Natural Gas stands ground above $2 in ADP aftermath

- Natural Gas price is trying to hold ground above $2.00.

- Gas exports from Norway are increasing again after unplanned maintenance.

- The US Dollar Index trades below 104.00, though the level is still within reach.

Natural Gas (XNG/USD) is pushing back against any selling pressure with holding the $2.00 level on Wednesday after it was able to eke out another gain on Tuesday. However, Gas bulls do not get much time to enjoy the recent rally as dark clouds are forming above the commodity. With politicians scrambling to eke out a ceasefire deal ahead of the Rammadam in Gaza, Norwegian Gas is back finding its way towards the UK and Europe after unforeseen outages in recent weeks.

Meanwhile, the US Dollar (USD) is seeing some prepositions ahead of three eventful days ahead. This Wednesday, US Federal Reserve Chairman Jerome Powell heads to Capitol Hill to keep his semi-annual testimony in front of Congress. On Thursday, markets will hear from European Central Bank President Christine Lagarde after the bank’s latest rate decision, and on Friday the US Employment Report will be released.

Natural Gas is trading at $2.04 per MMBtu at the time of writing.

Natural Gas market movers: Risk On helps Natural Gas

- Europe is reporting the highest Gas storage levels in years with the heating season ending and less need to refuel ahead of the next heating season.

- Norwegian Gas flows to the UK and Northwest Europe are rising after some unplanned maintenance.

- Meanwhile, more demand comes out of Asia, where Coal prices have rallied and Gas is now cheaper for electricity production.

- Ukraine Energy Minister German Galushchenko said on Tuesday that expiring Russian Gas contracts for deliveries will not be rolled over for another period, further reducing Russian gas inflows into Europe.

Natural Gas Technical Analysis: Substantially nothing changed

Natural Gas prices have quickly repriced the supply decrease by the US and Qatar. Meanwhile, traders are looking to the downside again with Europe confirming that it does not need that much Gas over the summer to be prepared for the next heating season. This could mean that prices remain at the current level or lower.

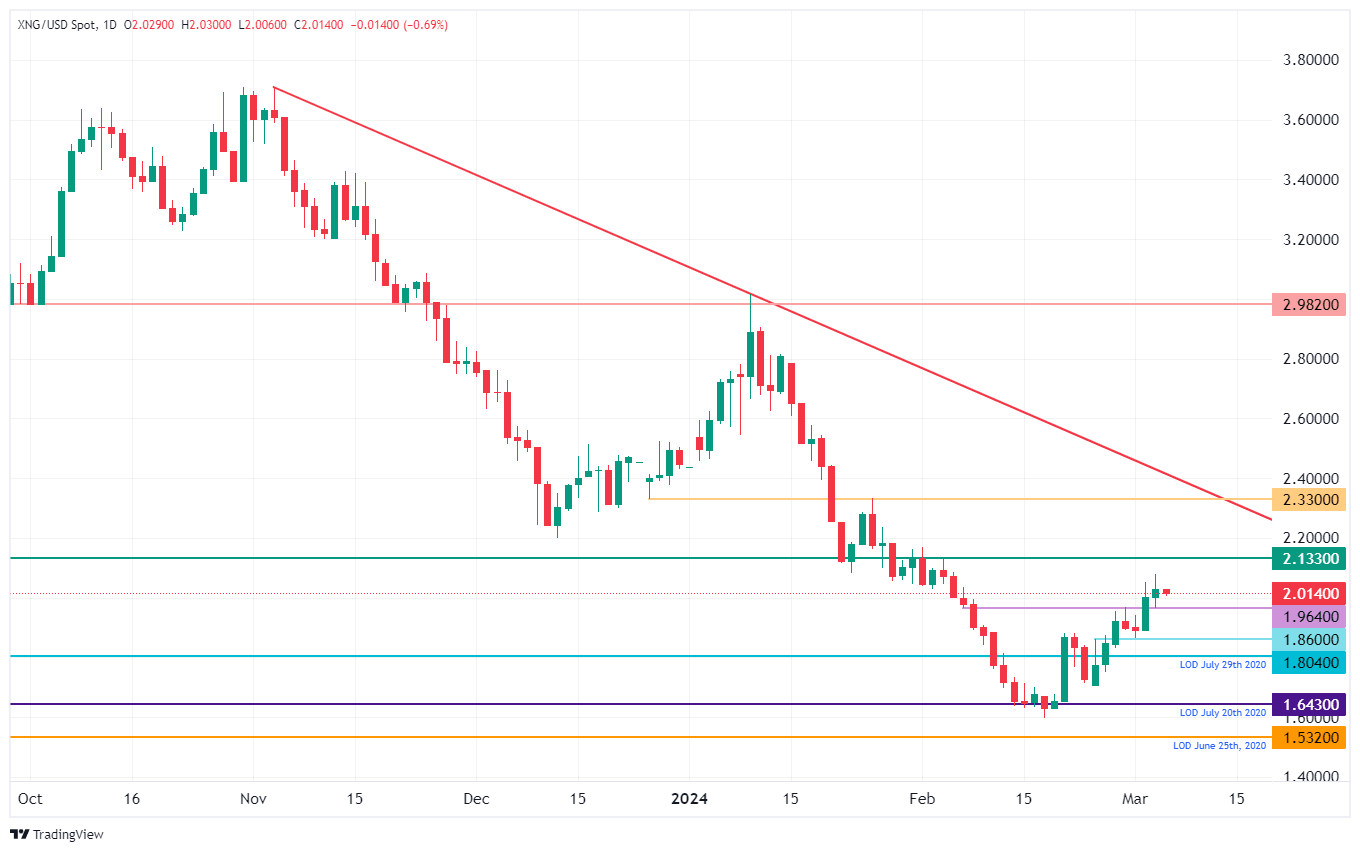

On the upside, Natural Gas has broken that $1.99-$2.00 marker, which already proved to be some support. After that, the green line at $2.13 comes into view, where the triple bottoms from 2023 are placed. If Natural Gas sees a sudden demand pickup, $2.40 could come into play.

On the downside, $1.64 and $1.53 (the low of 2020) are targets to look out for. Ahead of those levels, the recently-created pivotal levels at $1.86 and $1.80 should be able to provide some support and slow down any downside moves.

XNG/USD (Daily Chart)

Natural Gas FAQs

Supply and demand dynamics are a key factor influencing Natural Gas prices, and are themselves influenced by global economic growth, industrial activity, population growth, production levels, and inventories. The weather impacts Natural Gas prices because more Gas is used during cold winters and hot summers for heating and cooling. Competition from other energy sources impacts prices as consumers may switch to cheaper sources. Geopolitical events are factors as exemplified by the war in Ukraine. Government policies relating to extraction, transportation, and environmental issues also impact prices.

The main economic release influencing Natural Gas prices is the weekly inventory bulletin from the Energy Information Administration (EIA), a US government agency that produces US gas market data. The EIA Gas bulletin usually comes out on Thursday at 14:30 GMT, a day after the EIA publishes its weekly Oil bulletin. Economic data from large consumers of Natural Gas can impact supply and demand, the largest of which include China, Germany and Japan. Natural Gas is primarily priced and traded in US Dollars, thus economic releases impacting the US Dollar are also factors.

The US Dollar is the world’s reserve currency and most commodities, including Natural Gas are priced and traded on international markets in US Dollars. As such, the value of the US Dollar is a factor in the price of Natural Gas, because if the Dollar strengthens it means less Dollars are required to buy the same volume of Gas (the price falls), and vice versa if USD strengthens.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.