New Zealand labor report sinks NZD

Statistics New Zealand has released the employment as follows:

- New Zealand Unemployment Rate Q4: 3.4% (est 3.3%; prev 3.3%).

- Employment Change (QoQ) Q4: 0.2% (est 0.3%; prev 1.3%).

- Employment Change (YoY) Q4: 1.3% (est 1.5%; prev 1.2%).

- Participation Rate Q4: 71.7% (est 71.7%; prev 71.7%).

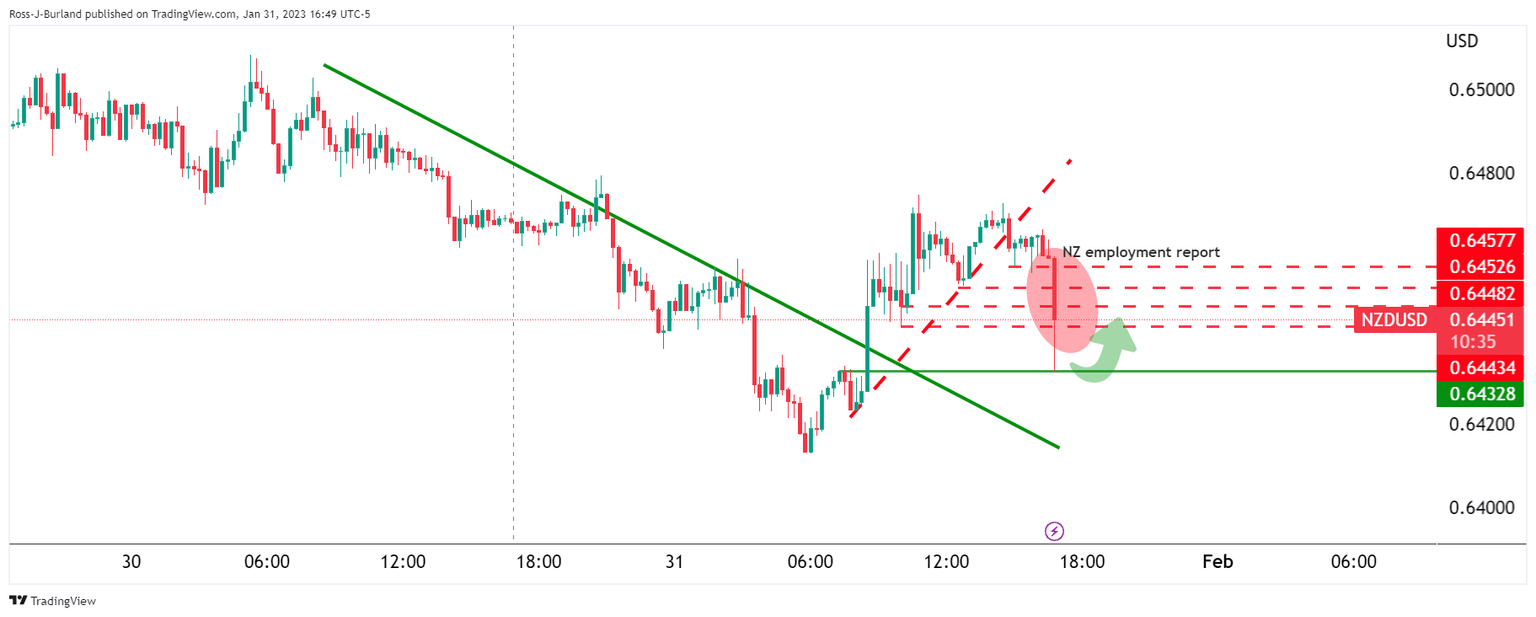

NZD/USD is breaking structures in a 27 pips drop:

The data is not as strong as the market was expecting and hence the Kiwi is losing ground at a rapid pace.

About New Zealand employment data

Statistics New Zealand releases employment data on a quarterly basis. The statistics shed a light on New Zealand’s labor market, including unemployment and employment rates, demand for labor and changes in wages and salaries. These employment indicators tend to have an impact on the country’s inflation and Reserve Bank of New Zealand’s (RBNZ) interest rate decision, eventually affecting the NZD. A better-than-expected print could turn out to be NZD bullish.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.