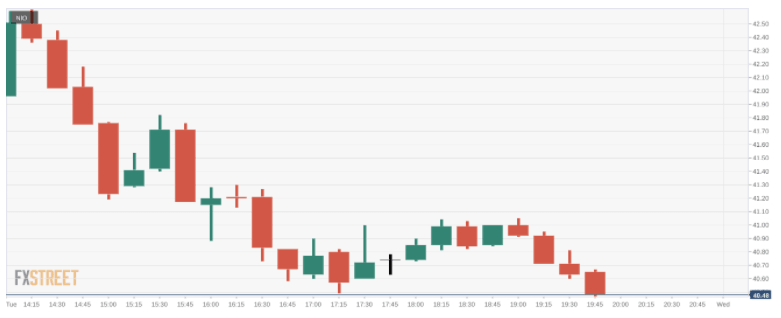

NIO Stock Forecast: Nio Inc pulls back as EV sector cools off

- NYSE:NIO fell by 1.94% during Tuesday’s trading session.

- The EV sector was hit with a flurry of good news on Monday.

- Lucid motors finally announces vehicle deliveries.

NYSE:NIO started the day strong on Tuesday, but was unable to hold another day of gains as the stock tumbled into the close. Shares of Nio fell by 1.94% on Tuesday, and closed the trading session at $40.47. After surging by more than 6.0% on Monday, Nio climbed higher by over 3.0% Tuesday morning, only to fall below water by the time the markets closed. It was a mostly flat day for the broader markets as all three indices edged higher and finished in the green for the second straight session. The NASDAQ and S&P 500 both paused on Tuesday ahead of major tech earnings from Microsoft (NASDAQ:MSFT), Alphabet (NASDAQ:GOOGL), and AMD (NASDAQ:AMD).

Stay up to speed with hot stocks' news!

The EV sector climbed higher on Monday after a flurry of good news for the sector. Tesla (NASDAQ:TSLA) screamed to a new all-time high on the news that Hertz was ordering 100,000 vehicles for its rental service. XPeng (NYSE:XPEV) introduced several new technology advances for its vehicles at its Tech Day event, including upgrading its supercharger network and introducing flying cars by 2024. Tuesday saw a pullback, which is normal in a sector as volatile as the EV industry.

NIO stock price

Elsewhere in the EV industry, Lucid Motors (NASDAQ:LCID) finally announced it is delivering its long awaited Air Dream sedans to its patient customers. Over the weekend the EV maker posted an image of several Air Dream sedans on a delivery truck seemingly heading out to their soon to be owners. Shares of Lucid pulled back on Tuesday alongside the rest of the EV market.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet