Gold Price Forecast: XAU/USD stays in balance above $1,660 as DXY consolidates, Fed policy buzz

- Gold price has gone dead cat as investors have sidelined ahead of the Fed policy.

- The DXY is aiming to print a fresh two-week high above 110.30.

- Investors should be prepared for a bumper rate hike by the Fed.

Gold price (XAU/USD) is displaying a lackluster performance as investors are awaiting the release of the monetary policy by the Federal Reserve (Fed). The precious metal is showing a volatility contraction of around $1,666.00. While the downside seems favored as the US dollar index aims to print a fresh two-week high above 110.30.

The gold prices don’t deserve support a worth penny as investors are now expecting a bigger-than-prior rate hike pattern. The Fed is escalating its interest rates by 75 basis points (bps) over the past two monetary meetings.

Price pressures have not displayed a justified response to the current pace of hiking borrowing rates by the Fed. Therefore, the Fed is expected to think out of the box and tight other quantitative tools along with a third consecutive 75 bps rate hike or so for a full percent rate hike.

An announcement of a mega rate hike will trigger the risk-off market mood. This will strengthen the DXY further and the market participants will ditch the risk-perceived assets.

Gold technical analysis

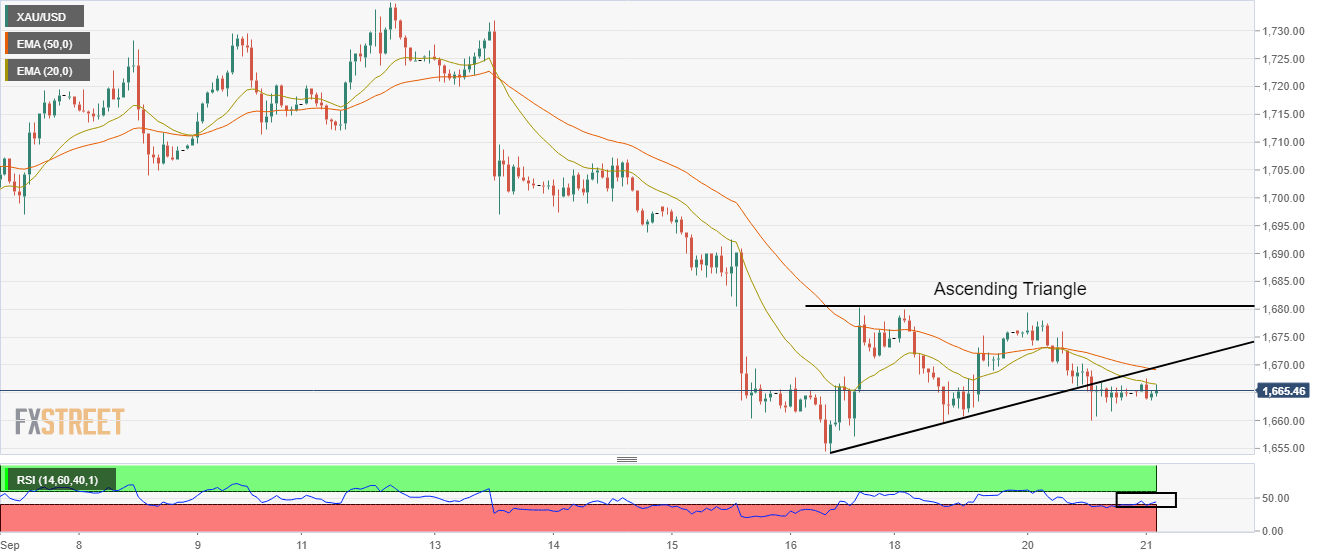

Gold prices have turned sideways after delivering a downside break of the Ascending Triangle whose upward-sloping trendline is placed from the previous week’s low at $1,654.17 while the horizontal resistance is plotted from Friday’s high at $1,680.39.

The 20-period Exponential Moving Average (EMA) at $1,666.56 acts as significant resistance for the bulls. Also, the 50-EMA at $1,668.90 is declining, which adds to the downside filters.

Meanwhile, the Relative Strength Index (RSI) (14) is on the verge of shifting into the bearish range of 20.00-40.00, which will trigger a fresh downside rally.

Gold hourly chart

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.