Gold Price News and Forecast: XAU/USD picks up a safe-haven bid in a correction of Friday's sell-off

Gold firms in proximity of the $1,600s, correcting a heavily long squeeze

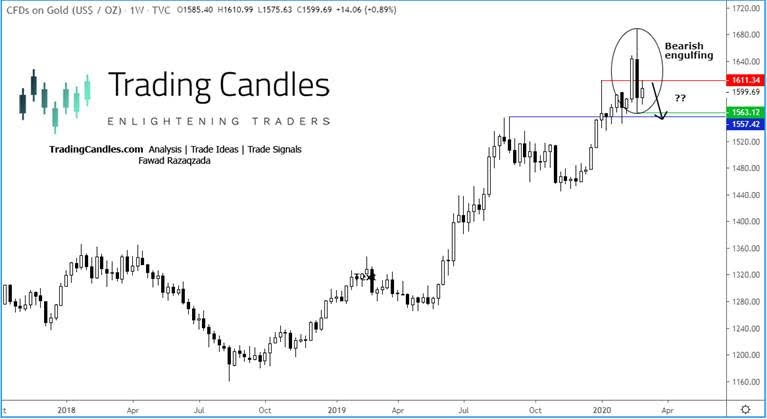

Gold is consolidating in a bullish correction of Friday's sell-off, up some 0.6% at the time of writing having travelled from a low of $1,575.63 to a high of $1,610.99 on the day so far. Friday's sentiment surrounding the prospects of a coordinated effort of central bankers coming to the rescue set-off a stamped in profit-taking triggering sell-stops, resulting in the biggest daily drop in the precious metal in seven years. Gold plummeted over 5% on the day following remarks from Federal Reserve's Chair Jerome Powell.

Gold rebounds but more pain than gains likely

Gold and silver have both rebounded today, along with equity markets. But after last week’s big falls, more pain could be on the way for gold bulls than gains this week. As we reported the possibility earlier last week, safe-haven gold continued to head lower despite widespread concerns over the outbreak of coronavirus. However, I didn’t think the metal would fall as much as it did on Friday. The fact that it did, means I must revise my expectations. So, while I still remain bullish on gold in the long term, I now think prices may go on to correct themselves for a while before starting to push higher again.

Author

FXStreet Team

FXStreet