NIO Stock News and Forecast: Why is NIO down again and again?

- NIO stock suffers yet again on Thursday after US CPI.

- NIO shares lose nearly 3% as tech and growth names suffer.

- NIO looking likely to remain mired under $27.34 resistance level.

NIO stock lost yet more ground on Thursday as high growth and tech names fall out of favour after Treasury yields rise. The US CPI saw the US 10-year pop above 2% for the first time since mid-2019. This will set alarm bells ringing among investors in high growth tech stocks, and NIO is obviously going to struggle to make headway.

NIO stock news

NIO shares had caught a few tailwinds recently, and the shares began to look more encouraging on the chart. Barclays has put out a bullish note on NIO and slapped a $34 price target on the shares. The British bank put an overweight rating on NIO. The bank was bullish on the overall EV picture and the Chinese EV market in particular. It said NIO was well-positioned to capitalize on both.

Also last week NIO had reported that deliveries in January rose nearly 34% from a year earlier. Yes, deliveries fell in January compared to December, but this was expected due to the Chinese lunar new year. This was replicated by other Chinese EV makers XPEV and LI.

We also note a report from CnEVPost that NIO will launch a subsidiary brand of EV models for mass market adoption in Hefei. Annual production is in the range of 60,000 units. NIO had previously commented that it would launch such a product.

NIO Stock Forecast: a possible drop below $20

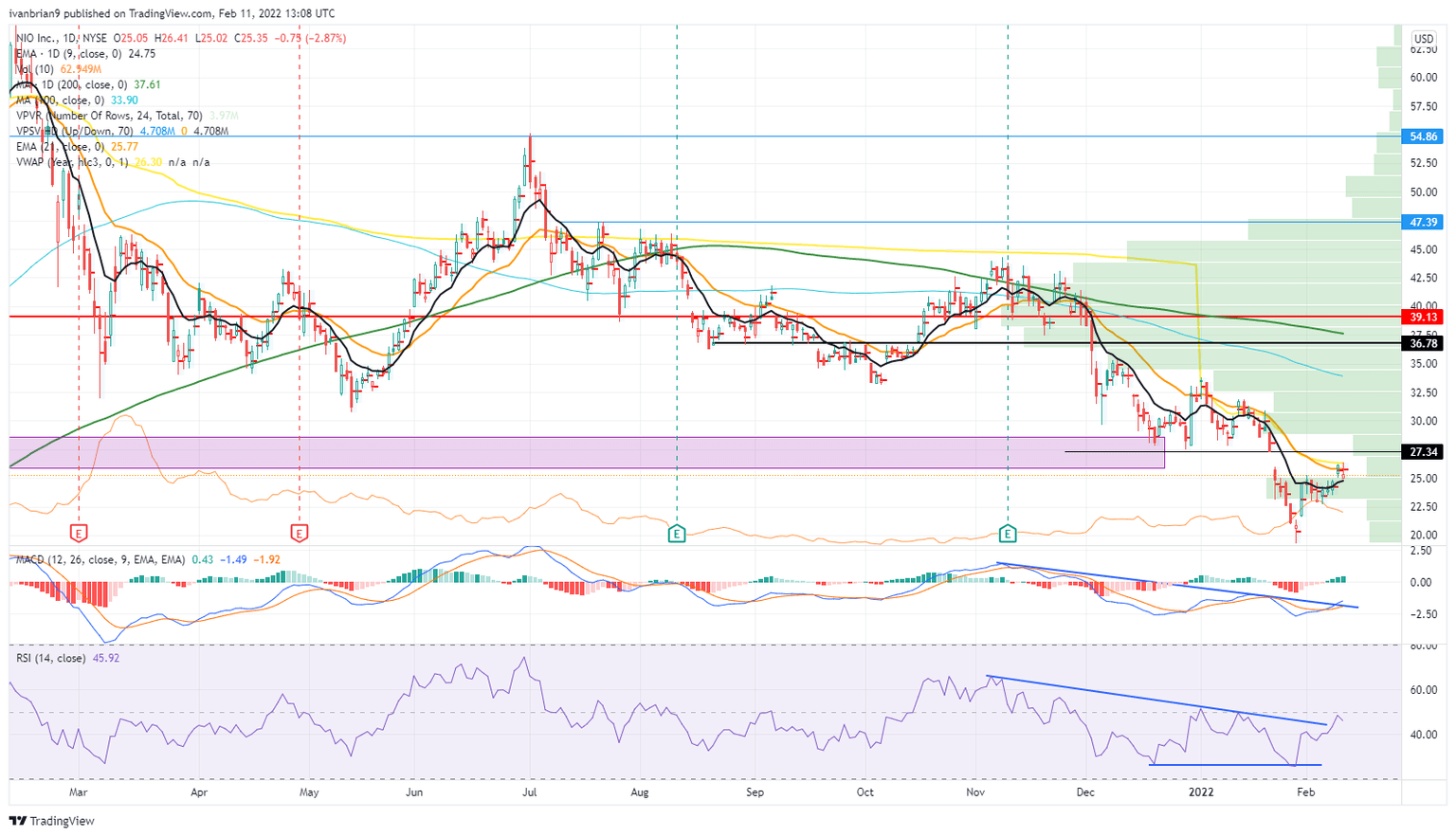

$27.34 remains a strong resistance level. Above here, NIO is back into a range zone from $27.40 to $33. That would have provided a stabilization point and a springboard for more gains. Now though the macro picture makes this more difficult to achieve. Yes, NIO has an impressive growth metric and may outperform other EV stocks, but outperformance in a down market is still down. Keep and eye on the Relative Strength Index (RSI) and Moving Average Convergence Divergernce (MACD). Both showed breakouts this week, but if both retrace, then a move to under $20 is likely in the short term for NIO.

NIO stock chart, daily

The author owns NIO shares.

Like this article? Help us with some feedback by answering this survey:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.