Gold Price Forecast: XAU/USD traders in high anticipation of the Federal Reserve interest rate decision

- The Federal Reserve interest rate decision is looming and will be key for the Gold price.

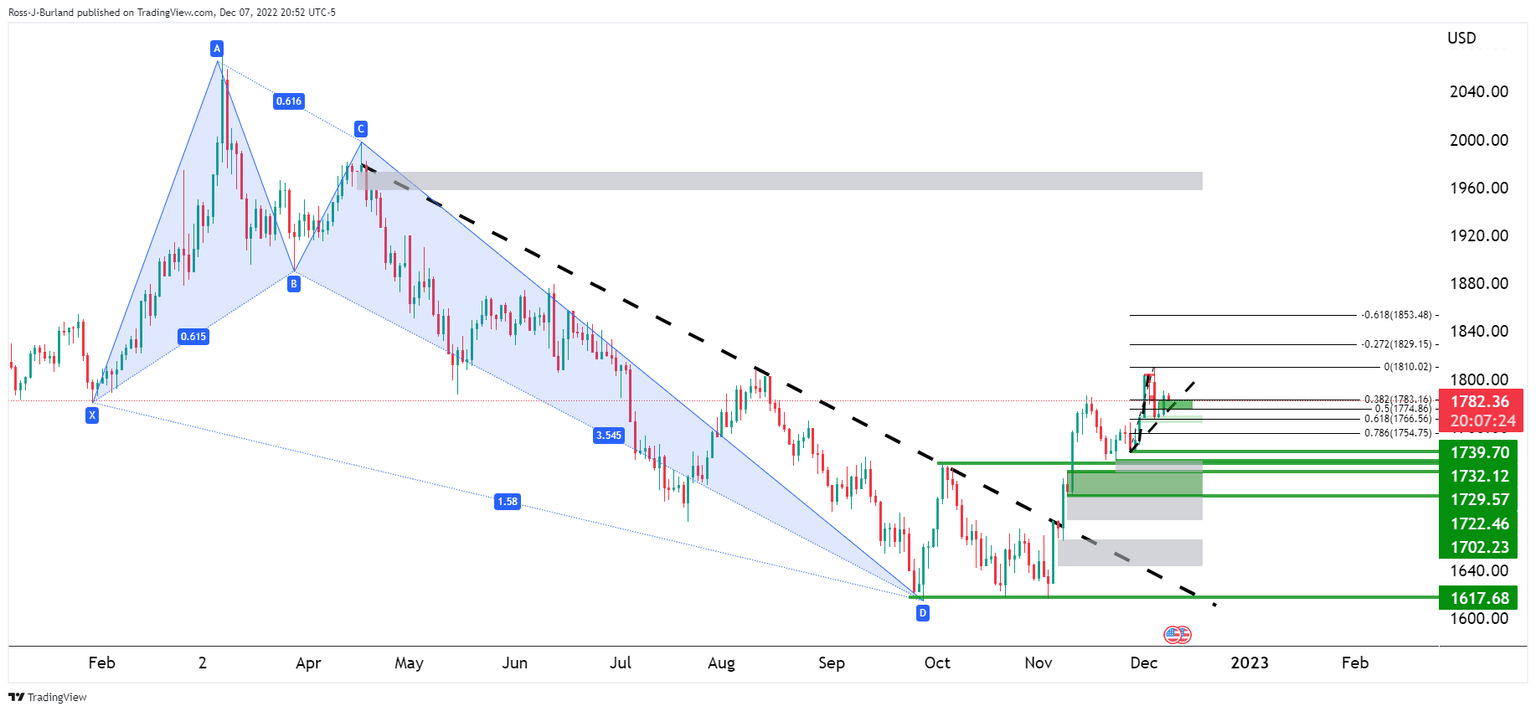

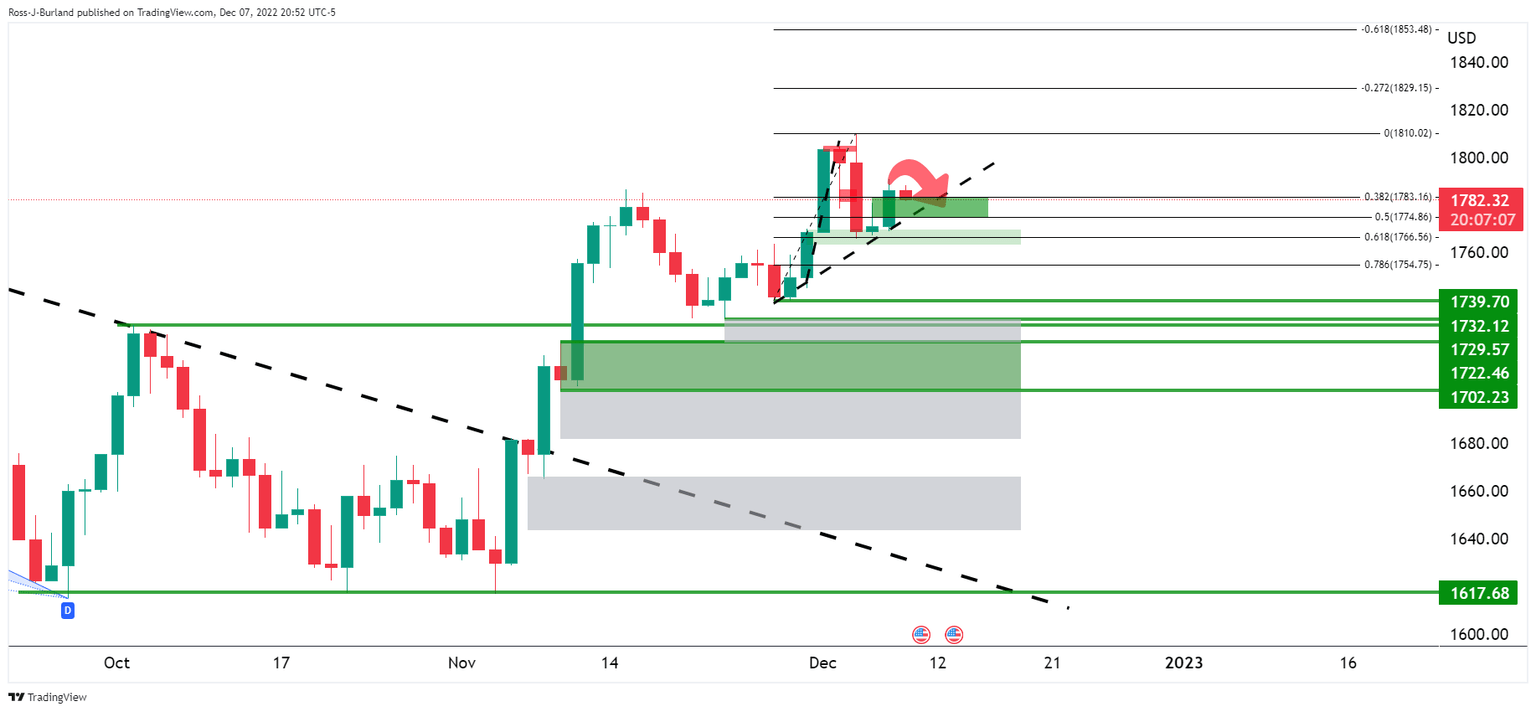

- Gold price is correcting in a daily harmonic formation although it has started to decelerate.

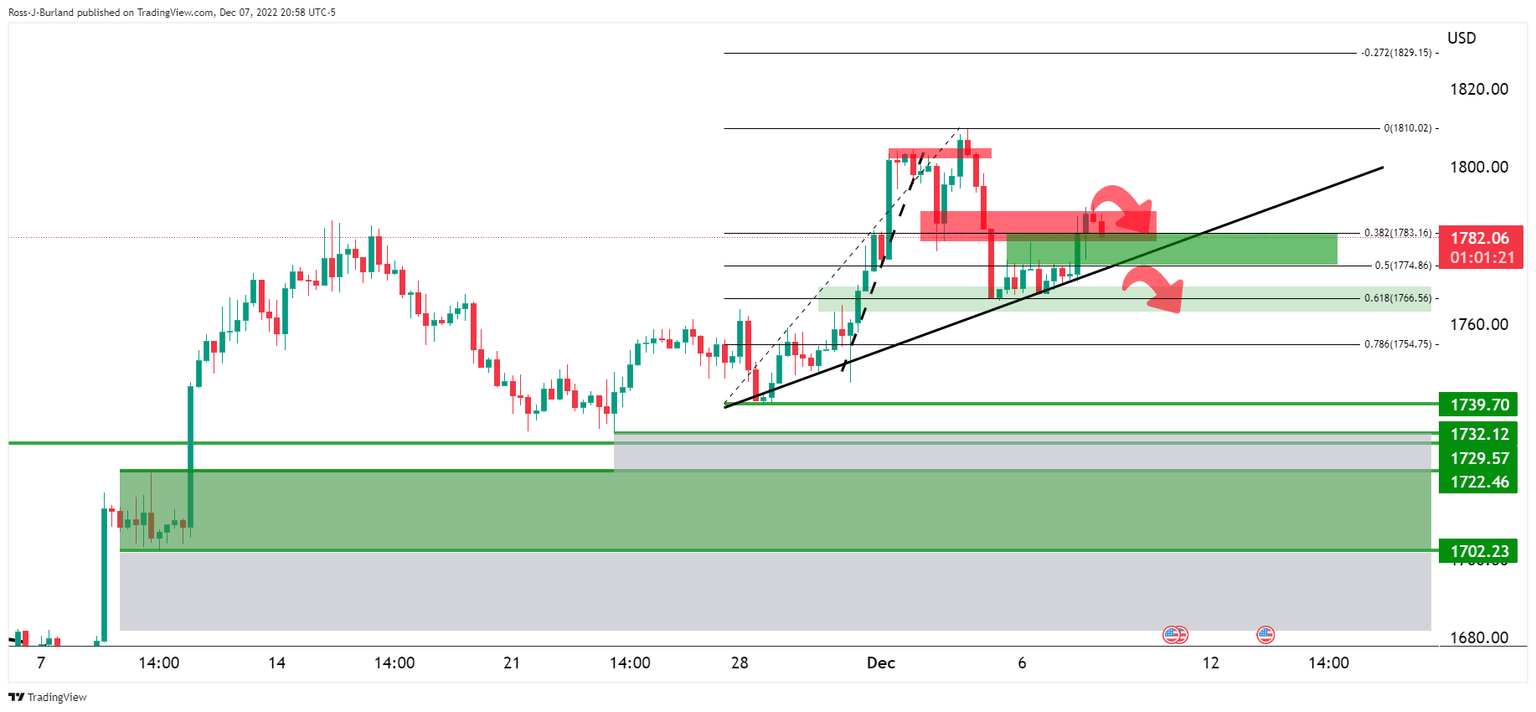

- On the 4-hour chart, the Gold price is hugging the dynamic support but is showing signs of an imminent test of the same.

Gold price has found a base at a technical level of support as traders look ahead to next week's Federal Reserve interest rate decision. In this regard, the US Dollar weakened against major currencies midweek amid worries that rising interest rates could push the United States economy into recession.

Gold price weighed by US Dollar bull correction

Traders are buying up the safe havens amid growing recessionary fears which has helped to boost sentiment in the Gold market. The ''thirty-year United States Treasuries dropped more than 10bp to a three-month low while yields on the 10-year United States Treasuries were also lower. The US Dollar, as measured by the DXY index, which measures the greenback against a basket of currencies, fell to a low of 104.87 on Wednesday where it has since stabilised, moving into the 105's on Thursday, weighing on Gold price.

Overall, Gold price investors are searching for direction as we await November Producer Price Index (PPI) data Friday as the next critical data that followed Monday’s upside surprise to ISM Services PMI. The US Dollar has been unable to build on any strength in the anticipation of the data and the absence of Federal Reserve speakers has left the Gold market void of a robust catalyst. Even news of further China reopening measures has failed to impact the Gold price, US Dollar or equities in any significant way.

Federal Reserve expectations have solidified

World Interest Rate Probabilities, (WIRP), are suggests that a Federal Reserve 50 bp interest rate hike at the Federal Open Market Committee (FOMC) meeting on December 14 is fully priced in. There are less than a 10% odds of a larger 75 bp move which has been a weight on the US Dollar while swaps markets are pricing in a peak policy rate of 5.0%.

Analysts at Brown Brothers note that the WIRP suggests around 60% odds of a 50 bp move on February 1 and then around 50% odds of a final 25 bp Federal Reserve interest rate hike in the second quarter, (Q2). With both Average Hourly Earnings and core Personal Consumption Expenditures flat-lining near 5% for most of this year, the analysts said they ''don’t think this tightening path will get inflation back to target, not when the labour market remains so firm and consumption is holding up. This is where we believe the mispricing lies. If and when markets reprice, that should be dollar-positive.''

Meanwhile, analysts at TD Securities argue that the pain trade in Gold price may finally be abating, ''but a notable consolidation in prices is still needed before CTA trend followers spark renewed outflows in Gold. We look for a break below the $1,745/oz range for the first of several selling programs likely to weigh on gold prices in this scenario.''

Gold technical analysis

The daily charts above show the Gold price correcting in the harmonic formation although it has started to decelerate around the key $1,800s.

On the 4-hour chart below, the Gold price is hugging the dynamic support but is showing signs of an imminent test of the same. A break of the trendline will expose the downside in the Gold price with $1,739.79 eyed as the prior lows from where the last bullish surge originated.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.