NIO Stock forecast and News: NIO slides below $40 ahead of Q1 results

- NIO reports earnings after the close on Thursday.

- NIO holding the bullish trend above moving averages.

- NIO is likely to see further bullishness from Biden and Fed effect.

Update April 29: After starting the day near Wednesday's closing level at $41.50, NIO shares lost traction and dropped to a fresh weekly low of $38.73 before going into a consolidation phase. As investors await first-quarter earnings figures that will be unveiled after the closing bell, NIO trades at $39.40, losing 4.4% on a daily basis. Earlier in the day, the electric vehicle (EV) manufacturer announced that it joined an industry park project in China's eastern city of Hefei, which is expected to have a manufacturing capacity of 1 million EVs per year.

NIO is a Chinese electric vehicle manufacturer designing, manufacturing, and selling smart EVs. NIO is also involved in the autonomous driving sector.

Stay up to speed with hot stocks' news!

NIO has been a retail favourite in 2021 with the shares driven to $66.99 in mid-January but has slipped substantially since as investor enthusiasm for the EV sector has waned. Tesla, the sector leader, has been under pressure, and this has spread to the rest of the EV stocks. Not helping the case has been mainstream auto companies announcing plans to move into the EV space.

Tesla is understandably the EV sector leader and the stock has remained under pressure. TSLA released results this week which disappointed many investors. Tesla made a lot of money from environmental credits and profits on Bitcoin trading and not as much direct revenue from Tesla car sales. TSLA shares slipped another 1.5% on Wednesday despite the general risk-on tone adopted by markets as the Fed and Jerome Powell remain in a fully supportive mode. to add to the woes Tesla has now broken short-term support levels and sits at the top of a break lower to a new trading range at$600-$690.

Some good news on Wednesday was Cathie Wood and ARK riding to the rescue and purchasing $34 million worth of Tesla shares. It remains to be seen if this and Fed policy can arrest the decline.

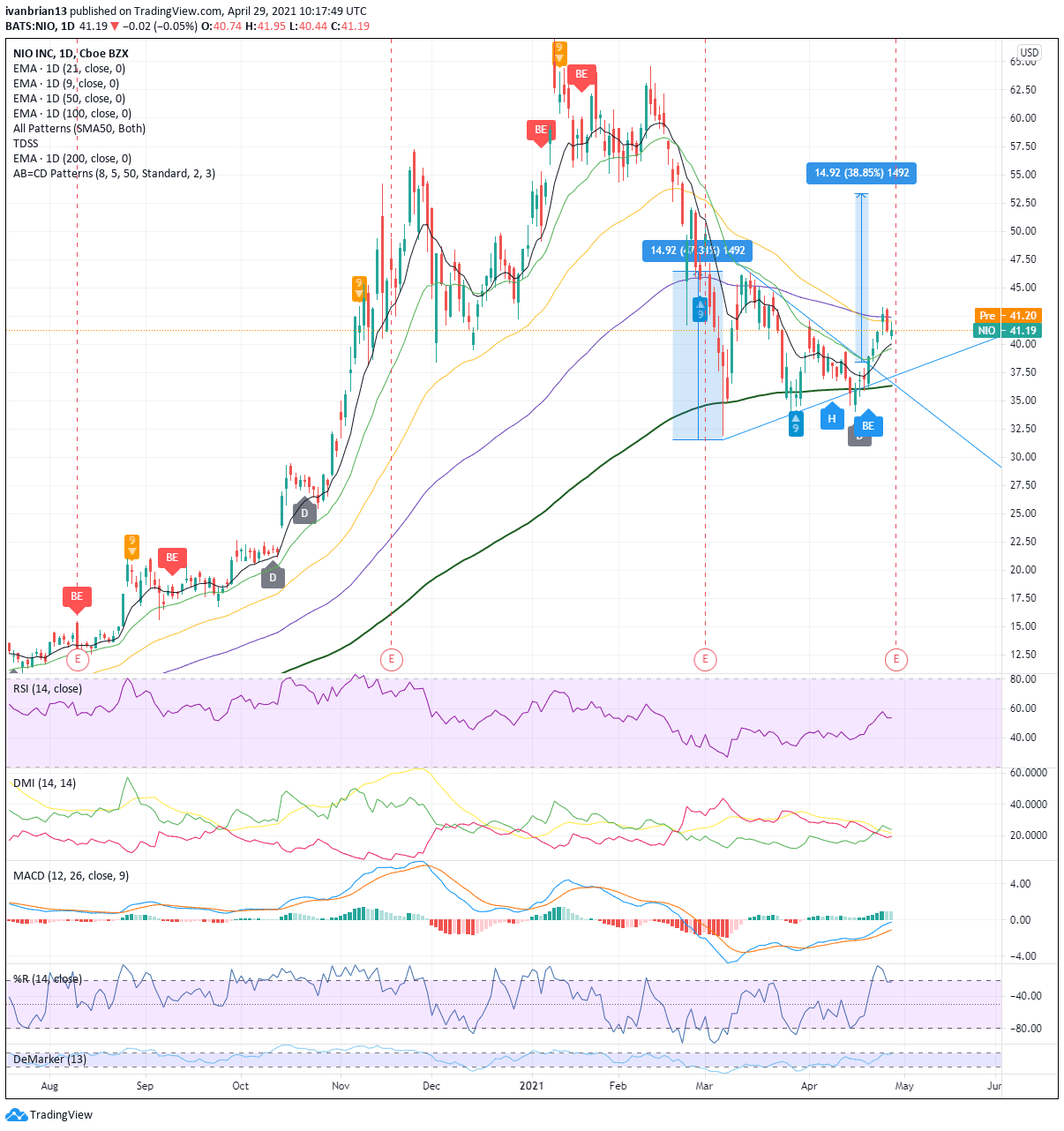

NIO stock price and chart

Ok, so back to NIO this article is not about Tesla. But it is always important to focus on the sector leader as that will set the sentiment tone for the overall risk profile of the sector.

NIO has been struggling for momentum recently as the shares run up against resistance from the 50 and 100 day moving averages.

NIO is also due to release Q1 2021 results after the close of markets today, Thursday. So investors are on the sideline until then. Earnings per share (EPS) are expected to come in at a loss of $0.16 and Revenue is expected to be $1.02 billion.

The chart below clearly shows the breakout from the triangle formation and now NIO running into resistance from the long-term moving averages. The breakout of the triangle was triggered by NIO breaking above the 9-day moving average. The move stalled at the 21-day moving average before powering through this. The Moving Average Convergence Divergence (MACD) indicator had given a bullish crossover on April 16 and this was confirmed by price action and by the Directional Movement Index (DMI) crossing on April 23.

The bullish triangle breakout theory has NIO targetting above $53. The breakout range should be the size of the entry range of the triangle. Results on Thursday will need to be solid to propel this momentum. The broader equity market remains bullish and the macroeconomic outlook remains positive. Tesla the sector leader is struggling so keep an eye on that one.

Buying dips toward the 9-day moving average with stops just below will allow traders to stay on the right side of the trend. A break of the 9-day MA will see a test of the 200-day moving average at $36.31.

Buying a break of the 50 and 100-day moving average resistance can also be used to initiate longs, again using a stop just below these levels. Alternatively, a $45 call option expiring in just over one month on May 28 is trading at $1.75 per share. Each option contract is for is 100 shares.

Those of you with existing positions from our call on April 22 "Go long on a break of the 9 and 21 day moving averages with a stop just below is the trade offering more risk-reward from a technical perspective". This trade is 10-15% higher depending on where you entered. Ahead of the results I would be booking some profits or at least use a stop to guarantee some profit. A stop at the 9-day moving average books some profits as this average has moved up with price. A break here puts the short-term bullishness into question so is a prime placement for a stop.

Results are key to the next stage but so is keeping an eye on sector leader Tesla (TSLA).

Previous updates

Update: NIO shares slide on Thursday as investors await Q1 2021 results after the close. NIO shares are currently trading $40.36 a loss of 2%. Short term moving average support is at $40.08.

At the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

This article is for information purposes only. The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice. It is important to perform your own research before making any investment and take independent advice from a registered investment advisor.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to accuracy, completeness, or the suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. The author will not be held responsible for information that is found at the end of links posted on this page.

Errors and omissions excepted.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.