NIO Stock Price: Nio Inc edges lower after sanctions on Carrie Lam Trump's TikTok move

- NYSE:NIO surges 13.90% on Monday as the company reports a tremendous July sales report.

- The electric vehicle sector rises on Nikola analyst upgrade and Workhorse Group news.

- Optimism amongst investors as the July sales report is released ahead of the quarterly earnings call.

The Chinese electric vehicle maker has reported delivering 3,533 vehicles in July – resulting in a whopping year over year growth of 322% from July 2019. Investors rejoiced in the good news, as the stock price climbed 13.90%, closing Monday’s trading session at $13.60 per share. The July sales report provided by Nio Inc. is fortuitous timing ahead of the quarterly earnings call set to take place on August 11th.

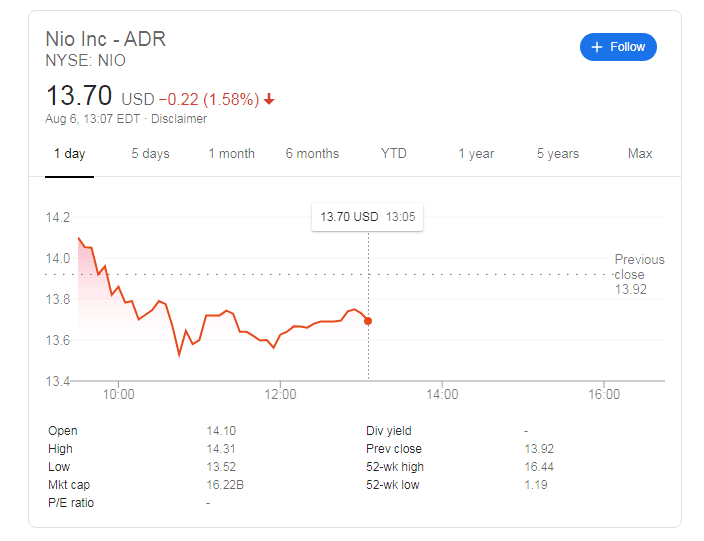

Update 7: China's NIO is on the back foot on Friday, trading around 1% lower. Sino-American tensions have been intensifying in the past 24 hours. US action against Chinese tech titans has been joined by a move against Hong Kong's leader, casting doubts about the sales of EV cars in the West. See Reports US to sanction Hong Kong leader Carrie Lam

Update 6: NYSE: NIO has dropped by a minor 0.5% on Thursday but Friday's session may see further declines if to judge by pre-market trading. Shares are quotes at around $13.25, a decline of around 4%. President Donald Trump slapped executive orders against TikTok and WeChat, two Chinese tech firms. Deteriorating Sino-American relations are having a detrimental impact on the Chinese electric vehicle maker, yet there is a silver lining.

Update 5: After opening higher on Thursday, Nio's stocks have been eroding their gains and are battling the $13.70 level at the time of writing. The broader EV sector is mixed while interest in coronavirus vaccines remains prevalent. More: NVAX, which has three reasons to rise.

Update 4: While those driving fast cars may lack patience, investors in NYSE: NIO may find it as a virtue. Thursday's trading is et to see fresh gains to $14 and potentially beyond that level. THe EV-maker has defied the rest of the sector in Wednesday's trading and continues its upward march toward a valuation of $20 billion.

Update 3: Nio Inc has been extending its gains in Wednesday's trading, rising toward the $14 mark. It is buoyed by expectations for robust sales of its electric vehicle and continues benefiting from the general buzz around the electric vehicle sector. The increase of around 1% is in line with the broader increase in the S&P 500 index, which is ignoring coronavirus figures.

Update 2: NYSE: NIO is set to consolidate its gains in early Wednesday trading, yet to hold onto the $13 handle. Keris Lahiff at CNVBC cites traders that say Nio and Nikola could be a better bet than Tesla. The influential financial outlet may help boost the EV sector. Update: Nio Inc is trading some 2% higher on Tuesday, nearing $14. NYSE: NIO had already reached higher ground earlier, hitting an intraday peak of $14.53. Further above, the 52-week high of $16.44 awaits the EV maker.

Nio was not the only electric vehicle maker that made headlines to start August off. Beleaguered electric truck maker Nikola (NASDAQ:NKLA) bounced back on the news of an analyst upgrade from Deutsche Bank. The report mentioned that optimism from Nikola's upcoming earnings call could be enough to get investors excited again for the long term. The stock closed Monday’s session up over 21% at $36.49 per share.

Workhorse Group (NASDAQ:WKHS) also received a boost on Monday as Lordstown Motors – a company in which Workhorse owns a 10% stake – announced it would be going public through a reverse merger with DiamondPeak Holdings (NASDAQ:DPHC). Workhorse shares rose by 23% on Monday, finishing at $19.66 per share.

NIO Stock Forecast

Nio Inc. may have enough momentum now for the proverbial dam to burst ahead of its earnings call next week. If the July sales report is any indication of how the call would go, investors would be wise to try and snatch the stock up now before it continues to rise. Further news indicates that Nio is ready to begin production of its newest car, the EC6 crossover coupe, with pre-orders starting last month.

Author

Stocks Reporter

FXStreet