Gold Price News and Forecast: XAU/USD consolidates recent gains above $1,900

Gold Price Analysis: XAU/USD to test key 50-DMA hurdle on its way to $2000

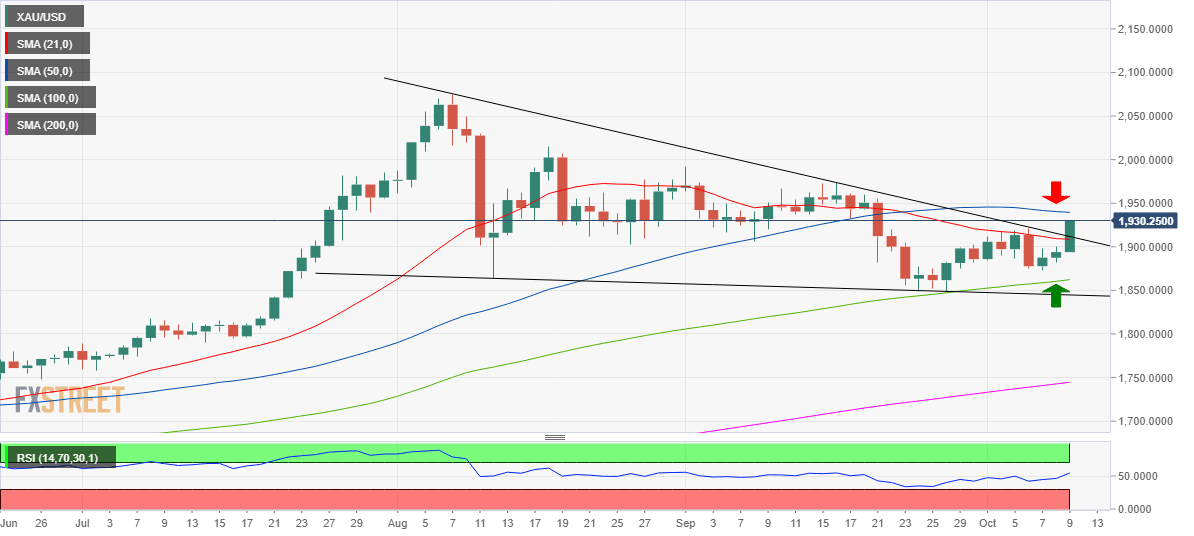

Following the settlement at two-week highs of $1930, Gold (XAU/USD) remains poised to extend the bullish momentum into a fresh week, courtesy of a classic technical breakout on the daily chart.

On Friday, the metal finally delivered a daily closing above the critical upside barrier at $1911, the confluence of the 21-daily moving average (DMA) and falling trendline resistance, yielding a falling wedge breakdown.

Gold Price Analysis: XAU/USD consolidates recent gains above $1,900

Gold takes rounds to $1,928/29, following the day-start weakness to $1,926.40, during the pre-Tokyo open Asian trading on Monday. The yellow metal rose to the highest since September 21 on Friday as the broad US dollar weakness, coupled with the risk-on mood, favored the buyers. However, the recent headlines concerning the American stimulus, Brexit and the coronavirus (COVID-19) question the bullion’s further upside. Even so, a lack of major catalysts and a long weekend at the US limit the downside momentum.

On Friday, US President Donald Trump’s fresh bid for the coronavirus (COVID-19) stimulus, worth the $1.8 trillion, propelled global risk markets. The same dimmed the US dollar’s safe-haven demand and dragged the US dollar index (DXY) to the lowest in three weeks.

Author

FXStreet Team

FXStreet