NZD/JPY Price Forecast: Holds steady above 86.00 with intact bullish structure

- NZD/JPY maintains bullish trend with higher highs and lows since April’s 79.81 bottom.

- Break above 87.01 needed to extend rally toward 87.73 and YTD high at 89.70.

- Key support seen at 84.61; breach opens path toward 84.21 Kumo top and 83.77 Senkou Span B.

The NZD/JPY begins Tuesday’s Asian session flat after registering minimal gains of over 0.24% on Monday amid a risk-on mood. At the time of writing, the cross-pair trades at 86.13, unchanged.

NZD/JPY Price Forecast: Technical outlook

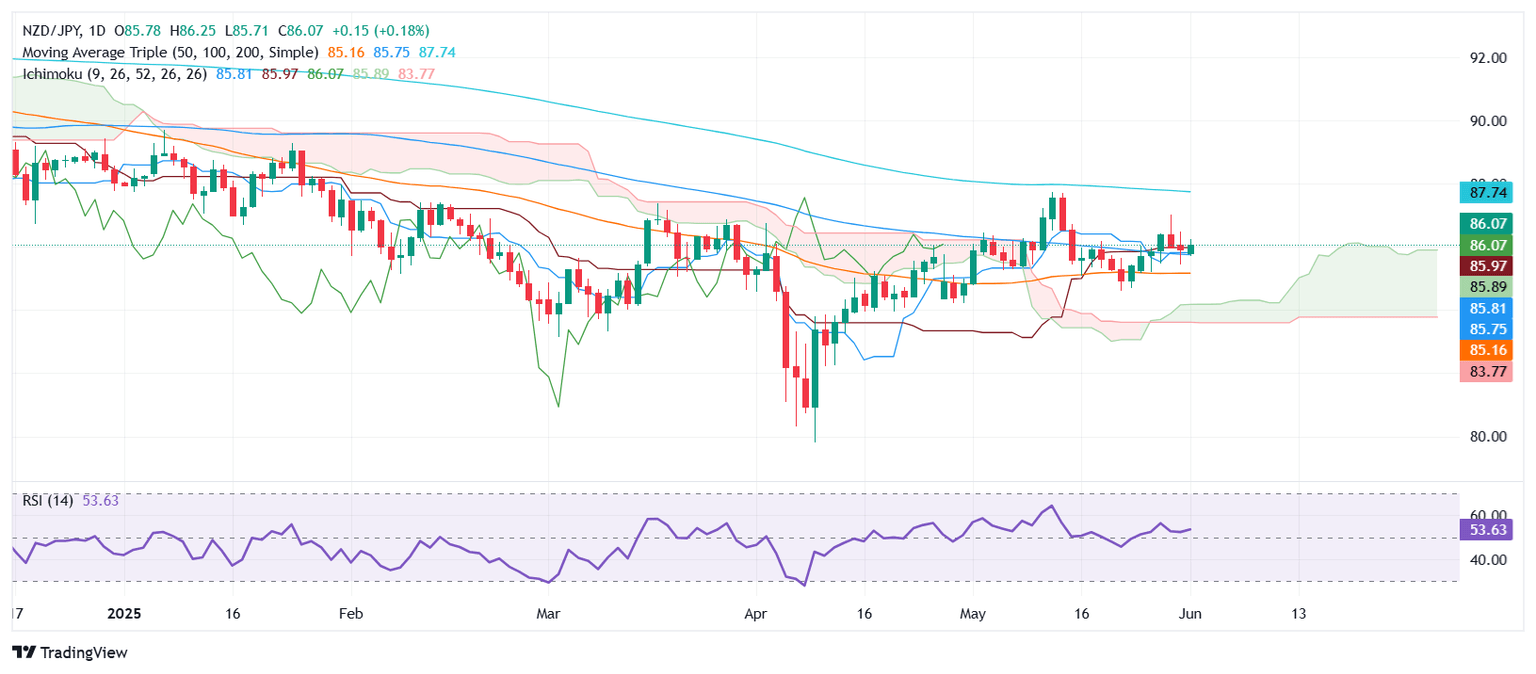

The NZD/JPY seems to have bottomed, with the pair remaining near current levels after hitting a yearly low of 79.81 on April 9. Since then, the pair climbed past the 86.00 figure, with price action printing a successive series of higher highs and higher lows, suggesting that the overall trend is up.

The Relative Strength Index (RSI) has also climbed past its 50 neutral line, although it signals that further consolidation lies ahead, given the lack of a catalyst.

For a bullish continuation, the NZD/JPY needs to clear the May 29 high at 87.01. A breach of the latter will clear the path to challenge higher prices, with May 13 swing high up next at 87.73, ahead of the year-to-date (YTD) high of 89.70.

Conversely, a drop below the May 22 swing low of 84.61 and the NZD/JPY could test the top of the Ichimoku Cloud (Kumo) at around 84.21. Once surpassed, the next stop would be the Senkou Span B at 83.77.

NZD/JPY Price Chart – Daily

New Zealand Dollar PRICE This week

The table below shows the percentage change of New Zealand Dollar (NZD) against listed major currencies this week. New Zealand Dollar was the strongest against the US Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.01% | -0.02% | -0.09% | 0.00% | 0.00% | -0.08% | -0.11% | |

| EUR | 0.01% | 0.02% | -0.05% | 0.03% | 0.03% | 0.02% | -0.08% | |

| GBP | 0.02% | -0.02% | -0.08% | 0.01% | 0.02% | -0.00% | -0.10% | |

| JPY | 0.09% | 0.05% | 0.08% | 0.08% | 0.07% | 0.03% | 0.05% | |

| CAD | -0.00% | -0.03% | -0.01% | -0.08% | -0.05% | -0.02% | -0.11% | |

| AUD | -0.01% | -0.03% | -0.02% | -0.07% | 0.05% | -0.02% | -0.11% | |

| NZD | 0.08% | -0.02% | 0.00% | -0.03% | 0.02% | 0.02% | -0.09% | |

| CHF | 0.11% | 0.08% | 0.10% | -0.05% | 0.11% | 0.11% | 0.09% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the New Zealand Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent NZD (base)/USD (quote).

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.