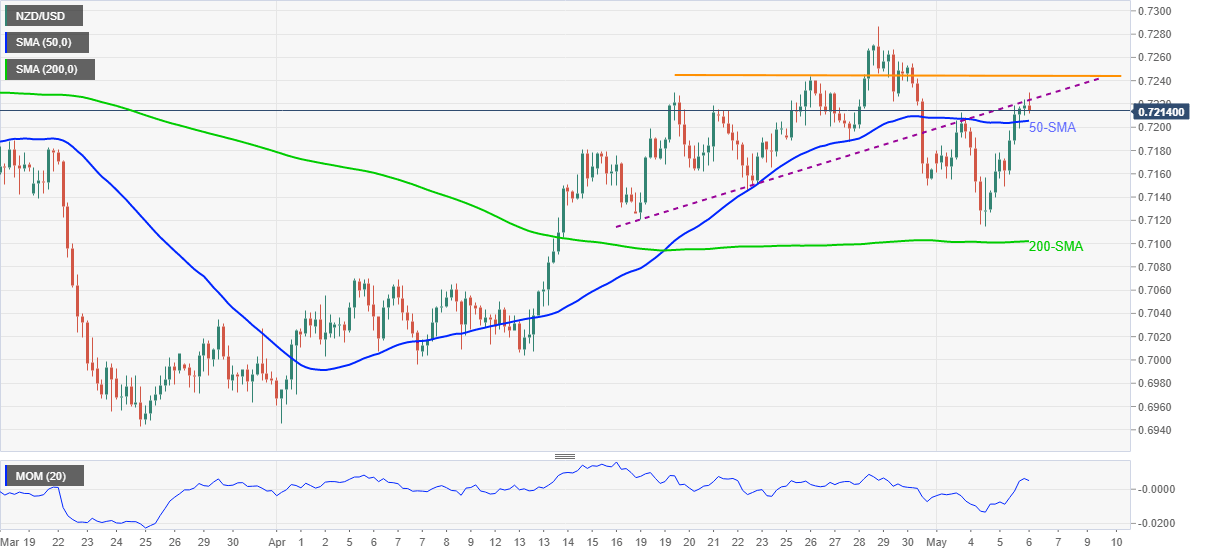

NZD/USD Price Analysis: Bulls battle previous hurdle above 0.7200 amid rumors over AU-NZ travel bubble

- NZD/USD eases after refreshing weekly top following its sustained break of 50-SMA.

- Upbeat Momentum backs the bulls but chatters over New Zealand’s border restrictions probe recent upside.

- Bears may not risk fresh entries beyond 200-SMA.

NZD/USD eases to 0.7220, after refreshing the weekly high with 0.7229, during early Thursday. Although the kiwi pair trades successfully above the key SMAs amid upbeat Momentum, the unconfirmed reports of New Zealand likely to shut borders for Sydney today seem to test the bulls of late.

Technically, the previous support line from April 19 also seems to challenge the quote’s upside moves.

Hence, NZD/USD traders should wait for a clear direction between the 50-SMA level of 0.7205 and the support-turned-resistance line near 0.7225 for a fresh direction.

It should, however, be noted that a nine-day-old horizontal resistance around 0.7245 may offer an intermediate halt during the pair’s run-up beyond 0.7225 towards April’s high of 0.7287.

Meanwhile, a downside break of 0.7205 will need to smash the 0.7200 threshold before declining towards the 200-SMA level of 0.7102.

During the fall, 0.7155-50 area may act as a buffer while the early April tops near 0.7070-65 can entertain NZD/USD bears afterward.

NZD/USD four-hour chart

Trend: Pullback expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.