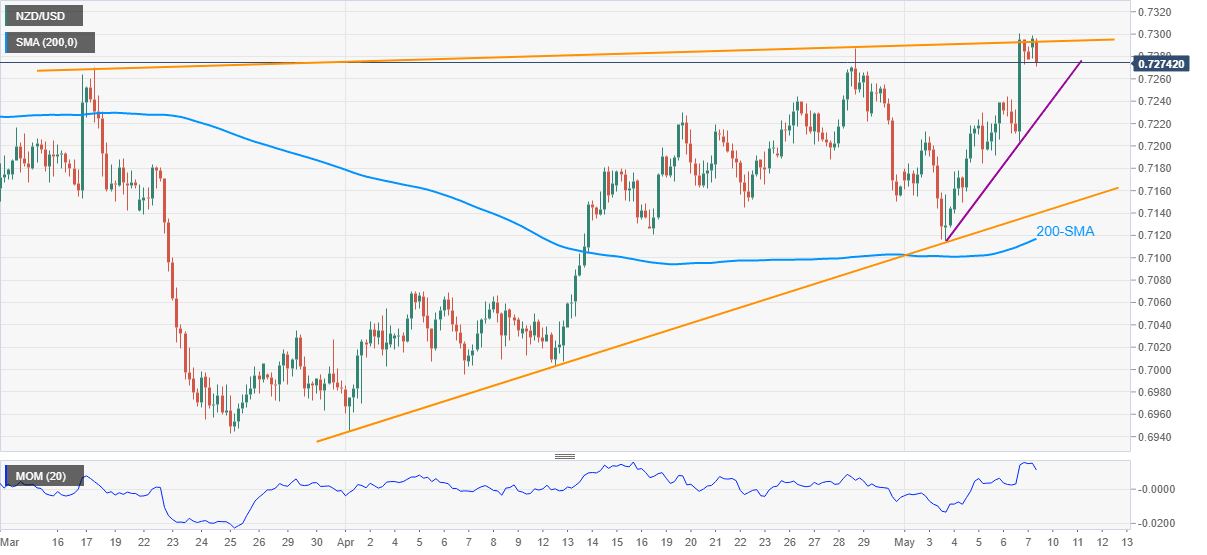

NZD/USD Price Analysis: Pulls back below 0.7300 as bulls battle seven-week-old hurdle

- NZD/USD refreshes intraday low after an initial choppy session in Asia.

- Momentum line suggests short-term consolidation of gains near the multi-day top.

- Sustained trading beyond the key trend lines, 200-SMA favor the buyers.

NZD/USD stays depressed around an intraday low of 0.7271, following its failure to cross Friday’s top, during early Monday. In doing so, the kiwi pair steps back from an ascending resistance line from March 18.

Given the multiple failures to cross the 0.7300 hurdle and Momentum pullback from overbought territory, NZD/USD may witness further profit-booking moves. However, a one-week-old rising support line near 0.7220 could test the intraday sellers.

If at all the bears conquer the 0.7220 support line, a monthly rising support line near 0.7140, followed by the 200-SMA level near 0.7115, will be the key levels to watch.

On the flip side, a clear run-up beyond the 0.7300 won’t make the NZD/USD bull’s life easier as January high near 0.7315 and 0.7370 will be the tough nuts to crack for them.

It should, however, be noted that a clear run-up beyond 0.7370 will propel the quote towards refreshing the yearly peak surrounding 0.7465.

NZD/USD four-hour chart

Trend: Pullback expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.