Pound Sterling Price News and Forecast: GBP jumps higher against US Dollar ahead of US data-packed day

Pound Sterling jumps higher against US Dollar ahead of US data-packed day

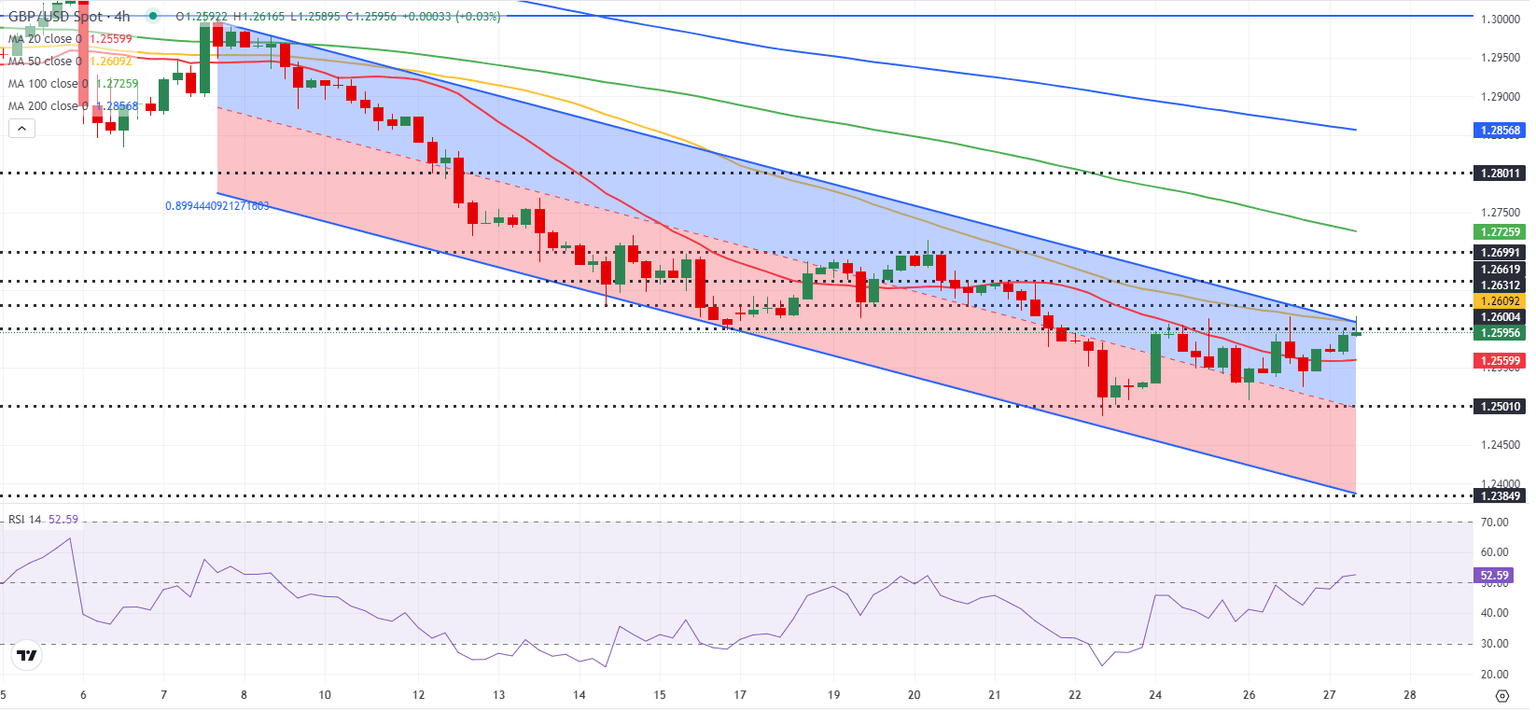

The Pound Sterling (GBP) moves higher against the US Dollar (USD), extends its upside above the three-day resistance of 1.2600 in Wednesday’s London session. The GBP/USD pair rises as the US Dollar declines. The US Dollar Index (DXY), which gauges the Greenback’s value against six major currencies, has remained under pressure this week after US President-elect Donald Trump nominated Scott Bessent, a seasoned hedge fund manager, to fill the position of Treasury Secretary. Market participants expect Bessent to execute Trump-stated trade policies strategically and gradually with the intention of avoiding a lethal trade war.

In Wednesday's session, investors will focus on the United States (US) Personal Consumption Expenditure Price Index (PCE) data for October, which will be published at 15:00 GMT. Economists expect the core PCE inflation data – which excludes volatile food and energy prices – to have accelerated to 2.8% year-over-year from 2.7% in September, with monthly figures growing steadily by 0.3%. Read more...

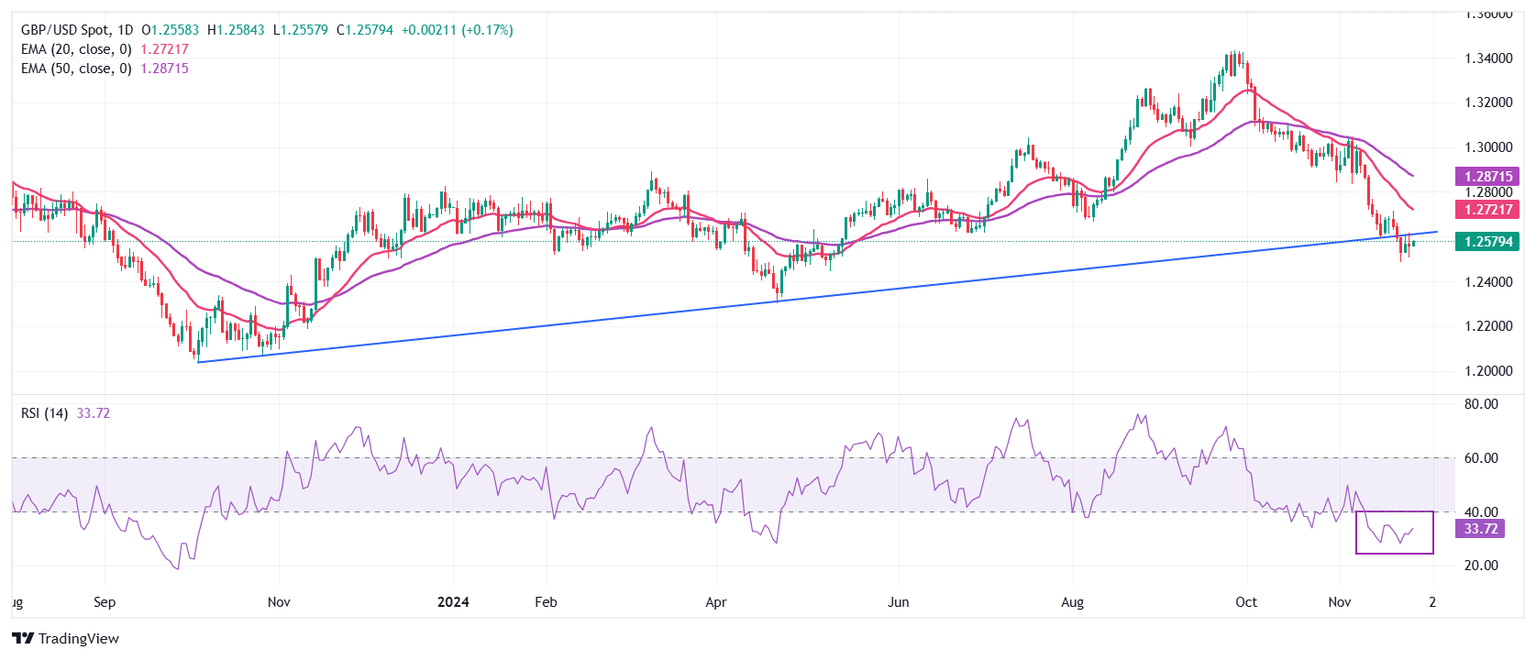

GBP/USD Forecast: Pound Sterling buyers could take action if 1.2600 hurdle is cleared

After failing to clear 1.2600 during the European trading hours on Tuesday, GBP/USD lost its traction and closed the day flat. Once again, the pair edges higher toward 1.2600 in the European session on Wednesday as investors gear up for the US data dump ahead of the Thanksgiving holiday.

In the minutes of its November policy meeting, the Federal Reserve (Fed) noted that officials expressed mixed views regarding how much interest rates might need to be cut. Read more...

Author

FXStreet Team

FXStreet