NIO Stock Forecast: Nio Inc rises after reporting May delivery figures

- NYSE:NIO gained 1.04% during Wednesday’s trading session.

- Nio and other Chinese EV makers report their deliveries for May.

- Nio assures investors that production should return to normal in June.

NYSE:NIO saw its momentum carry over from May as the Chinese EV maker saw its stock rise for the sixth straight day on Wednesday. Shares of Nio added a further 1.04% and closed the first trading session of June at $17.57. Some comments from the Fed caused another choppy day of trading as all three major averages closed in the red. Fed President James Bullard mentioned that reigning inflation in is still the top priority for the Fed, although he also mentioned he does not foresee a recession at this time. The Dow Jones lost a further 176 basis points, while the S&P 500 and the NASDAQ dropped lower by 0.75% and 0.72% respectively during the session.

Stay up to speed with hot stocks' news!

Chinese EV makers released their delivery figures for the month of May on Wednesday before the markets opened. All three of Nio, XPeng (NYSE:XPEV), and Li Auto (NASDAQ:LI) reported both sequential growth over April deliveries as well as on a year-over-year basis. Li Auto and XPeng were both affected less than Nio was during the Shanghai lockdowns, and expectedly managed to deliver more vehicles than Nio during the month. Shares of Li Auto closed higher by 1.56% while XPeng closed lower by 2.47% on Wednesday.

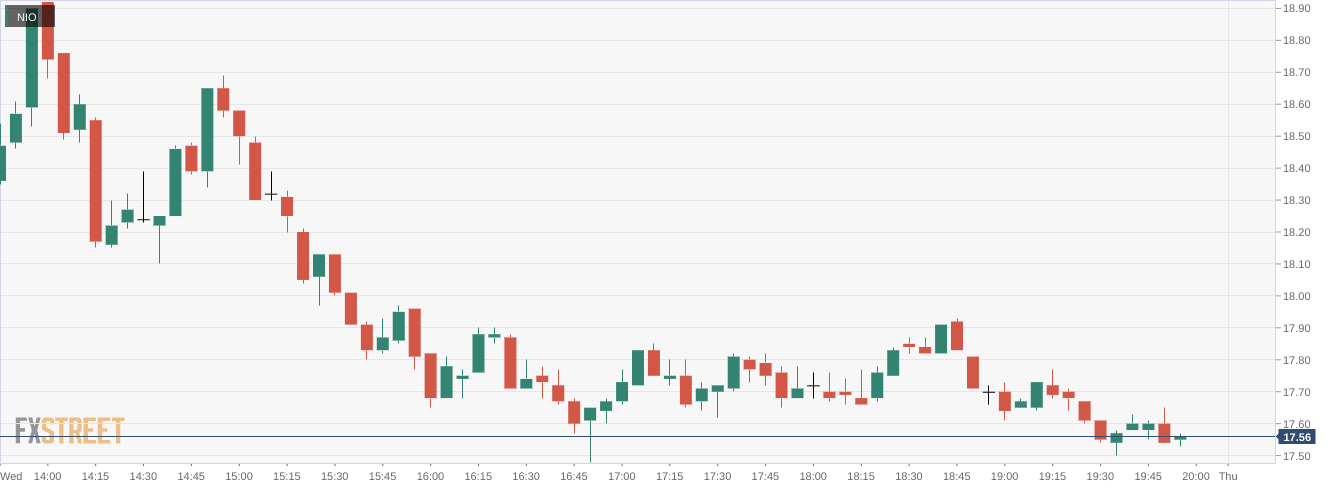

NIO stock price

Perhaps what was moving Nio’s stock higher on Wednesday was the fact that the company expects production rates to return to normal in June. Shanghai officially relaxed its COVID-19 imposed lockdowns on Wednesday, and Nio’s production should be back in full force. On top of this, the Chinese government is also beginning to offer cash subsidies once again for residents who buy domestically-made EVs. This should give a boost to sales for EV makers in the second half of 2022.

Stay up to speed with hot stocks' news!

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet