Pound Sterling Price News and Forecast: GBP/USD bears press 1.3700 critical daily support

GBP/USD Price Analysis: Bears press 1.3700 critical daily support

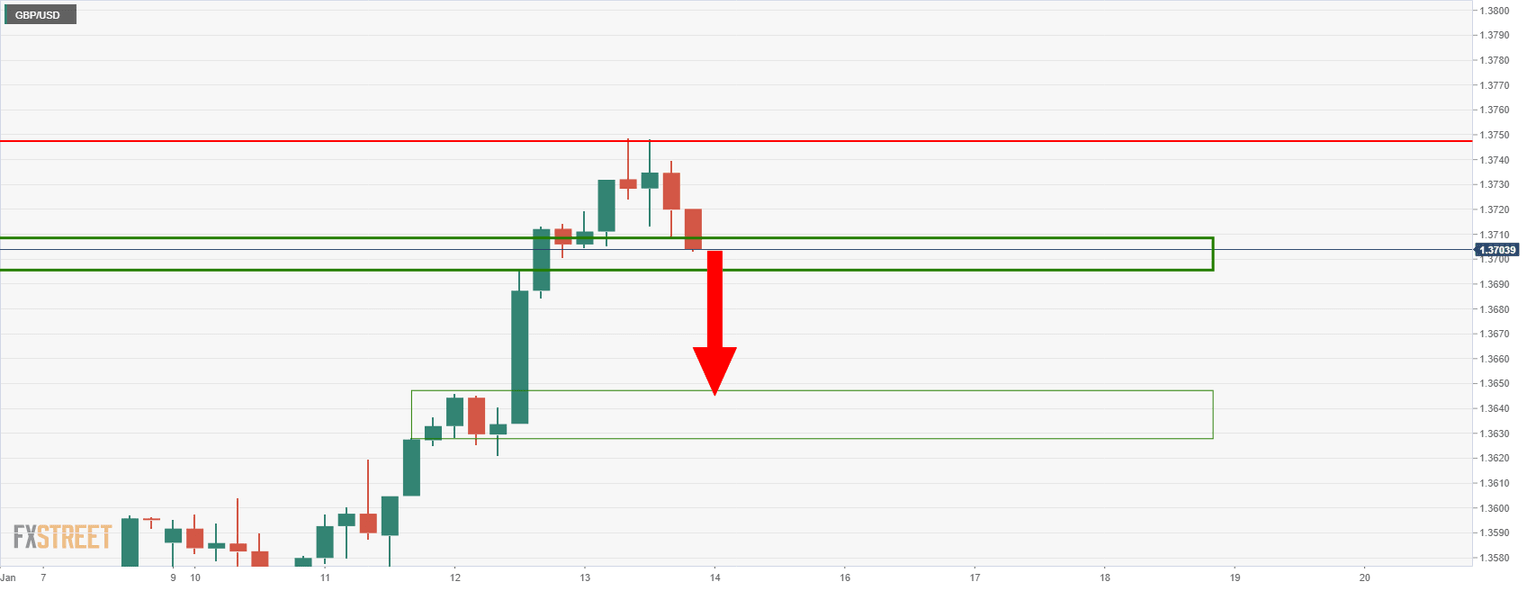

GBP/USD is on the verge of a break of critical support according to the following top-down analysis that illustrates the market structure across the daily, 4-hour and 1-hour charts. The daily chart shows that the price has run-up to a critical area and level of resistance between 1.3700 and 1.3750. A downside correction could be on the cards on a break below 1.37 as follows. Read more...

GBP/USD Forecast: Bullish bias intact as long as 1.3675 support holds

GBP/USD has preserved its bullish momentum following Wednesday's rally and touched its highest level since late October near 1.3750. The dollar's valuation continues to drive the pair's action but the technical developments suggest that the pair may need to make a downward correction before stretching higher. The US Dollar Index, which tracks the greenback's performance against a basket of six major currencies, fell sharply on Wednesday and continued to edge lower early Thursday. On a weekly basis, the index is already down 1% and on track to post its largest one-week loss since May. Read more...

GBP/USD analysis: US CPI surge reaches 1.3750

The surge of the GBP/USD that was caused by the US Consumer Price Index release has reached the 1.3750 level's resistance. The round exchange rate level forced the pair into a retracement back down just before mid-day on Thursday. The consolidating decline appeared to be finding support in Wednesday's high level at 1.3715. If the GBP/USD currency exchange rate continues to surge, it would have to pass the 1.3750 level. A move above 1.3750 level would have no technical resistance as high as the weekly R3 simple pivot point at 1.3820. However, the 1.3800 mark might act as resistance. Read more...

Author

FXStreet Team

FXStreet