Pound Sterling Price News and Forecast: GBP/USD bears engage at a key 61.8% ratio

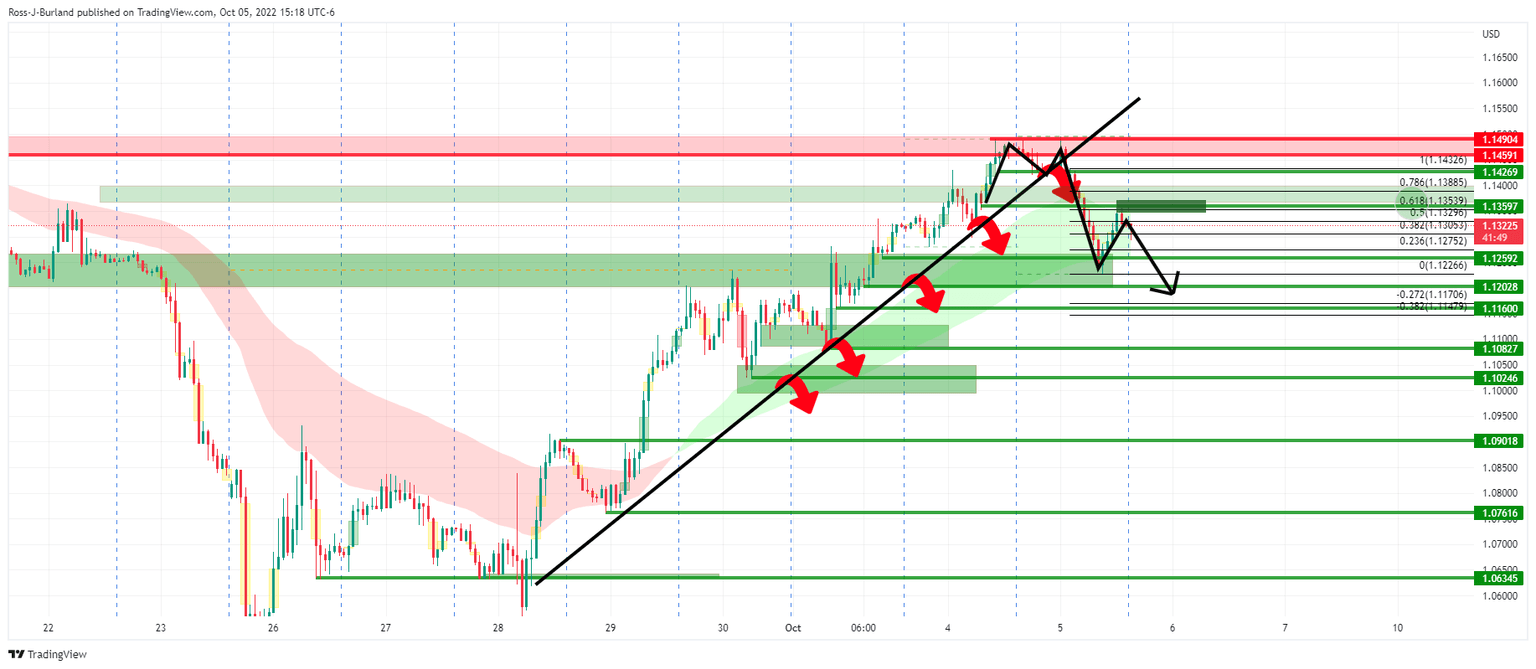

GBP/USD Price Analysis: Bears engage at a key 61.8% ratio

GBP/USD has come under pressure to test the 1.1300 level following a resurgence in the US dollar on Wednesday. The US dollar index, DXY, was last seen up near to 1% at 111.21 but it had been as high as 111.735 overnight. US yields rallying has helped to prop up the US dollar as the money markets price out overall optimistic speculation over a Federal Reserve pivot. The yield on the US 10-year note was up a high of 3.78%. Read more...

GBP/USD Forecast: Buyers move to sidelines amid risk aversion

GBP/USD has lost its traction and declined to the 1.1400 area after having advanced toward 1.1500. The souring market mood helps the dollar regather its strength and weighs on the pair ahead of key macroeconomic data releases from the US. The selling pressure surrounding the dollar and the UK government's decision to step back on massive tax cuts fueled GBP/USD's rally earlier in the week. The US Dollar Index (DXY), which tracks the greenback's performance against a basket of six major currencies, lost more than 1% on Tuesday as market participants cheered falling bond yields. Read more...

GBP/USD outlook: Bulls face headwinds at 1.15 zone, looking for fresh signals

Bulls are taking a breather under new highest since Sep 15 as recent rally faced headwinds on approach to 1.1500 barrier. Fundamentals work in favor of pound, as U-turn in government’s plan to cut tax to the highest rate of income boosted the sentiment, while traders expect fresh signals from Fed, after the latest data showed signs of wobbling US economic growth that would prompt the central bank to reduce the pace of tightening, in the fight against high inflation. Read more...

Author

FXStreet Team

FXStreet