Gold Price News and Forecast: XAU/USD fails to keep it above $1,700 as bulls catch a breath

Gold fails to keep it above $1,700 as bulls catch a breath

Following its run-up to the highest since December 2012, Gold prices drop to $1,662.80, down 0.73%, ahead of the European open on Monday. The yellow metal’s early-day run-up could be attributed to the week-start risk-off whereas the latest declines might have taken clues from the global policymakers’ readiness to counter the coronavirus (COVID-19).

A complete blockage in Lombardy and the rising death toll in Italy, coupled with the news from Saudi Arabia and Russia, triggered the early-Asian risk-off moves. The momentum propelled the yellow metal towards a multi-month top piercing $1,700, high of $1,703.40.

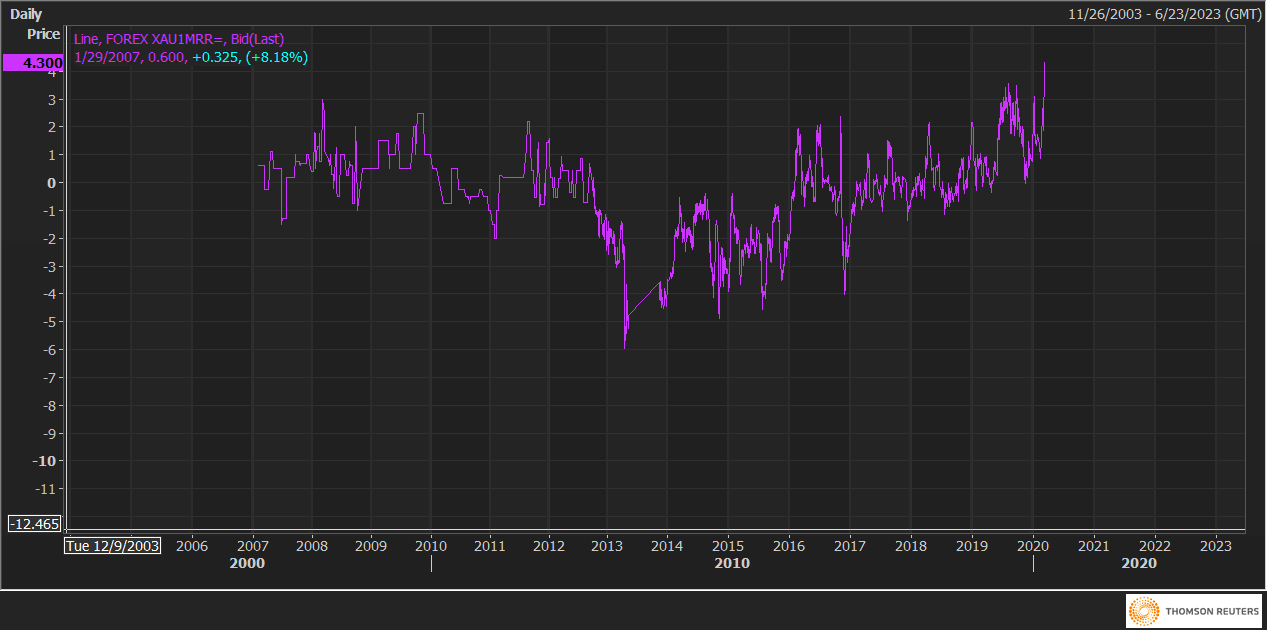

Gold: Call (bullish) bias strongest on record, risk reversals show

Call options on gold are drawing record premiums, indicating increased demand for bullish bets amid broad-based risk aversion in the financial markets. One-month risk reversals on gold (XAU1MRR) have surged to a record high of 4.30 from Friday's print of 3.975, having bottomed out near 0.85 on Feb. 12.

A positive number indicates the implied volatility premium or demand for calls is higher than that for puts. Gold's spot price is currently trading at $1,698 per Oz, representing a 1.5% gain on the day. The yellow metal is up over 10% on a year-to-date basis.

FXStreet Indonesian Site - new domain!

Access it at www.fxstreet-id.com

Author

FXStreet Team

FXStreet