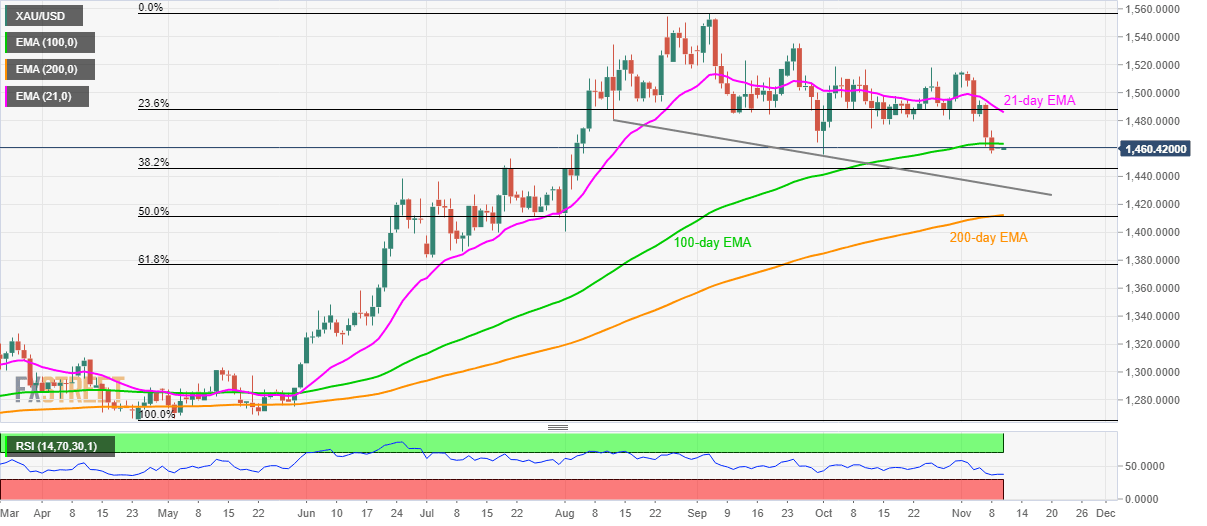

Gold Technical Analysis: 100-day EMA keeps sellers hopeful

- Gold prices seesaw near October low.

- Oversold RSI conditions, July month high question further declines.

- October 11 low, 21-day EMA exert downside pressure.

Although Gold prices stop further declines below October low, a sustained trading below 100-day EMA for the first time since late-May keep sellers hopeful as the metal trade around $1,460 during the Asian session on Monday.

July month high close to $1,452.50 seems to be the immediate support ahead of 38.2% Fibonacci retracement of April-September upside, at $1,445.

Should the quote continue trading southwards past-$1,445, a descending trend line since mid-August, around $1,433 and $1,412/11 area including 200-day Exponential Moving Average (EMA) and 50% Fibonacci retracement will be on bears’ radar.

Though, nearly oversold conditions of 14-bar Relative Strength Index (RSI) can pierce a 100-day EMA level of 1,464, which in turn could challenge October 11 low around $1,474.

It should, however, be noted that 21-day EMA and 23.6% Fibonacci retracement close to $1,486/88 area could keep buyers in check after $1,474.

Gold daily chart

Trend: pullback expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.