NZD/USD declines on Monday, falls back into 0.6190 in early week action

- The Kiwi backslid to kick off the new trading week.

- Risk appetite favored the US Dollar on Monday despite US market holiday.

- Asia market sees China GDP, Retail Sales figures due on Wednesday.

The NZD/USD skidded back into near-term lows on Monday, falling through the 0.6200 handle as the Kiwi (NZD) sold off against the US Dollar (USD) in a broad-market Greenback bid as markets rebalanced with US markets shuttered in observance of Martin Luther King Day.

Antipodean traders will be keeping an eye out for China’s headline data prints on Wednesday, with Chinese Gross Domestic Product (GDP) and Retail Sales figures slated for early in the mid-week trading session.

China’s fourth-quarter GDP is forecast to increase from 4.9% to 5.3% for the year ended December, while annualized Retail Sales through December are expected to hold flat at 6.6%. QoQ China GDP is expected to settle from 1.3% to 1.0%.

New Zealand’s NZIER QoQ Business Confidence Survey rebounded in December but still printed negative, coming in at -2% compared to the previous quarter’s -52%. The NZIER Business Outlook has printed in negative territory since July of 2021.

NZD/USD Technical Outlook

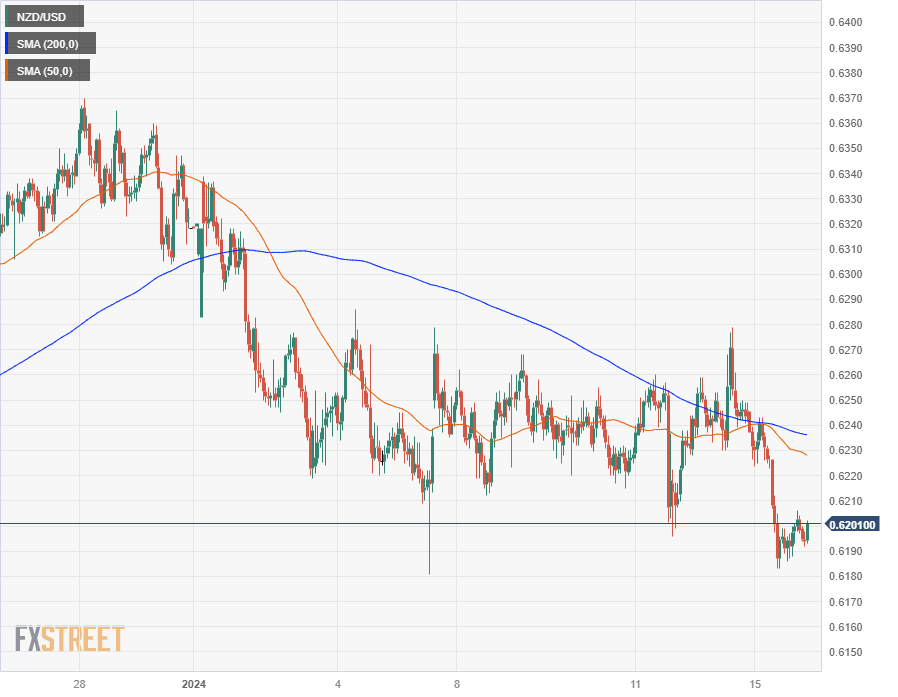

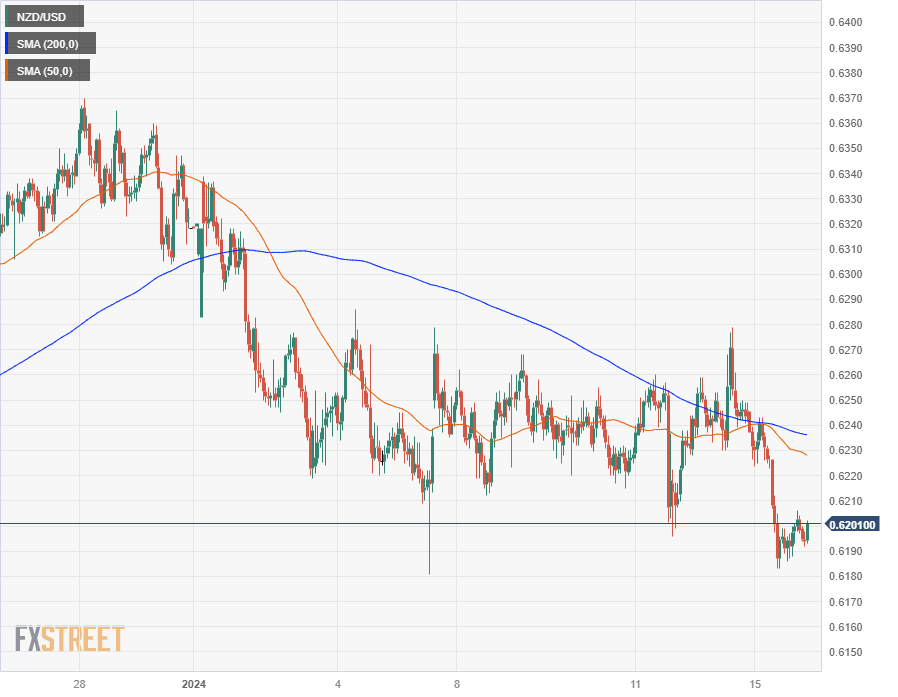

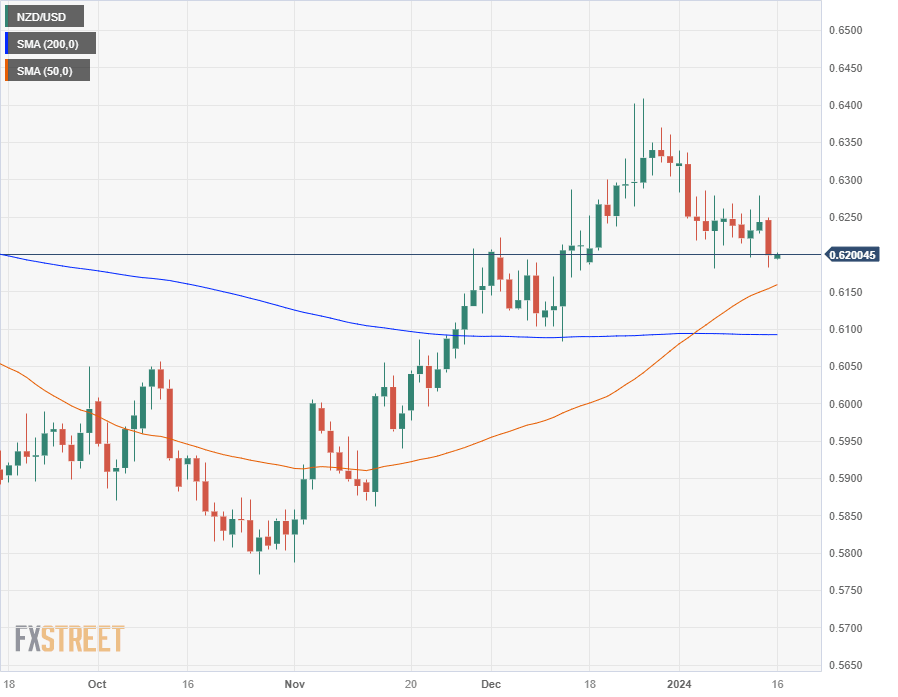

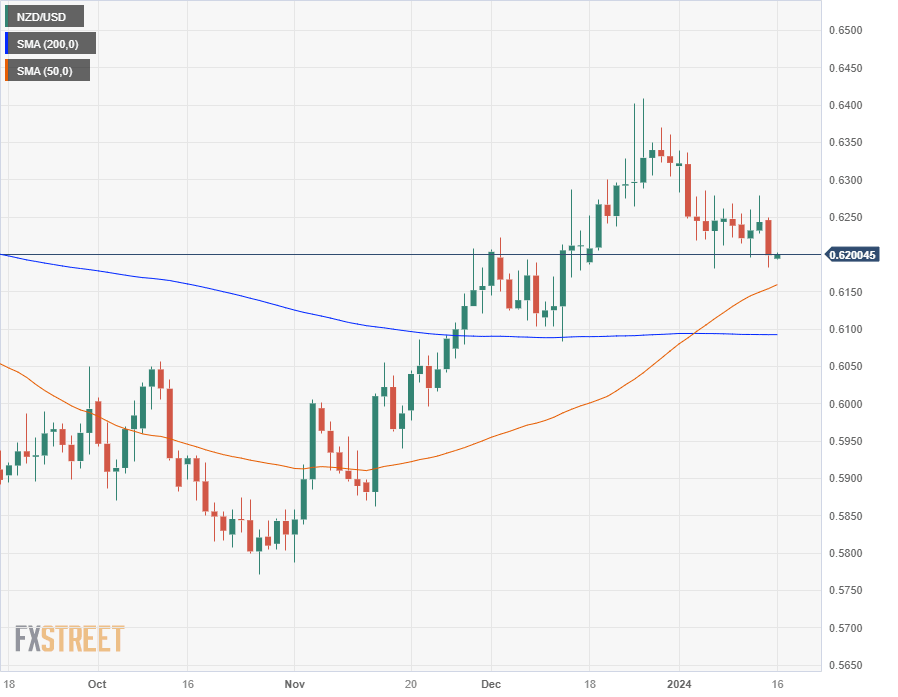

The Kiwi broke into the low side of a rough consolidation range that has plagued the NZD/USD since declining into the current chart range at the outset of 2024’s trading, testing back into the 0.6200 handle.

Monday’s backslide brings the NZD/USD closer to a technical floor at the 50-day Simple Moving Average (SMA) near 0.6150, with a bullish crossover of the 200-day SMA providing a possible bottom of near-term bearish momentum from the 0.6100 handle.

NZD/USD Hourly Chart

NZD/USD Daily Chart

NZD/USD Technical Levels

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.