Pound Sterling underperforms US Dollar as Fed supports restrictive policy stance

- The Pound Sterling declines to near 1.2920 against the US Dollar as the Fed is not in a rush to move to interest rate cuts.

- The Fed sees high uncertainty over the US economic outlook amid new policies from US President Trump.

- BoE Bailey is confident that interest rates are on a gradually declining path.

The Pound Sterling (GBP) extends correction to near 1.2920 against the US Dollar (USD) in North American trading hours on Friday. The GBP/USD pair weakens as the US Dollar extends recovery amid growing expectations that the Federal Reserve (Fed) will not cut interest rates soon. The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, gathers strength to break above the key resistance of 104.00.

The Fed expressed that it is in no hurry to move to interest rate cuts after leaving them unchanged in the range of 4.25%-4.50% on Wednesday. The comments from the Fed regarding holding interest rates at their current levels were based on “unusually elevated” uncertainty over the United States’ (US) economic outlook due to the implementation of significant policy changes under the administration of US President Donald Trump.

Fed Chair Jerome Powell said in the press conference on Wednesday that tariff policies by US President Trump could push inflation higher and weigh on growth in the near term.

During North American trading hours on Friday, Chicago Fed Bank President Austan Goolsbee and New York Fed Bank President John Williams also stated that interest rates should remain in the current range amid uncertainty over Trump's economic policies. "The Fed needs to be a steady hand and take the long view on the economy," Goolsbee said.

According to the CME FedWatch tool, the Fed is almost certain to keep interest rates unchanged in the May meeting, but there is a 73% chance the central bank can cut them in June.

Globally, investors’ risk appetite is expected to remain capped as President Trump is poised to impose reciprocal tariffs on April 2, which means equal tariffs for the same products imported and exported by the US with his trading partners. Such a scenario will be unfavorable for economic growth across the globe.

Daily digest market movers: Pound Sterling declines despite BoE maintains gradual easing approach

- The Pound Sterling slips against its major peers on Friday. The British currency weakens after the Bank of England (BoE) left interest rates unchanged at 4.5% on Thursday. The Pound drops even though the steady interest rate decision seemed slightly hawkish.

- Eight out of nine Monetary Policy Committee (MPC) members voted for keeping borrowing rates at their current levels, while policymaker Swati Dhingra supported a 25 basis points (bps) interest rate reduction. Economists expected that two officials would vote for a quarter-to-a-percent reduction in interest rates.

- BoE Governor Andrew Bailey said there is a lot of uncertainty at the moment, but he still thinks the monetary policy is on a “gradually declining path”.

- Meanwhile, fears of persistently high United Kingdom (UK) inflation remain solid amid steady wage growth. The Office for National Statistics (ONS) reported on Thursday that Average Earnings Excluding Bonuses, a key measure of wage growth, rose steadily by 5.9% in three months ending January. High wage growth has remained a key contributor to stubborn inflation in the services sector, which BoE officials closely track for decision-making on interest rates.

- For fresh cues on the current status of UK inflation, investors will focus on the Consumer Price Index (CPI) data for February, which will be released on Wednesday. In January, the headline CPI accelerated at a robust pace of 3% compared to the 2.5% rise seen in December.

British Pound PRICE Today

The table below shows the percentage change of the British Pound (GBP) against listed major currencies today. British Pound was the strongest against the Australian Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.20% | 0.24% | 0.04% | 0.22% | 0.46% | 0.13% | -0.03% | |

| EUR | -0.20% | 0.07% | -0.16% | 0.04% | 0.27% | 0.00% | -0.24% | |

| GBP | -0.24% | -0.07% | -0.21% | -0.02% | 0.20% | -0.07% | -0.29% | |

| JPY | -0.04% | 0.16% | 0.21% | 0.17% | 0.40% | 0.11% | -0.13% | |

| CAD | -0.22% | -0.04% | 0.02% | -0.17% | 0.22% | -0.04% | -0.27% | |

| AUD | -0.46% | -0.27% | -0.20% | -0.40% | -0.22% | -0.27% | -0.59% | |

| NZD | -0.13% | -0.00% | 0.07% | -0.11% | 0.04% | 0.27% | -0.23% | |

| CHF | 0.03% | 0.24% | 0.29% | 0.13% | 0.27% | 0.59% | 0.23% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

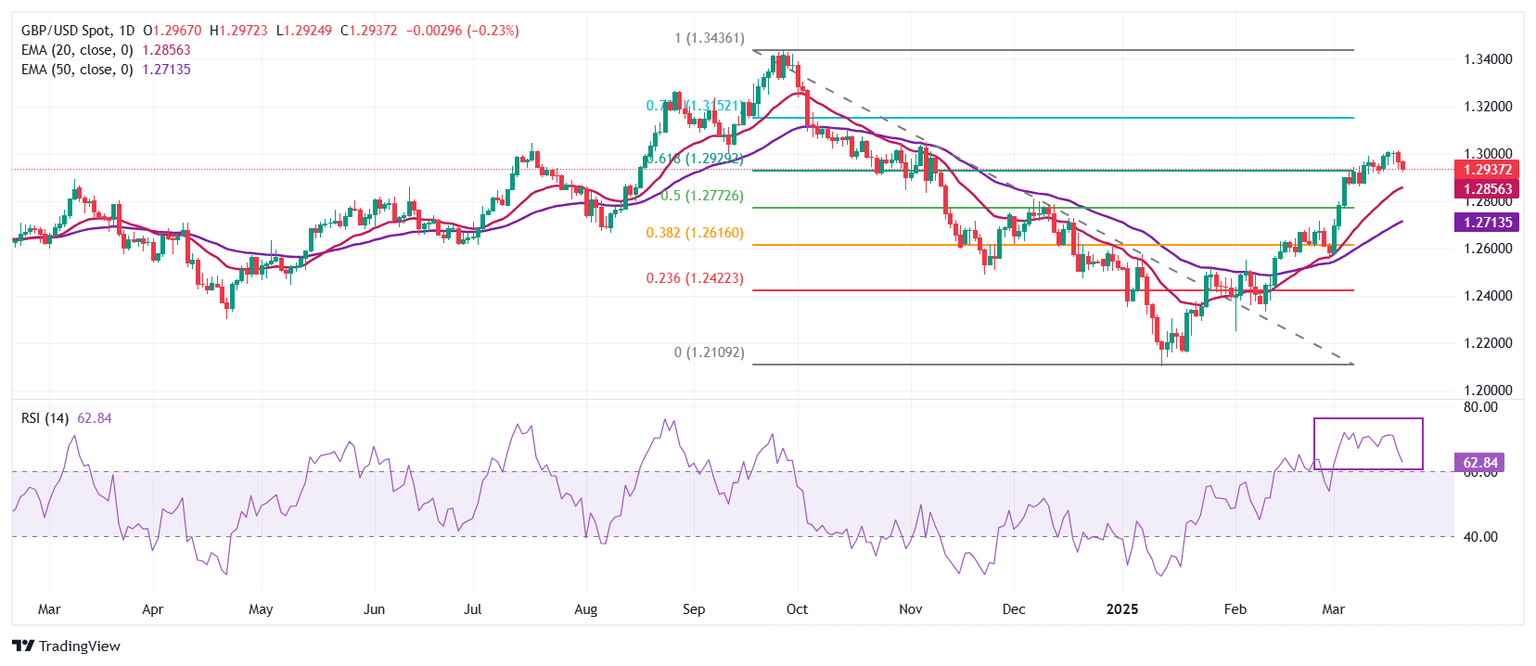

Technical Analysis: Pound Sterling falls towards 20-day EMA

The Pound Sterling slumps to near 1.2920 against the US Dollar on Friday after failing to extend its upside above the four-month high of 1.3000 the previous day. GBP/USD bulls take a breather as the 14-day Relative Strength Index (RSI) reached overbought levels above 70.00. However, this doesn’t reflect that the bullish trend is over. The upside trend could resume once the momentum oscillator cools down to near 60.00.

Advancing 20-day and 50-day Exponential Moving Averages (EMAs) near 1.2855 and 1.2712, respectively, suggest that the overall trend is bullish.

Looking down, the 50% Fibonacci retracement, plotted from late-September high to mid-January low, at 1.2770 and the 38.2% Fibo retracement at 1.2615 will act as key support zones for the pair. On the upside, the October 15 high of 1.3100 will act as a key resistance zone.

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

BRANDED CONTENT

Choosing a broker that aligns with your trading needs can significantly impact performance. Our list of the best regulated brokers highlights the best options for seamless and cost-effective trading.

BRANDED CONTENT

Finding the right broker for your trading strategy is essential, especially when specific features make all the difference. Explore our selection of top brokers, each offering unique advantages to match your needs.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.