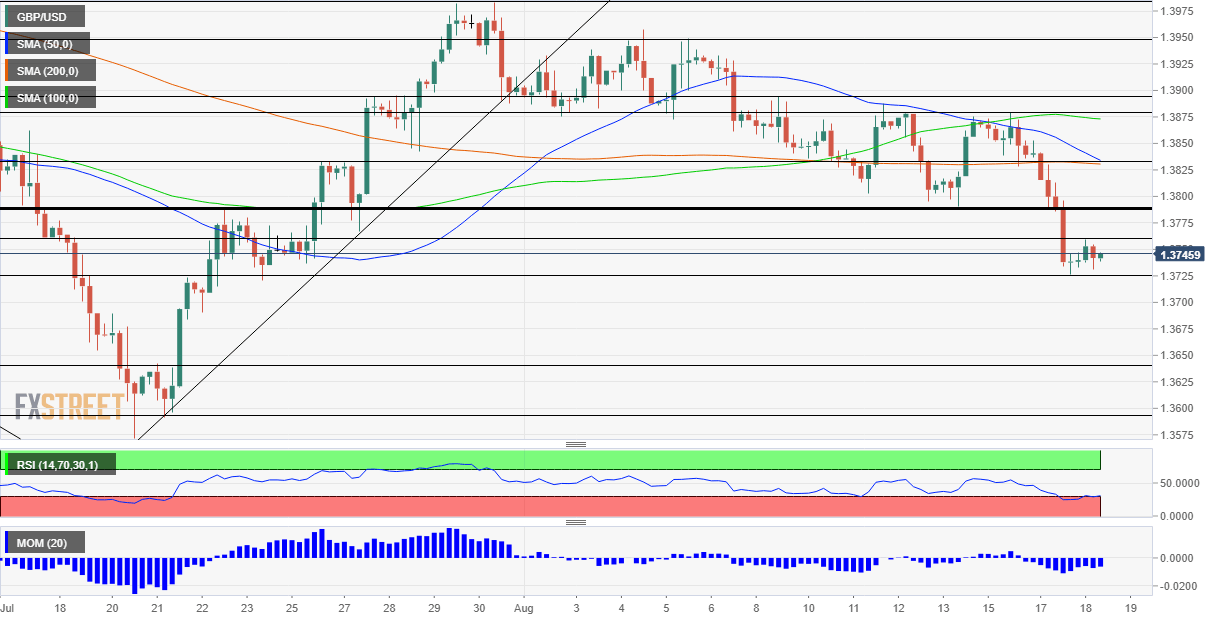

GBP/USD is struggling to extend its bounce above 1.3750, having hit monthly lows at 1.3726 on Tuesday. The cable is currently trading at 1.3756, up 0.13% on the day, having rebounded from a critical upward-sloping daily support line at 1.3730. The line connects the previous day’s low and July lows.

In doing so, the pair has stalled its two-day decline, although the risks remain skewed to the downside following a daily closing below the 200- Daily Moving Average (DMA) at 1.3768. Read more...

Author

FXStreet Team

FXStreet