GBP/USD Forecast: Buyers move to sidelines amid risk aversion

- GBP/USD has lost its bullish momentum on Wednesday.

- Investors move toward safe-haven assets amid escalating geopolitical tensions.

- US stock index futures decline sharply ahead of key US data.

GBP/USD has lost its traction and declined to the 1.1400 area after having advanced toward 1.1500. The souring market mood helps the dollar regather its strength and weighs on the pair ahead of key macroeconomic data releases from the US.

The selling pressure surrounding the dollar and the UK government's decision to step back on massive tax cuts fueled GBP/USD's rally earlier in the week. The US Dollar Index (DXY), which tracks the greenback's performance against a basket of six major currencies, lost more than 1% on Tuesday as market participants cheered falling bond yields.

Nevertheless, escalating geopolitical tensions caused investors to seek refuge early Wednesday and the DXY managed to erase a portion of Tuesday's losses.

Russia's ambassador to the US said that the danger of a direct clash between Russia and the west had escalated following the White House's decision to provide additional military aid to Ukraine. Meanwhile, reports claiming that Russian President Vladimir Putin was preparing to address the nation and announce a change in the status of the "special operation" triggered another bout of flight to safety.

Mirroring the risk-averse market atmosphere, US stock index futures are down between 0.7% and 0.8% during the European trading hours.

The ISM will release the Services PMI report later in the day. On Monday, the dollar faced selling pressure after the ISM Manufacturing PMI survey showed a contraction in sectoral employment and a further easing of input price pressures. In case the Employment Index of the Services PMI survey stays below in September and the Prices Paid Index falls at a stronger pace than expected, the USD could have a hard time outperforming its rivals.

Unless Wall Street's main indexes turn positive on the day, however, any potential negative impact on the DXY is likely to remain short-lived. Market participants will also pay close attention to the ADP Employment Change data, which is forecast to rebound to 200K in September from 132K in August. Fed policymakers are willing to stay on an aggressive tightening path until they see convincing signs of the labor market conditions loosening. Hence, a positive print could support the dollar and vice versa.

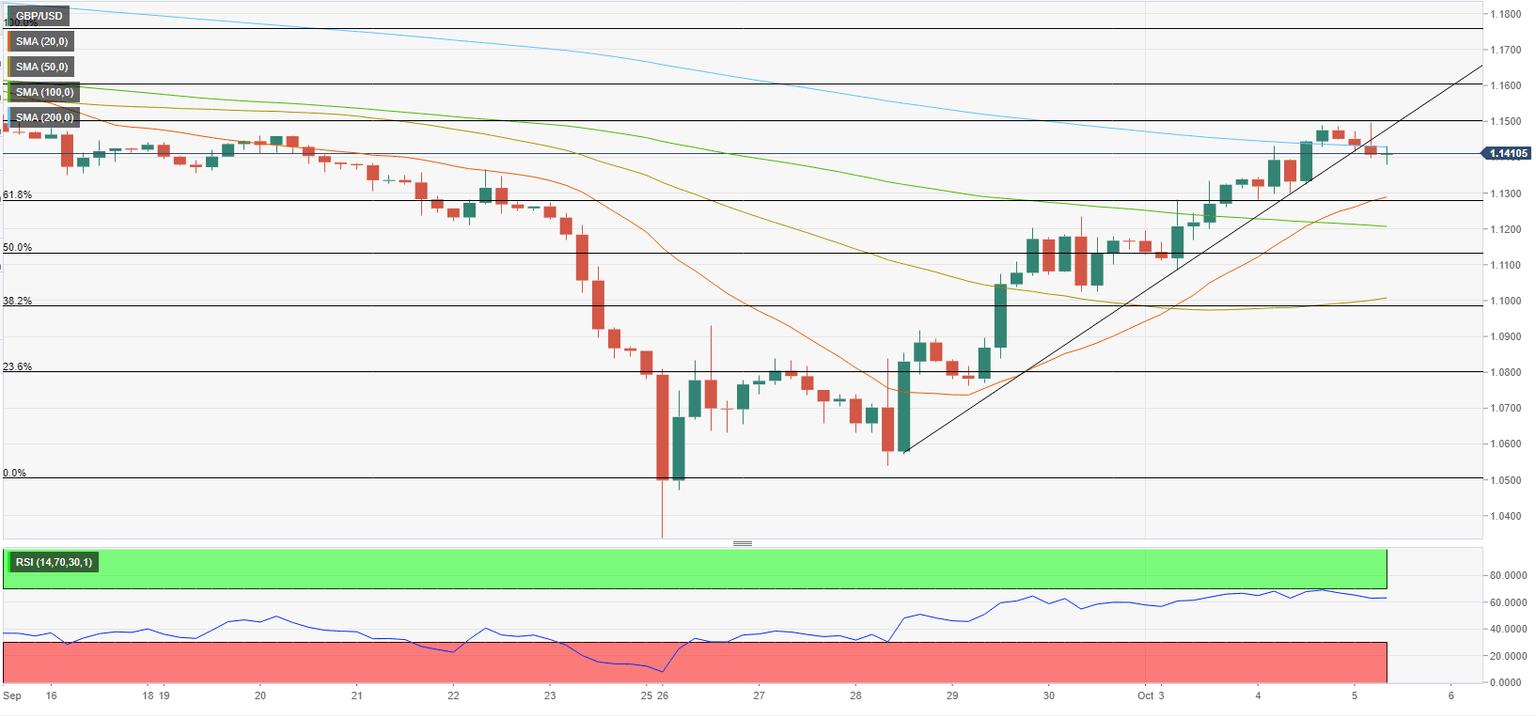

GBP/USD Technical Analysis

GBP/USD is trading within a touching distance of the 200-period SMA on the four-hour chart, which is currently located at 1.1430. In case the pair manages to stabilize above that level, buyers could show interest and lift it back above the ascending trend line at 1.1470. In that scenario, 1.1500 (psychological level, static level) aligns as next resistance before the pair could target 1.1600 (psychological level).

If the 200-period SMA stays intact and continues to act as resistance, additional sellers could come into play and cause GBP/USD to slide toward 1.1300 (psychological level, Fibonacci 61.8% retracement of the latest downtrend) and 1.1200 (100-period SMA).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.