GBP/USD climbs after FOMC hold rates, revise long-term projections

The

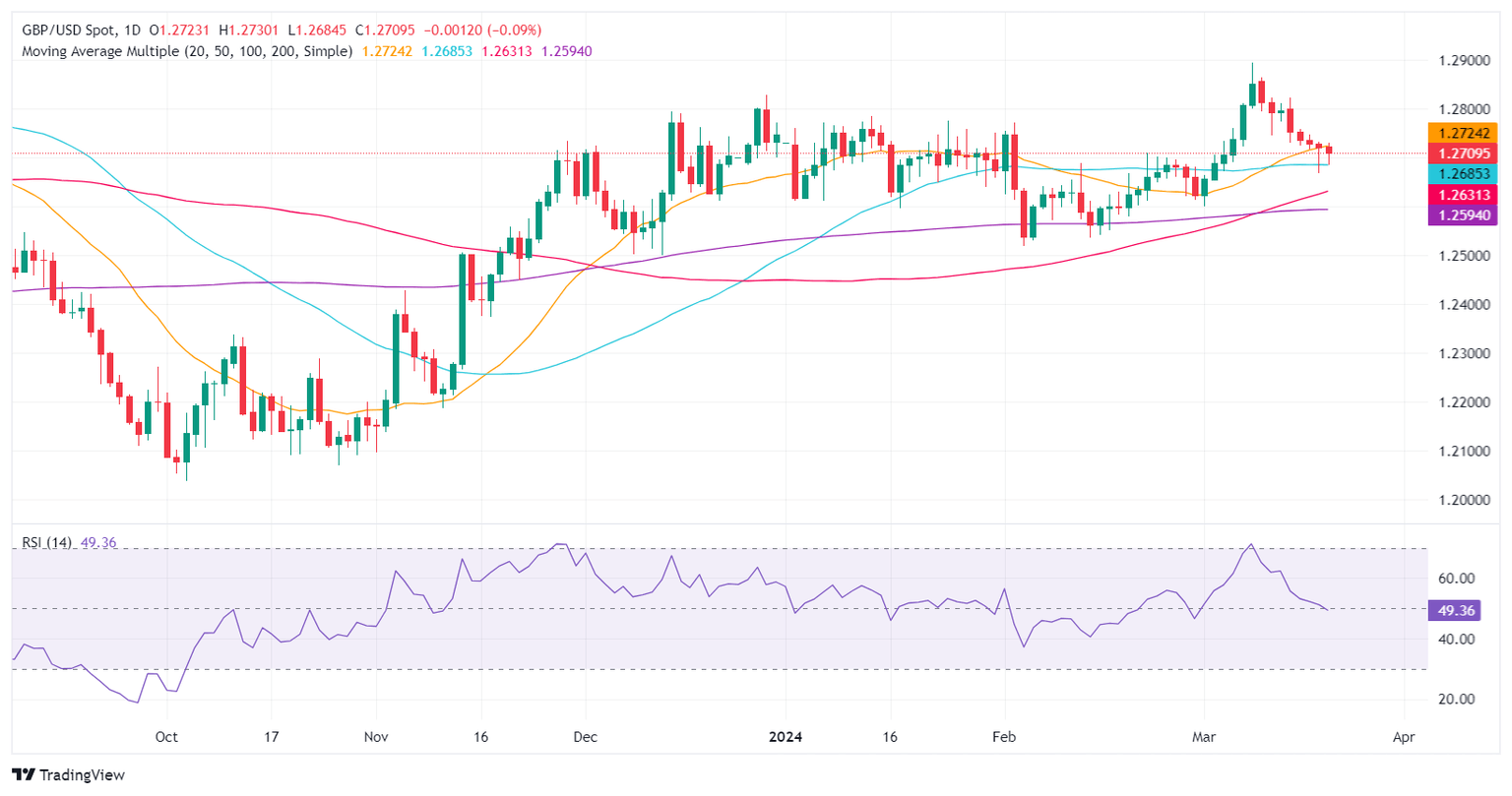

GBP/USD climbed sharply after the Federal Reserve’s (Fed) decision to hold rates but kept their interest rate cut projections unchanged for 2024. Consequently, the Greenback tumbled, while US Treasury bond yields climbed. At the time of writing, the GBP/USD trades volatile in the 1.2700/1.2750 area ahead of Fed Chair Jerome Powell's press conference.

Read More...

GBP/USD Price Analysis: Subdued around 1.2700, with bears in charge pre-FOMC decision

The Pound Sterling drops some 0.12% against the US Dollar in early trading during the North American session as traders brace for the Federal Reserve’s monetary policy. A softer inflation report in the United Kingdom (UK) didn’t move the needle in the session, as the

GBP/USD trades at 1.2706, with sellers hoping to push prices below the 1.2700 mark.

Read More...

Pound Sterling slumps on UK’s soft inflation, Fed policy in focus

The Pound Sterling (GBP) falls sharply in Wednesday’s London session as the United Kingdom Office for National Statistics (ONS) reported softer-than-expected Consumer Price Index (CPI) data for February. Annual headline and core inflation decelerated to 3.4% and 4.5%, respectively. Lower inflation is expected to allow

Bank of England (BoE) policymakers to consider cutting interest

rates earlier than what market participants had anticipated.

Read More...