Pound Sterling Price News and Forecast: GBP gains against USD as BoE supports gradual rate-cut approach

Pound Sterling gains against USD as BoE supports gradual rate-cut approach

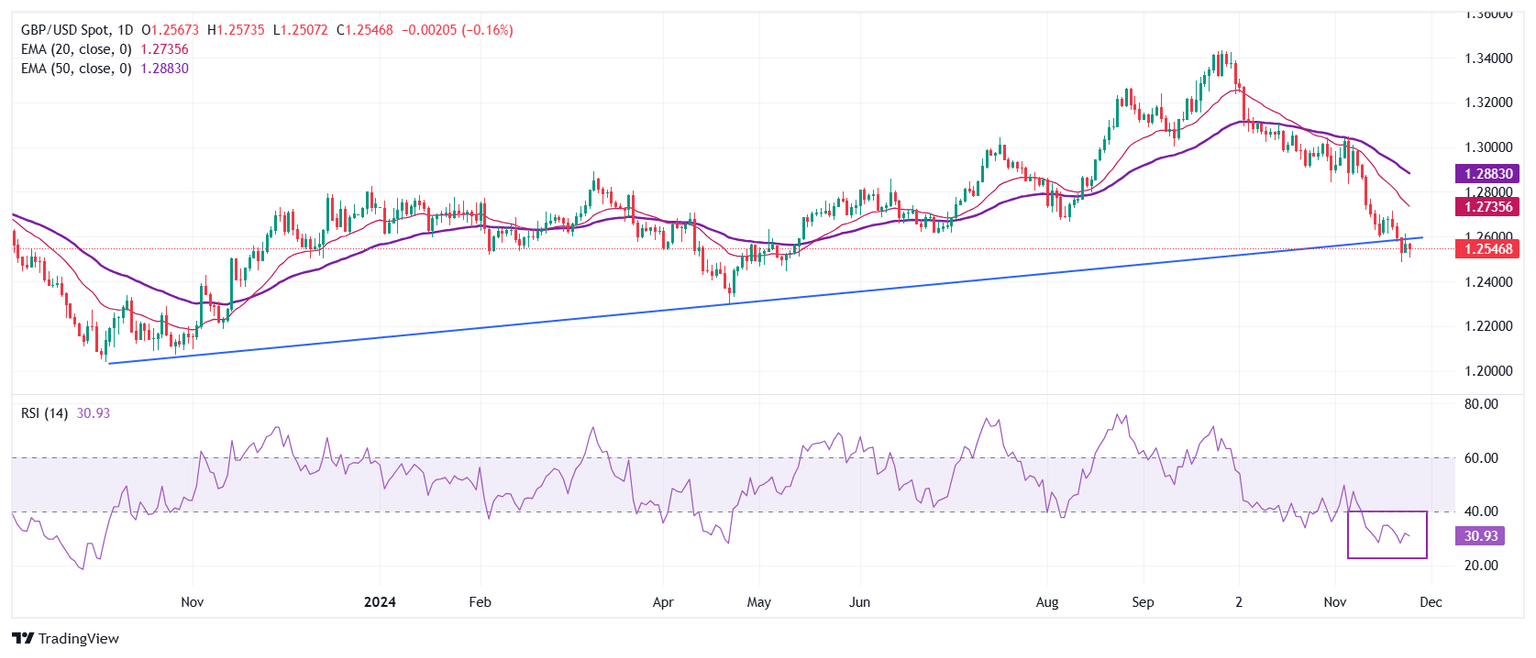

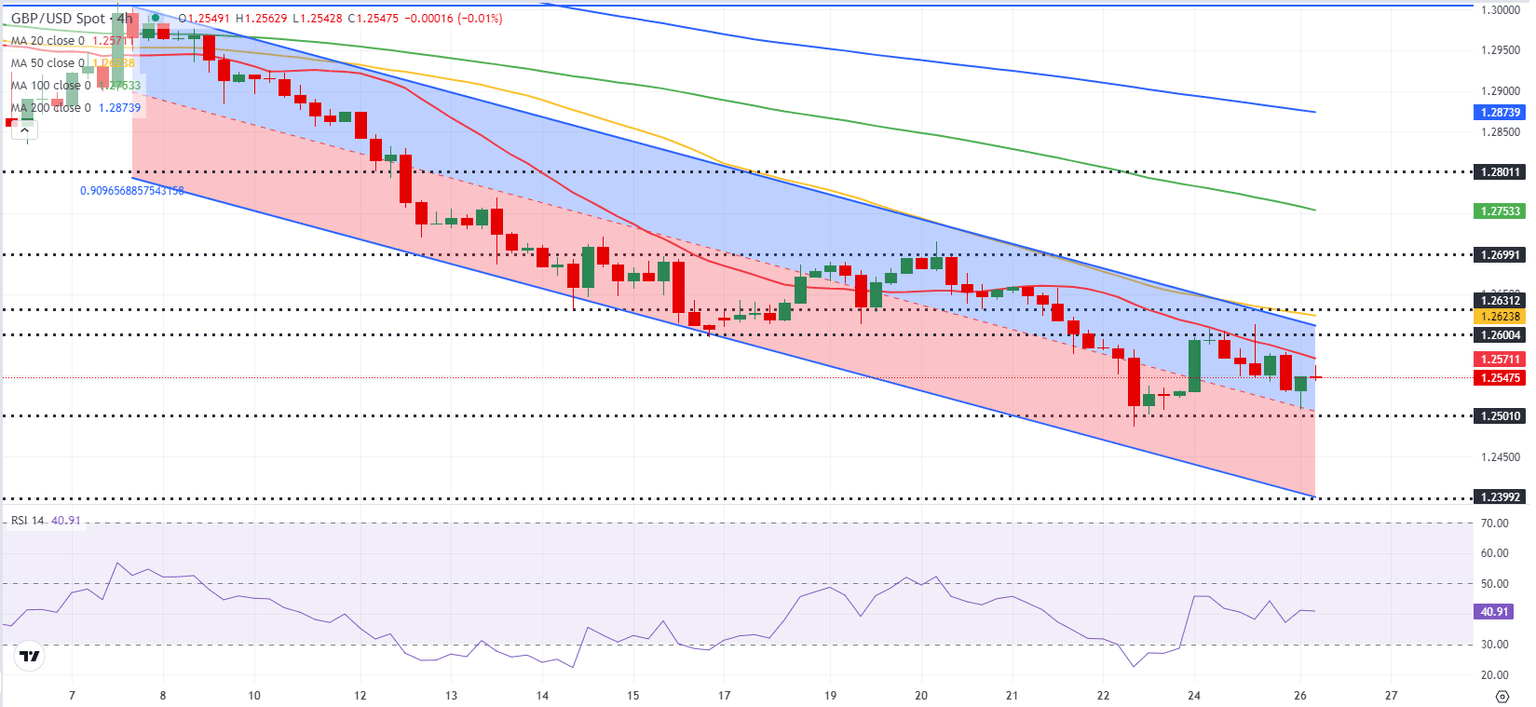

The Pound Sterling (GBP) recovers intraday losses and turns positive against the US Dollar (USD) in Tuesday’s London session after diving near the psychological support of 1.2500 in Asian trading hours. The GBP/USD pair rebounds as the US Dollar surrenders its entire intraday gains after a strong opening.

The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, had a stellar opening after President-elect Donald Trump warned that he would impose 25% import tariffs on all products from Canada and Mexico. Trump added that there will be an additional 10% tariff on imports from China for pouring illicit drugs into the United States (US) through Mexico. Read more...

GBP/USD Forecast: Pound Sterling stabilizes between key technical levels

After briefly rising above 1.2600 on Monday, GBP/USD reversed its direction to close the day in the red. The pair declined to the 1.2500 area during the Asian trading hours on Monday but managed to recover toward 1.2550 by the European morning.

The US Dollar came under heavy selling pressure at the start of the week and helped GBP/USD gather bullish momentum. News of Donald Trump selecting fund manager Scott Bessent as the US Treasury Secretary eased concerns over unorthodox fiscal policies. Later in the day, however, markets have adopted a cautious stance as Trump announced that he would impose a 25% tax on all products entering the US from Canada and Mexico in addition to a 10% tariff on goods from China as one of his first executive orders. Read more...

Author

FXStreet Team

FXStreet