NIO Stock News and Forecast: Shares fall for a second day, but there are reasons to rise

- NIO shares have been recovering from strong falls.

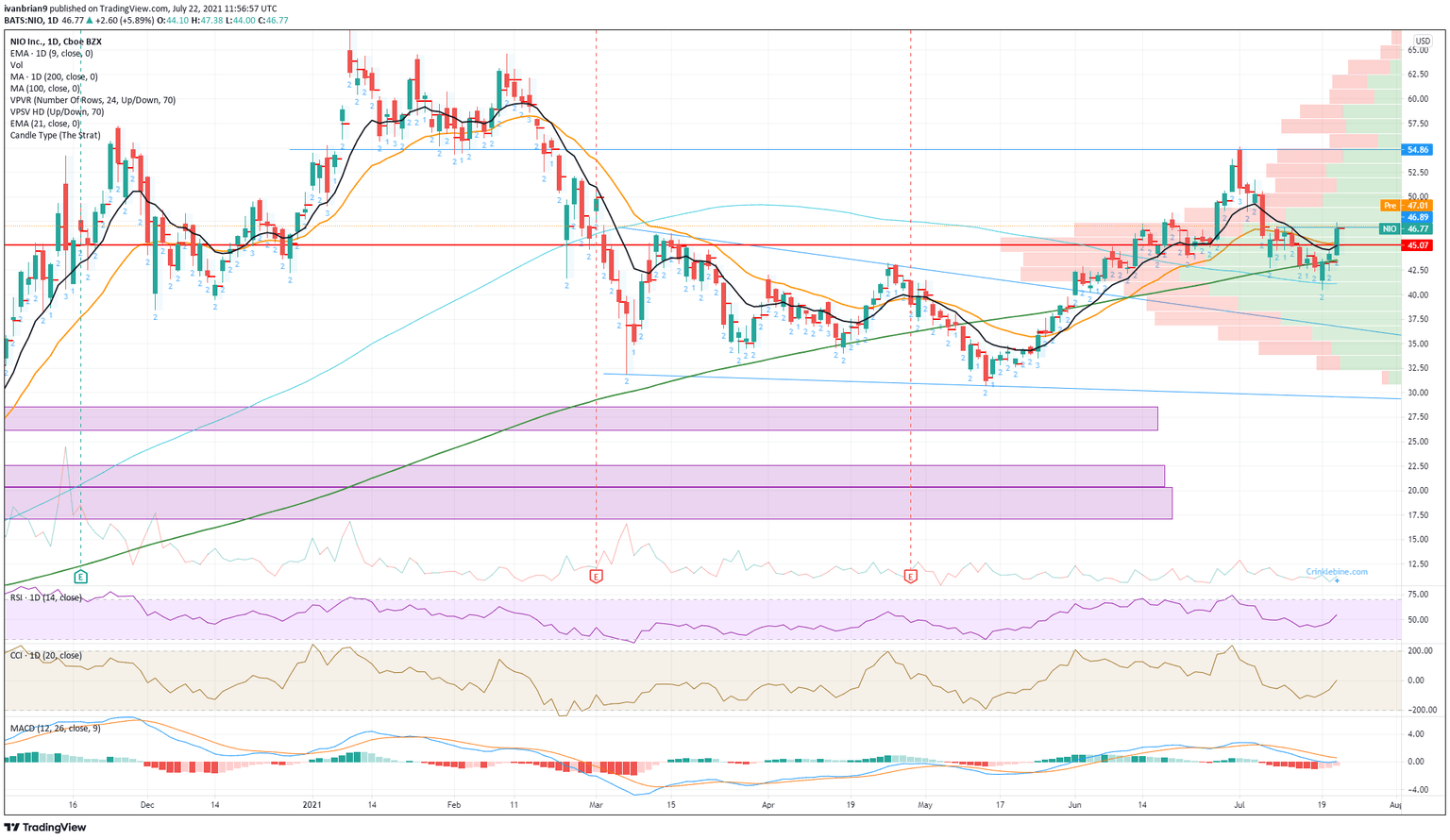

- The Chinese EV maker failed at $54.86 and treaded to nearly $40.

- NIO is now back above short-term moving averages.

Update July 23: Nio Inc ADR (NYSE: NIO) has kicked off Friday's trading session with another decline, this time of nearly 5% to below $44. Critical support awaits at July's lowest close of $42.80, recorded last Friday. Holding above that level would be a bullish sign – a higher low that would mark an uptrend. Critical resistance is at $46.77, which was the highest close this week and marginally above the $46.34 high seen on July 12. For investors to be confident of the stock's recovery, rising above the psychologically significant $50 line is critical.

NIO stock suffered a backlash from the DIDI fallout (see here) and retraced to the 200-day moving average. The sell-off was also technical in nature as the stock had failed to break the $54.89 resistance. NIO then retraced and briefly broke the 200-day moving average but bounced quickly from the 100-day just below. FXStreet had identified this support zone – "NIO will then have a last chance at the 100-day moving average, currently at $41.24" – and this has played out nicely. Wednesday saw a powerful move of nearly 6% higher with the stock closing at $46.77.

Recent delivery numbers from all Chinese electric vehicle manufacturers were strong. LiAuto (LI) posted record June deliveries, up 166% YoY. XPeng (XPEV) posted a 439% yearly gain in deliveries, while NIO itself posted a yearly gain of nearly 116%. This had set the sector up for a strong early July, but NIO ran into strong resistance at $54.86.

NIO statistics

| Market Cap | $79 billion |

| Price/Earnings | -83 last 12 months |

| Price/Sales | 25 |

| Price/Book | 19 |

| Enterprise Value | $56 billion |

| Gross Margin | 16% |

| Net Margin |

NA |

| Average Wall Street Rating and Price Target | Buy $54.89 |

NIO stock forecast

The strong move on Wednesday was a continuation of the strong Monday turnaround that Tuesday followed up on. NIO stock was down over 4% in early trading on Monday but turned around in the afternoon to close up over 2%. A 7% intraday turnaround is definitely something to get bulls excited about, especially when the volume was toward the higher end of prices. Tuesday started off negative again, but eventually bulls awoke and remembered Monday. They pushed NIO to close up again, this time by nearly 2%. Now Wednesday's strong rally has taken NIO up to a small resistance at $46.89, the series of highs on July 9, 12 and 13. It is not too strong, but a move through this level would open the door to a retest of our $54.86 resistance. This would ensure we do not set a series of lower highs, a bearish trend obviously.

Wednesday's move has put the risk-reward back nicely to longs with NIO now clear of the 9 and 21-day moving averages and the Relative Strength Index (RSI) and Commodity Channel Index (CCI) both trending higher, thereby confirming the price action. The final piece of the jigsaw would be to see the Moving Average Convergence Divergence (MACD) cross back into bullish territory.

Like this article? Help us with some feedback by answering this survey:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.