Gold slips from record highs as profit-taking and a firmer Dollar weigh

- Gold slips from record highs amid profit-taking and a firmer US Dollar.

- Easing Iran tensions have slightly reduced safe-haven demand, though geopolitical and Fed uncertainty persist.

- Technically, overbought conditions cap near-term upside as XAU/USD enters consolidation mode.

Gold (XAU/USD) trades with a mild negative bias on Thursday as traders book profits following Wednesday’s surge to a fresh record peak near $4,643. At the time of writing, XAU/USD trades around $4,586, down nearly 1.0% on the day.

Meanwhile, a firmer US Dollar (USD) is also capping upside attempts in Gold, as stronger-than-expected US data reinforces near-term support for the Greenback. Weekly Initial Jobless Claims fell to 198K, undershooting expectations of 215K. Regional manufacturing data also improved, with the Empire State index rising into positive territory at 7.7 from -3.7, while the Philadelphia Fed survey climbed to 12.6 from -8.8.

The modest retreat in Gold also reflects slightly reduced safe-haven flows, following reports that anti-government protests across Tehran have eased somewhat and US President Donald Trump has signaled he will hold off on any immediate military action for now.

However, the broader geopolitical backdrop remains fragile, and ongoing unease over the Federal Reserve’s (Fed) independence continues to support the metal, keeping it anchored near record territory.

Beyond geopolitical and political risks, sustained expectations of lower US interest rates are adding another layer of support to the non-yielding metal. While recent hawkish remarks from Fed officials suggest policymakers are in no rush to cut rates, markets continue to price in two rate cuts later this year.

Looking ahead, attention turns to remarks from Fed officials for fresh clues on the monetary policy outlook.

Market movers: Geopolitical risks and Fed outlook in focus

- US President Donald Trump said on Wednesday that he has been told “on good authority” that the killing in Iran is “stopping” and that there are “no plans for executions.” Speaking to reporters in the Oval Office, Trump added that he would “watch it and see” when asked whether threatened US military action was now off the table.

- In an interview with Reuters, US President Donald Trump said he has no plans to fire Fed Chair Jerome Powell despite a Justice Department criminal investigation. Asked whether the probe gave him grounds to do so, Trump said the administration is “in a little bit of a holding pattern” and will determine what to do, adding that it is “too soon” to make any decision.

- Fed Chair Jerome Powell is under criminal investigation by US prosecutors over his June 2025 testimony on the Fed’s headquarters renovation, drawing sharp criticism from global central bankers and other Fed officials. Powell has described the move as politically motivated.

- Minneapolis Fed President Neel Kashkari said on Wednesday that it is “entirely plausible” inflation could remain well above the Federal Reserve’s 2% target for another two to three years, according to an interview with The New York Times. He added, “Then we’re looking at seven or eight years of elevated inflation. That’s very concerning to me.”

- Philadelphia Fed President Anna Paulson said that she sees further rate cuts later this year if the forecast is met. Paulson added that inflation is expected to moderate in 2026 and the labor market to stabilize, noting that the job market is “bending but not breaking.”

- St. Louis Fed President Alberto Musalem said on Tuesday there is “little reason for further easing of policy in the near term” and that policy is “well positioned to balance risks on both sides.” He added that the latest inflation reading was encouraging and supports the view that inflation could converge toward 2% this year.

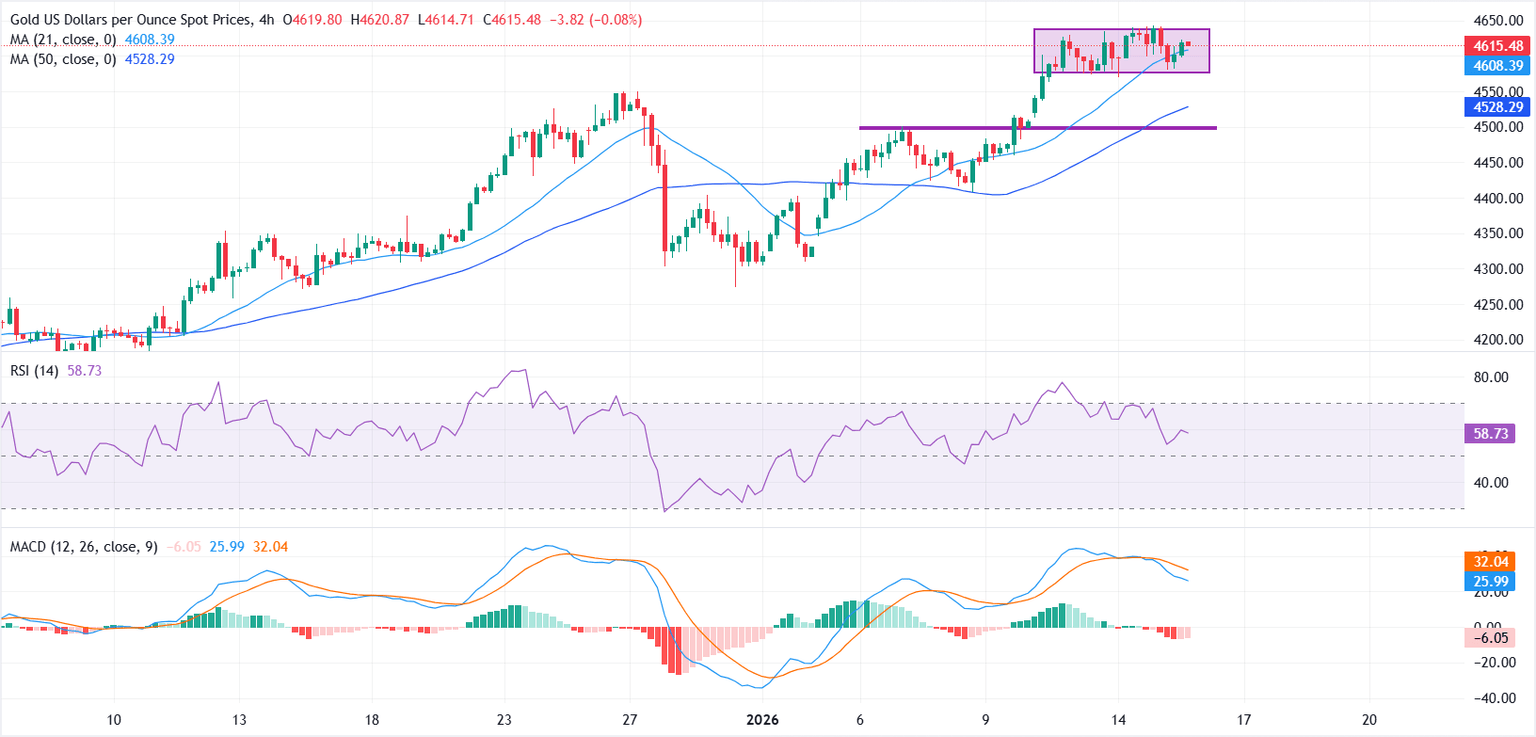

Technical analysis: XAU/USD range-bound near record highs

From a technical standpoint, XAU/USD appears to be entering a consolidation phase near record highs, with price action capped between the $4,580-$4,640 zone. Overbought conditions are discouraging buyers from aggressively chasing further gains for now, even as the broader structure remains firmly bullish.

On the 4-hour chart, price is holding above the 21-period Simple Moving Average (SMA) near $4,608, which provides immediate dynamic support. A clear break below this level would expose the 50-period SMA at $4,528.

On the upside, a sustained move above the $4,650 area could revive bullish momentum and open the door for a push toward the $4,700 psychological level.

Momentum signals support a pause rather than a reversal. The 4-hour Relative Strength Index (RSI) sits near 59, easing from overbought territory. The Moving Average Convergence Divergence (MACD) remains below the signal line and in negative territory, though the histogram is narrowing, suggesting limited downside and reinforcing the near-term consolidation bias.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Author

Vishal Chaturvedi

FXStreet

I am a macro-focused research analyst with over four years of experience covering forex and commodities market. I enjoy breaking down complex economic trends and turning them into clear, actionable insights that help traders stay ahead of the curve.