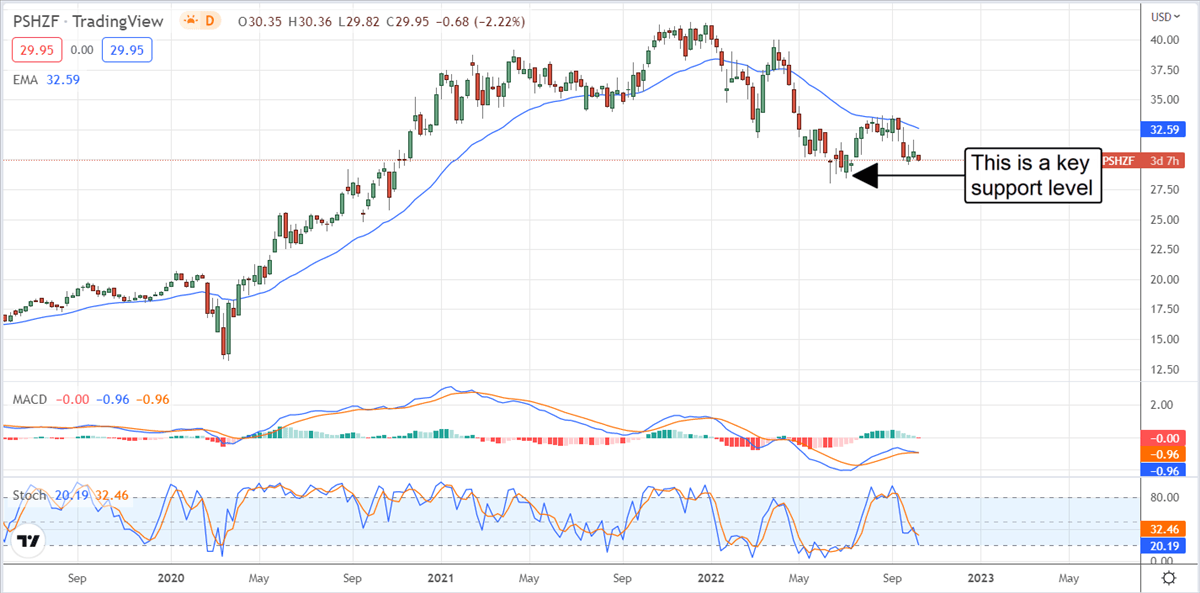

Pershing Square Holdings: Deep-value play for long-term investors

-

Pershing Square Holdings is a closed-ended hedge fund managed by Pershing Square Capital Management.

-

The fund invests in undervalued large-cap stocks with steady cash flow and uses hedging and other strategies to maximize returns and minimize risk.

-

The fund is trading at a deeper-than-normal discount to NAV which is setting up a buying opportunity.

If the name Pershing Square Holdings Ltd (OTCMKTS: PSHZF) sounds familiar it should. It is a closed-ended hedge fund traded on the OTC pink sheets (in the US) and headquartered in London (where it trades on the London Stock Exchange).

The fund was launched by Pershing Square Capital Mgt, one of the world's most prominent hedge fund investment firms, which was founded by Bill Ackman, one of the world’s most prominent investors.

The fund is intended to provide a balanced exposure to global equity and fixed-income markets, presumably with the experience of Mr. Ackman and Pershing Square Capital Management guiding the investments, and returns capital to shareholders in the form of capital appreciation, dividends, and share repurchases.

What, exactly, is Pershing Square Holdings Ltd?

Pershing Square Holdings Ltd is a closed-end fund investing in global equity and fixed-income markets. The equity portion of the portfolio is the largest and tends to be static and based on 8-12 core holdings. New holdings are added every 3-6 months as market conditions allow and tend to be stable, large-cap companies operating in North America.

The firm likes to invest in large, non-controlling interests in companies that they view as having limited downside, offer a value, provide stable and predictable cash flow, and may also come with some other attractive quality such as merger or acquisition potential.

Since its inception, this strategy has resulted in a 16.1% annualized return compared to the primary benchmark which is the S&P 500 (NYSEARCA: SPY). The S&P 500 returned only 9.7% in the same time span so there are advantages to this investment vehicle.

Pershing Square Holdings also uses derivative and fixed-income investment vehicles to enhance and hedge its positions. The latest company report states a new hedge was initiated in the summer of 2022 in the form of an interest-rate swaption that is already providing capital protection.

Pershing Square Holdings will also invest in alternative vehicles when it suits the manager and uses leverage to maximize its returns. The total leverage in mid-2022 was running at only 18.8%, however, which is low and backed up by a liquid portfolio of heavily-traded names.

Pershing Square Holdings Ltd is not without risks

Persing Square Holdings Ltd has a long track record of success but it is not without risks. At present, the company’s holdings and performance are down double-digits on a YOY basis and underperforming the S&P 500 by a fair margin.

The company views this as a dislocation in the market and one that will correct itself over time, however, because of the fundamental strength of core holdings. Core holdings, it was also noted, are all producing solid cash flow and growth despite the downturn in the market this year.

Along with market conditions, the fund is also susceptible to large losses as happened with Netflix early in 2022. The firm believed Netflix (NASDAQ: NFLX) to be undervalued, entered a large position, and then quickly exited it following the Q2 earnings results. Those results led the stock to fall 26% overnight.

There is a deep-value opportunity in Pershing Square Holdings Ltd

Pershing Square Holdings Ltd trades at discount to its NAV or net asset value which is common for a closed-end fund. The discount to NAV can provide a means of buying a high-quality stock at a discount and that is true here as well.

The company is trading at a 35% (roughly) discount to its NAV which is a very attractive discount for names like Universal Music Group (OTCMKTS: UMGNF), Restaurant Brands International (NYSE: QSR), Chipotle Mexican Grill (NYSE: CMG), and Lowe’s (NYSE: LOW) which are all core holdings.

The downside is that the discount to NAV can be a value trap because the discount may never narrow, but Pershing Square Holdings' 35% discount is well above average and suggests oversize returns are possible.

Not only will Pershing Square Holdings Ltd's share prices rebound when the market rebounds but the discount should narrow and it could easily move to the other extreme, narrower than historical data suggests is right for this fund.

Author

Jacob Wolinsky

ValueWalk

Jacob Wolinsky is the founder of ValueWalk, a popular investment site. Prior to founding ValueWalk, Jacob worked as an equity analyst for value research firm and as a freelance writer. He lives in Passaic New Jersey with his wife and four children.