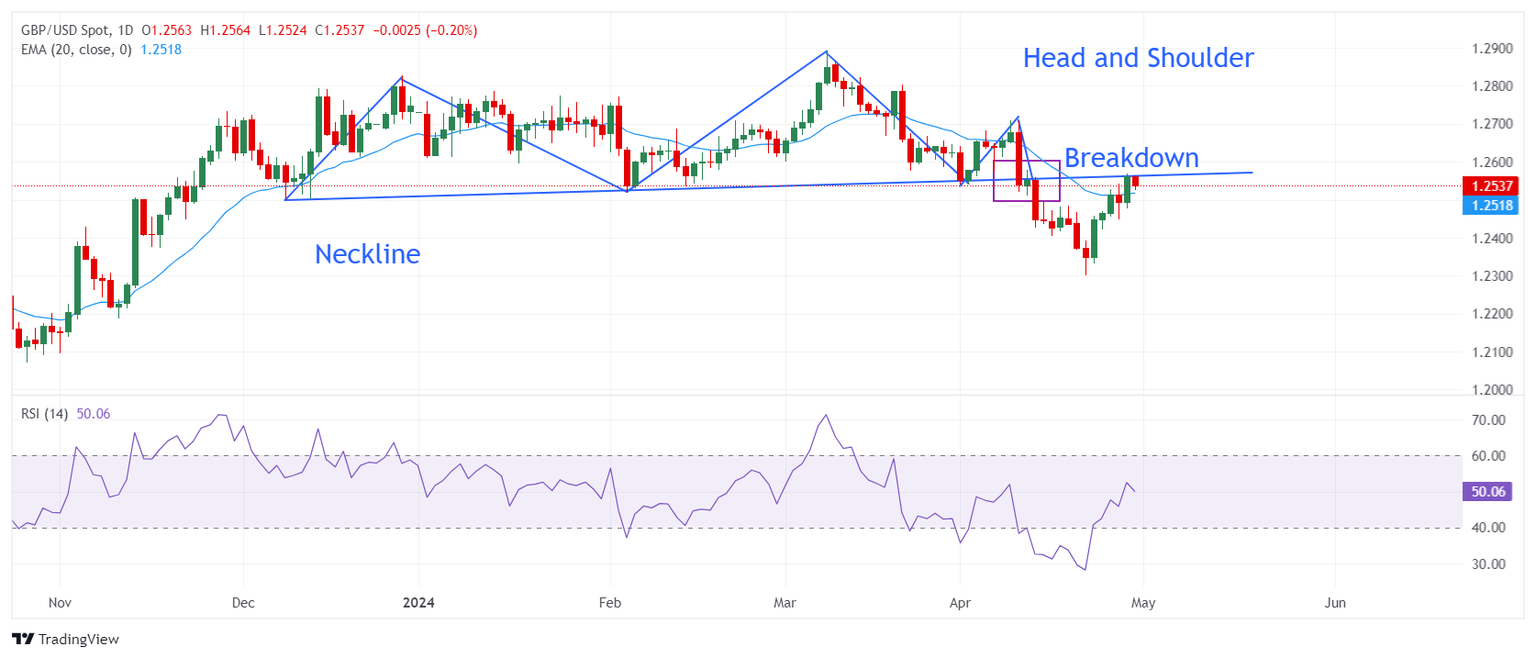

GBP/USD Price Analysis: Drops below 200-DMA, at cross-roads to resume downtrend

The

Pound Sterling reverses its course against the

US Dollar, after extending its gains past the 200-day moving average (DMA). However, data from the

United States (US), showing that inflation could be picking up, as shown by the Employment Cost Index (ECI), bolstered the Greenback. Therefore, the GBP/USD trades at 1.2517 down by some 0.36%, after hitting a daily high of 1.2563.

Read More...

Pound Sterling remains under pressure ahead of Fed’s policy decision

The Pound Sterling (GBP) edges down from a two-week high of 1.2570 but holds above the psychological support of 1.2500 against the

US Dollar (USD) in Tuesday’s early American session. The GBP/USD pair comes under pressure as investors await the US Federal Reserve’s (Fed) monetary policy announcement on Wednesday for fresh guidance.

Read More...

GBP/USD consolidates its gains above 1.2550, investors await Fed rate decision

The GBP/USD pair consolidates its gains near 1.2560 after flirting with the key 200-day SMA and three-week highs in the 1.2550-1.2560 zone during the early Asian session on Tuesday. The recovery of the major pair is supported by a falling

US Dollar Index (DXY) to 105.65. On Wednesday, the Federal Open Market Committee's (FOMC) interest rate decision will take center stage ahead of the release of April’s Nonfarm Payrolls (NFP) on Friday.

Read More...