Gold Price Forecast: XAUUSD clings to monthly high above $1,700 amid softer DXY, China, US inflation eyed

- Gold price remains sidelined around 100-DMA after crossing short-term key resistance line.

- Risk-on mood joined downbeat yields to weigh on the US dollar.

- Optimism surrounding US midterm Elections propelled equities, bonds amid light calendar.

- Inflation data from US/China could offer immediate directions, softer CPI can weaken XAUUSD amid talks of Fed’s easy rate hikes.

Gold price (XAUUSD) treads water around $1,712-13 after rising to the one-month high the previous day. The bullion’s inaction during early Wednesday could be linked to the cautious mood amid US Midterm Elections and waiting for China’s inflation data. However, the market’s optimism surrounding the US elections outcome and a lack of major directives led to the metal’s rally that crossed a short-term key hurdle on Tuesday.

The US Mid-term Elections are underway, and the Democrats may lose control in one of the Houses, considering a small gap to retake control for the Republicans. The election results, which would take a couple of days, also become important as ex-President Donald Trump teased a “very big” announcement coming on November 15. Should the Democrats lose power in any house, President Biden’s policies concerning higher spending will be challenged and so the inflation may also ease.

The hopes of a respite from inflation enabled equities to rally and drowned the US Treasury yields the previous day, which in turn exerted downside pressure on the US Dollar Index (DXY). On the same line could be a reduction in the US NFIB Small Business Optimism Index for October, 91.3 versus 92.1 prior.

Given the light calendar and a lack of major macros, the XAUUSD bulls could cheer the technical break even if the latest cautious mood ahead of the key China Consumer Price Index (CPI) and the Producer Price Index (PPI) for October challenge the commodity buyers of late.

Although forecasts suggest easy inflation numbers from China, any surprise uptick might not go well with the gold buyers as they seem to be running out of steam of late.

Technical analysis

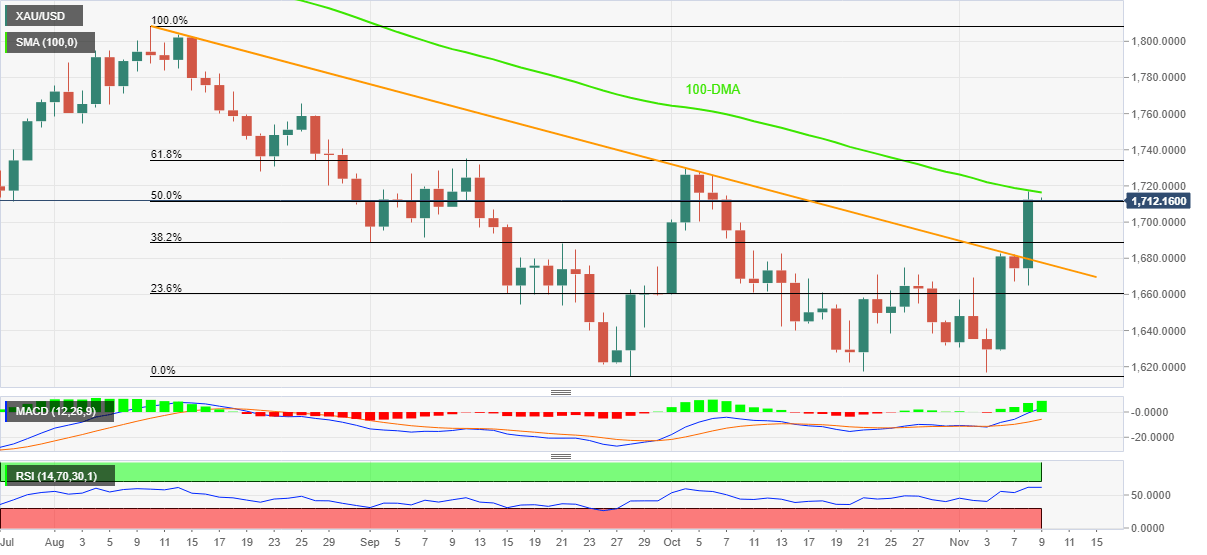

A daily closing beyond the three-week-old resistance line, now support around $1,677, allows gold buyers to keep the reins even as the 100-DMA challenges the immediate upside around $1,717.

It’s worth noting, however, the RSI (14) is approaching the overbought territory and is also forming a bearish divergence with the prices.

Hence, further upside hinges on a clear break of $1,717, which could propel prices toward the tops marked in October and September, respectively near $1,730 and $1,735.

Meanwhile, XAUUSD declines remain elusive until the quote exceeds the resistance-turned-support surrounding $1,677. That said, the $1,700 threshold late September swing high around $1,688 may act as an intermediate halt during the fall.

Gold buyers are running out of steam but the bears need validation from $1,677 to retake control.

Gold price: Daily chart

Trend: Limited downside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.