Gold Price News and Forecast: XAU/USD is at critical support level

Is gold set to run higher?

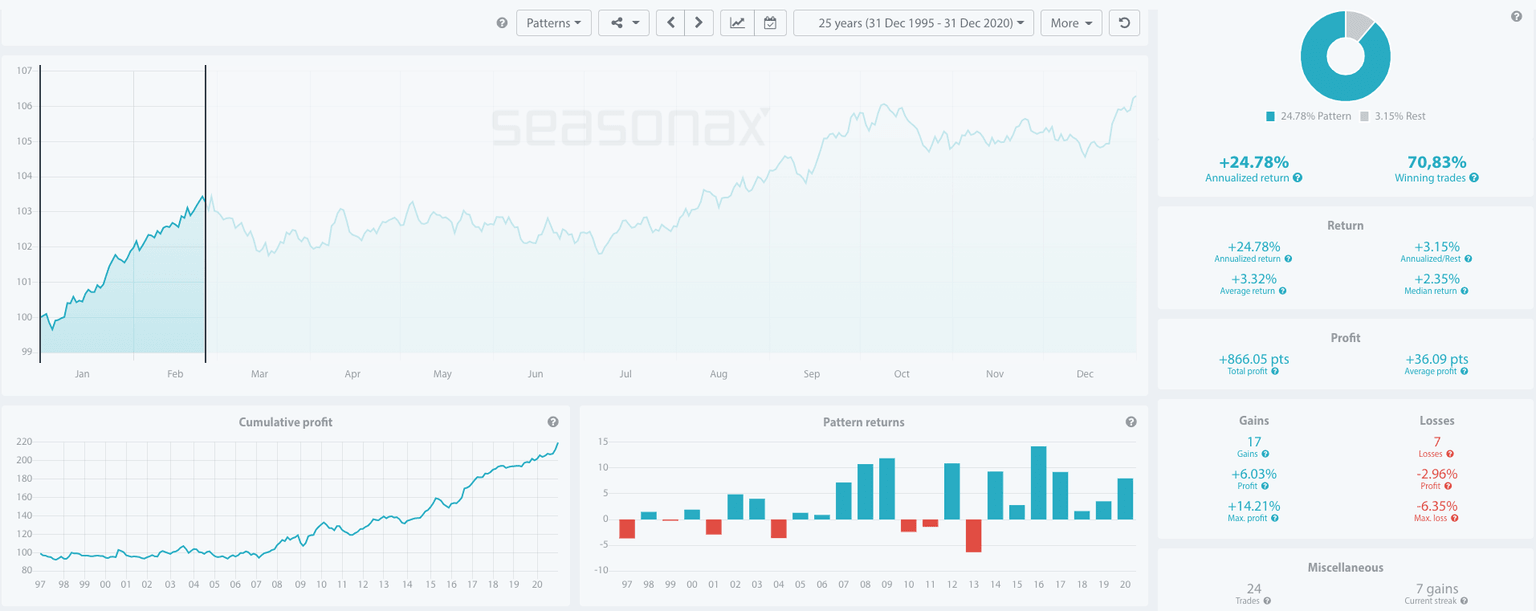

The recent run higher in gold looks set to continue based on the following reasons. There are some very strong seasonals in play with the Chinese Lunar New Year approaching. Gold tends to do very well at the start of the year and this point is being confirmed by the rise in ETF flows that are coming in at the start of the year.

Gold ETF flows start to rise again after bottoming out. The holdings in SPDR gold shares, which is the largest bullion backed ETF, grew by 17.2 tons on the first day of this week. That is the biggest amount of inflow since September. The last run higher in gold was driven by these rising ETF levels. This was despite the drop off in physical demand due to COVID-19. So, this means that gold looks set for higher prices based on the rising ETF flows. The ETF flows tend to trend and they also tend to move in tandem with gold prices. Rising ETF flows generally equates to rising gold prices and vice versa. Read more...

Gold is at critical support level

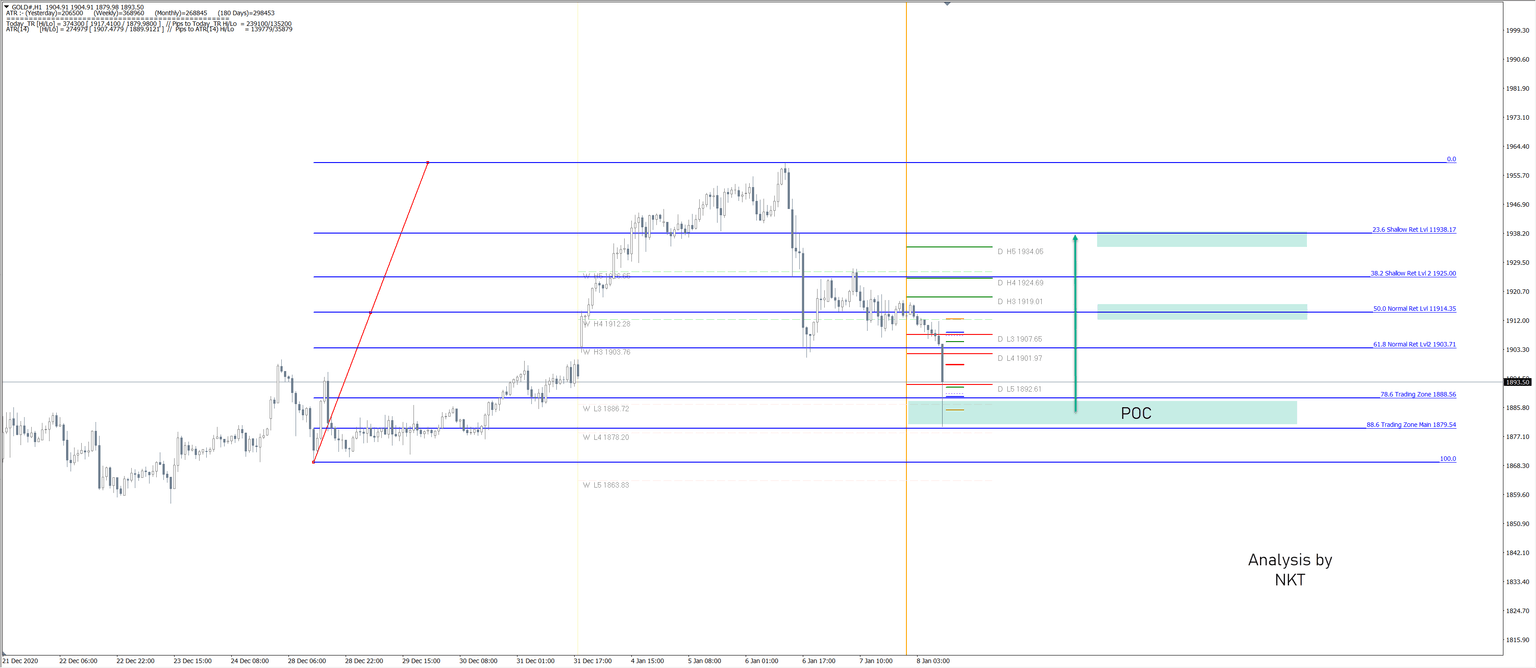

Gold is bullish and after a big retracement we might see the final attempt from bulls to spike the price up.

1879-1888 is the critical support zone. Below 1869 the weekly trend will change to bearish. If we see the bounce from the POC zone watch for 1914 and 1938 as targets. However, a break below 1868 might instruct the market to remain bearish next week so we will sell on rallies. Have in mind that GOLD is volatile and big moves can happen on Friday. Read more...

Gold Price Analysis: XAU/USD off lows, $1900 still at risk ahead of NFP

Gold (XAU/USD) has bounced-off a dip to near the $1906 region, as the bulls attempt a tepid recovery above the 200-hourly moving average (HMA), currently at $1909. Despite the pullback, gold’s path of least resistance appears to the downside, especially after the price confirmed a rising channel breakdown on the hourly chart in the Asian trades.

Bears eye a break below the critical $1900 level to accelerate the downside. Further south, the previous week low of $1869 could be tested. Meanwhile, the bearish bias will remain intact so long as the price holds below powerful resistance aligned around $1913, which is the confluence of the bearish 21-HMA and the channel support now resistance. Read more...

Author

FXStreet Team

FXStreet