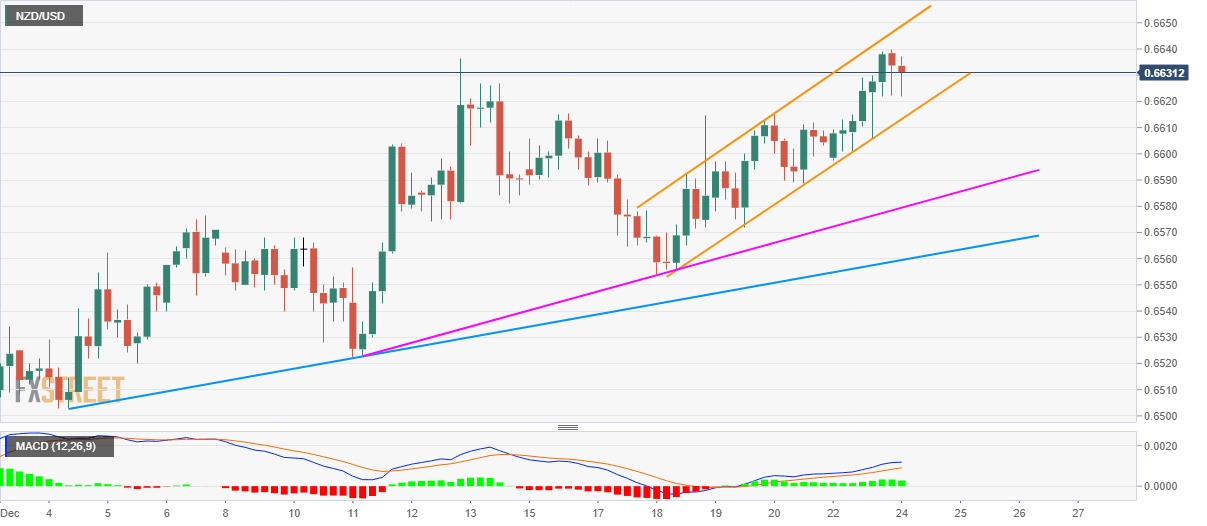

NZD/USD Technical Analysis: Weekly rising trend channel keeps buyers hopeful

- NZD/USD pulls back from a five-month high.

- Bullish MACD, short-term rising trend channel favors the pair’s further upside.

- Multiple support trend lines since the month’s start will challenge sellers.

NZD/USD declines to 0.6630 amid the initial trading session on Tuesday. The pair takes a U-turn from the fresh five-month high flashed at the end of Monday’s US session.

Even so, a weekly rising trend channel keeps the buyers hopeful. In doing so, pair’s run-up beyond 0.6640 will push buyers towards early-June month high near 0.6680 whereas 0.6700 round-figure could lure the Bulls then after.

Meanwhile, pair’s declines below the channel’s support of 0.6613 can trigger fresh declines to the two-week-old ascending trendline, at 0.6580.

In a case where bears fail to respect the bullish signals from 12-bar Moving Average Convergence and Divergence (MACD), the monthly support line at 0.6560 will be the key to watch for sellers.

NZD/USD four-hour chart

Trend: Bullish

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.