META eyes support base with corrective rally potential [Video]

![META eyes support base with corrective rally potential [Video]](https://editorial.fxsstatic.com/images/i/supermicro-01_XtraLarge.jpg)

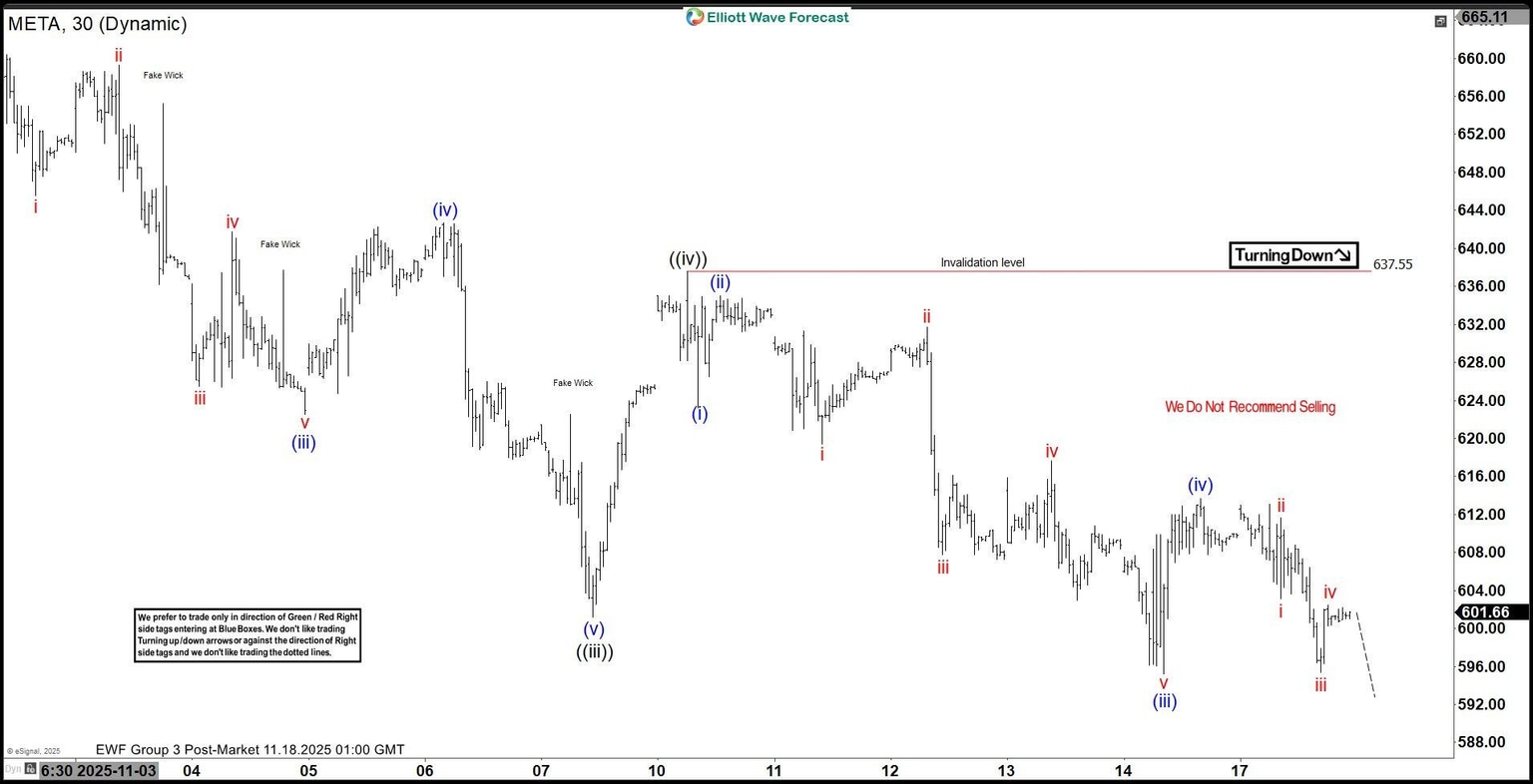

The short-term Elliott Wave outlook for META indicates that the cycle from the October 29 high remains in progress, unfolding as a five-wave impulsive structure. From the October 29 peak, wave ((i)) concluded at $650.17. A corrective rally in wave ((ii)) then followed which terminated at $680.96. Subsequently, the stock declined in wave ((iii)), reaching a low of $601.20. A rebound in wave ((iv)) then ended at $637.55, as illustrated in the 30-minute chart.

Currently, wave ((v)) appears to be unfolding as a lower-degree impulse. Within this structure, wave (i) completed at $623.23, and a brief rally in wave (ii) ended at $635. The decline resumed in wave (iii), which bottomed at $595.20. It was followed by a modest recovery in wave (iv) that concluded at $613.68. The final leg, wave (v) should extend lower, thereby completing wave ((v)) and the broader cycle from the October 29 high. Upon completion of this five-wave sequence, a minimum three-wave corrective rally should happen to retrace the decline from the October 29 peak. In the near term, as long as the $637.55 pivot remains intact, the stock retains potential for a marginal new low to finalize wave ((v)) and complete the current bearish cycle

META 30-minute Elliott Wave chart from 11.18.2025

META Elliott Wave [Video]

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com