Pound Sterling gains further against US Dollar ahead of US NFP revision

- The Pound Sterling gains further to near 1.3580 against the US Dollar as the Greenback falters on cooling US job demand.

- Investors await the key US NFP benchmark revision report and the BoE’s Breeden speech.

- Investors expect a 25-basis-point interest rate cut by the Fed next week.

The Pound Sterling (GBP) extends its winning streak for the third trading day against the US Dollar (USD) on Tuesday. The GBP/USD pair posts a fresh three-week high around 1.3580 during the European trading session as the US Dollar slumps ahead of the release of the United States (US) Nonfarm Payrolls (NFP) benchmark revision report, which will be published at 14:00 GMT.

During the press time, the US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, posts a fresh six-week low around 97.30.

Investors will pay close attention to the US NFP benchmark revision report as it will show deviation in cumulative monthly figures for the year ending March 2025. The final 2025 revision will be implemented in the 2026 Employment Situation release.

The impact of the above-mentioned figures will be significant on the Federal Reserve’s (Fed) monetary policy outlook as the US central bank delivered a 50-basis-point (bps) interest rate cut in the September 2024 meeting after the report showed a downward revision in payroll figures by 818K.

Daily digest market movers: The Fed is expected to cut interest rates next week

- The US Dollar is underperforming its peers on Tuesday as an interest rate cut by the Federal Reserve (Fed) in the monetary policy meeting next week seems a done deal.

- According to the CME FedWatch tool, traders see an 11.6% chance that the central bank will cut interest rates by 50 bps to 3.75%-4.00%, while the rest point a standard 25 bps interest rate reduction.

- Fed dovish speculation has been intensifying due to deteriorating US labor market conditions. The US NFP report for August showed on Friday that employers added 22K fresh workers. Fed rate cut expectations also escalated in early August after July’s NFP report showed a downward revision in payrolls figures for May and June.

- This week, investors will also focus on the US Producer Price Index (PPI) and the Consumer Price Index (CPI) data for August, which will be released on Wednesday and Thursday, respectively.

- In the United Kingdom (UK), investors await the speech from Bank of England (BoE) Deputy Governor Sarah Breeden, which is scheduled at 15:15 GMT. Her comments on the likely monetary policy action in the policy meeting next week will be closely monitored. Economists expect the BoE to hold interest rates steady at 4% in next week’s meeting. Breeden was one of five Monetary Policy Committee (MPC) members who voted for reducing interest rates by 25 bps in August.

- This week, investors will also focus on the UK's monthly Gross Domestic Product (GDP) and factory data for July, which will be released on Friday. The economy is expected to have grown at a moderate pace of 0.1%.

Pound Sterling Price Today

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the strongest against the US Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.02% | -0.26% | -0.69% | -0.04% | -0.45% | -0.27% | -0.06% | |

| EUR | 0.02% | -0.26% | -0.67% | -0.02% | -0.37% | -0.23% | -0.04% | |

| GBP | 0.26% | 0.26% | -0.46% | 0.23% | -0.11% | 0.02% | 0.21% | |

| JPY | 0.69% | 0.67% | 0.46% | 0.64% | 0.28% | 0.43% | 0.63% | |

| CAD | 0.04% | 0.02% | -0.23% | -0.64% | -0.39% | -0.20% | -0.01% | |

| AUD | 0.45% | 0.37% | 0.11% | -0.28% | 0.39% | 0.14% | 0.33% | |

| NZD | 0.27% | 0.23% | -0.02% | -0.43% | 0.20% | -0.14% | 0.21% | |

| CHF | 0.06% | 0.04% | -0.21% | -0.63% | 0.01% | -0.33% | -0.21% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

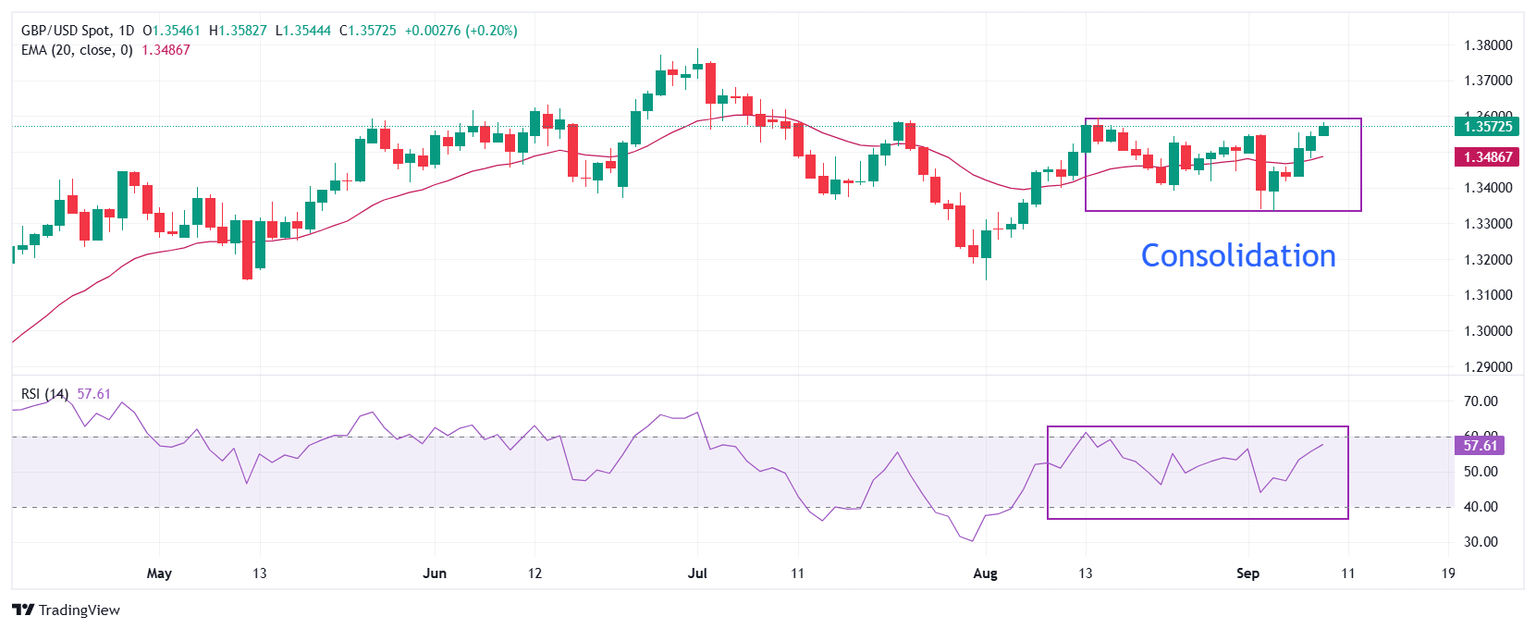

Technical Analysis: Pound Sterling refreshes three-week high around 1.3580

The Pound Sterling jumps to near 1.3580 against the US Dollar on Tuesday, the highest level seen in three weeks. The GBP/USD pair climbs to near the upper end of the consolidation formed in a range between 1.3333 and 1.3595 in the last four weeks.

The near-term trend of the GBP/USD remains bullish as it trades above the 20-day Exponential Moving Average (EMA), which is around 1.3487.

The 14-day Relative Strength Index (RSI) on the daily chart oscillates inside the 40.00-60.00 range, indicating a sideways trend.

Looking down, the August 1 low of 1.3140 will act as a key support zone. On the upside, the July 1 high near 1.3800 will act as a key barrier.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.