NNDM Stock Forecast: Nano Dimension Ltd technicals still point lower after acquisition-related jump

- Nano Dimension Ltd has jumped by 7.53% on Tuesday following prosing acquisition news.

- NASDAQ: NNDM technicals continue pointing lower for the next few trading sessions.

- The Israeli firm's positioning in the Industry 4.0 sector may help gain traction in the longer term.

Machine learning, deep learning, Industry 4.0 – Nano Dimension Ltd (NASDAQ: NNDM) has all the hot buzzwords and also backs it up with its own and acquired technologies. However, while the firm's prospects are promising (see below), shares are far from being out of the woods.

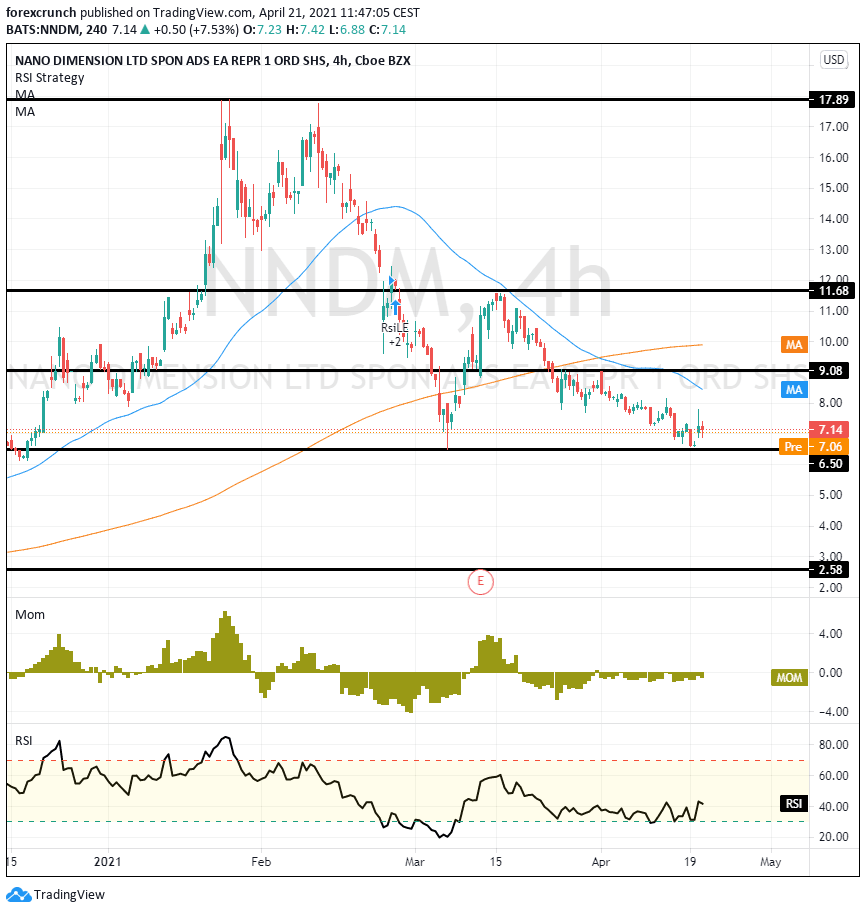

Examing's NNDM's four-hour chart shows that the downtrend remains intact. Failing to break above the $17.89 peak – twice – back in February triggered a slide that has yet to conclude.

Stay up to speed with hot stocks' news!

The 50 Simple Moving Average (SMA) crossed the 200 SMA in early April, another bearish sign while the Relative Strength Index (RSI) is outside oversold conditions, also allowing for more falls. Moreover, momentum is to the downside. Another worrying factor is that Tuesday's price action saw a significant decline from a 17.3% gain at the peak to only 7.5% at the close, showing bears have more strength at this point.

Bulls may find solace in the fact that similar to that double-top, the recent bounce off the $6.50 level is forming a double-bottom which may eventually turn into a bullish scenario.

All in all bears still have an upper hand, at least in the near term.

MNDM stock news

As mentioned at the outset, Nano Dimension is at the right place, and at the right time. The Israeli-based firm is in the Additively Manufacturing Electronic (AME) industry which is gaining traction as several countries want to enhance their own industries. The covid crisis has given deglobalization a boost and industry may become more redundant.

Moreover, the development that sent shares higher came from Nano's acquisition of DeepCube, which has developed deep-learning and machine learning technologies. This move further boosts the company's fortunes. The deal is worth a total of roughly $70 million in cash and shares and is set to close within days. The sums seem small in comparison with Nano Dimension's $1.7 billion market capitalization at the time of writing.

Overall, long-term investors may certainly consider buying shares, but those looking for a quick buck may want to reconsider given the unfavorable technical positioning.

The author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

This article is for information purposes only. The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice. It is important to perform your own research before making any investment and take independent advice from a registered investment advisor.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to accuracy, completeness, or the suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. The author will not be held responsible for information that is found at the end of links posted on this page.

Errors and omissions excepted.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.