GBP/USD Outlook: Bears take a brief pause ahead of UK CPI, FOMC minutes

- A combination of factors prompted aggressive selling around GBP/USD on Tuesday.

- Worries that job losses will rise after the furlough scheme ends weighed on the GBP.

- The risk-off impulse benefitted the safe-haven USD and contributed to the steep fall.

The GBP/USD pair witnessed aggressive selling on Tuesday and dived to over three-week lows, recording the heaviest fall since June despite a mostly upbeat UK jobs report. In fact, the unemployment rate unexpectedly edged lower to 4.7% during the three months to June from 4.8% previous. This was accompanied by strong wage growth data, showing that Average Earnings including Bonuses improved from 7.4% to 8.8% during the reported period. However, the number of people claiming unemployment-related benefits fell 7.8K in July as against the previous month's print of -114.8K. This comes amid worries that job losses will rise after the furlough scheme ends in September, which, in turn, was seen as a key factor that undermined the British pound.

Apart from this, a strong pickup in the US dollar demand further contributed to the pair's sharp intraday decline. Against the backdrop of concerns over the fast-spreading Delta variant of the coronavirus, political tension in Afghanistan took its toll on the global risk sentiment. This was evident from a sharp pullback in the US equity markets, which drove some haven flows towards the greenback. The risk-off impulse in the markets was exacerbated following the release of weaker US monthly retail sales figures for July. The headline sales missed consensus estimates by a big margin and declined sharply by 1.1% in July. Adding to this, core retail sales (excluding autos) fell 0.4% during the reported month as against expectations for a modest 0.1% growth.

Nevertheless, the data reaffirmed that the US consumer has grown more cautious in response to the latest surge in COVID-19 cases. This further forced investors to scale back their expectations about an early policy tightening by the Fed, though did little to hinder the strong USD positive move. The pair finally settled near the lower end of its daily trading range, though lacked any follow-through selling and edged higher during the Asian session on Wednesday. The uptick wasn't backed by any fundamental catalyst and remained limited as market participants now look forward to the UK consumer inflation figures for a fresh impetus. The key focus, however, will be on the release of the latest FOMC monetary policy meeting minutes, due later during the US session.

Investors will look for clues about the Fed's monetary policy outlook and the likely timing when the US central bank will begin tapering its asset purchases. This will play a key role in influencing the near-term USD price dynamics and assist investors to determine the next leg of a directional move for the major.

Short-term technical outlook

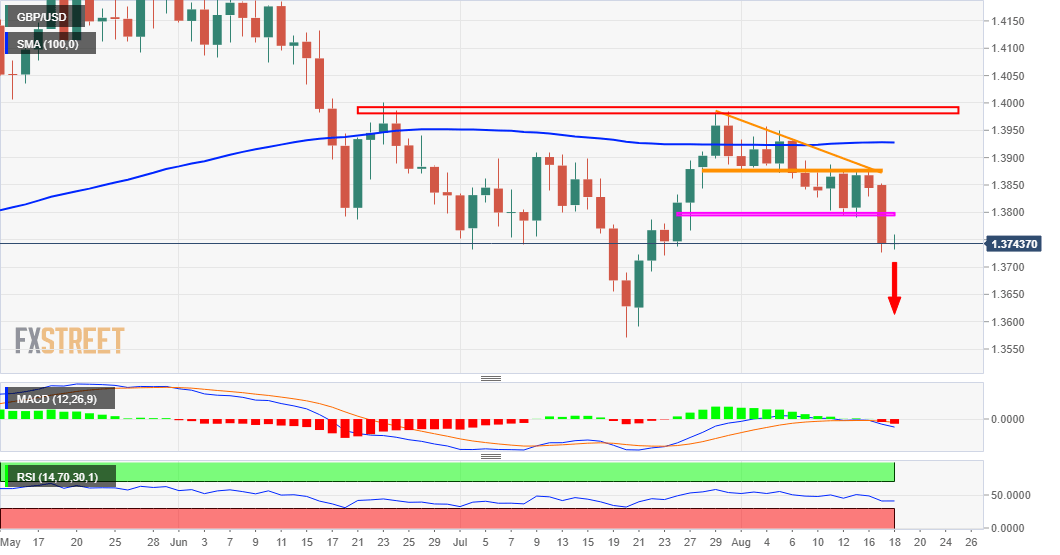

From a technical perspective, this week’s pullback from the 1.3875-80 region validated a descending triangle breakdown. A subsequent break and acceptance below the 1.3800 mark now support prospects for a further depreciating move. From current levels, the pair seems more likely to slide back towards the 1.3700 round figure. Some follow-through selling will set the stage for a slide back towards July monthly swing lows, around the 1.3570 region, with some intermediate support near the 1.3640-35 region and the 1.3600 mark.

On the flip side, any meaningful recovery attempt might now seem seen as a selling opportunity and runs the risk of fizzling out rather quickly near the 1.3800 mark. A sustained strength beyond might trigger a short-covering move towards the 1.3875-80 heavy supply zone. This should now act as a key pivotal point, which if cleared decisively will shift the near-term bias in favour of bullish traders. The pair might then surpass the 1.3900 mark and aim to test 100-day SMA, currently near the 1.3925 region.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.