Gold Price Analysis: XAU/USD off lows, $1900 still at risk ahead of NFP

- Gold is off the lows but not out of the wood yet.

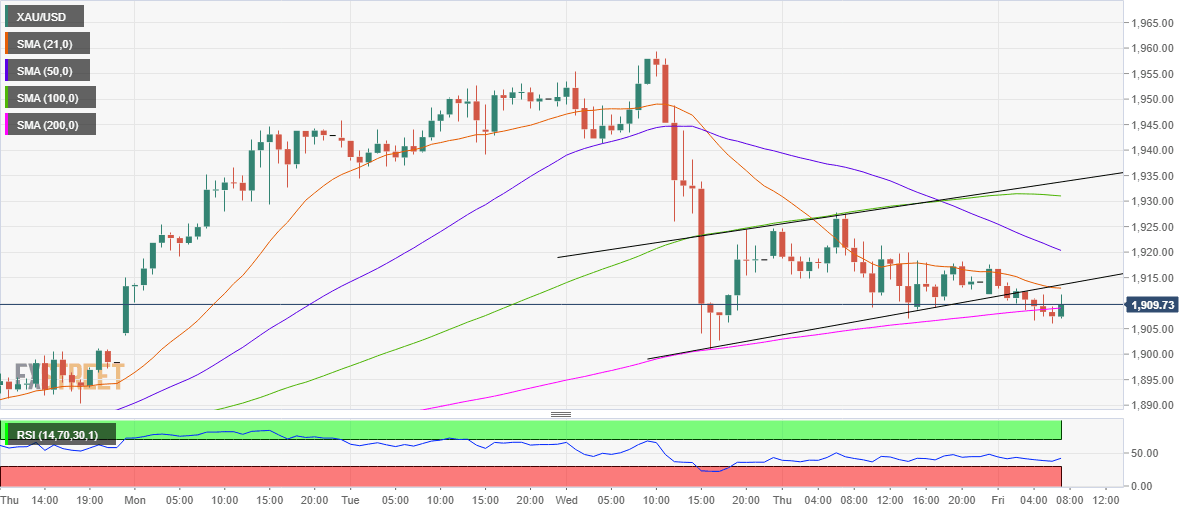

- Recaptures 200-HMA, RSI still remains in the bearish zone.

- Rising channel breakdown on 1H keeps the sellers hopeful.

Gold (XAU/USD) has bounced-off a dip to near the $1906 region, as the bulls attempt a tepid recovery above the 200-hourly moving average (HMA), currently at $1909.

Despite the pullback, gold’s path of least resistance appears to the downside, especially after the price confirmed a rising channel breakdown on the hourly chart in the Asian trades.

Gold Price Chart: Hourly

Bears eye a break below the critical $1900 level to accelerate the downside. Further south, the previous week low of $1869 could be tested.

Meanwhile, the bearish bias will remain intact so long as the price holds below powerful resistance aligned around $1913, which is the confluence of the bearish 21-HMA and the channel support now resistance.

The next line of defense for the bears is seen at the downward-sloping 50-HMA at $1920.

The Relative Strength Index (RSI) has witnessed an uptick in the last hour, although remains below the 50 level, supporting the case for lower levels.

Gold Additional levels

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.