Gold Price Forecast: XAU/USD snaps four-day uptrend as Covid woes sour sentiment

- Gold price fades upside momentum amid risk aversion.

- China’s coronavirus concerns, cautious mood ahead of the key data, events weigh on Gold price.

- Federal Reserve Chairman Jerome Powell’s speech, United States Nonfarm Payrolls are crucial to watch for fresh impulse.

- Risk catalysts are the key for intraday moves of the XAU/USD price.

Gold price (XAU/USD) drops for the first time in five days while printing mild losses at around $1,750 during early Monday. In doing so, the yellow metal bears the burden of the market’s sour sentiment, as well as the cautious mood ahead of important data and events scheduled for publishing during the week.

China coronavirus conditions trigger Gold price drop

The virus woes in China escalated and joined the protest against the government’s Zero-Covid policy to add to the market’s pessimism, which in turn exerted downside pressure on the Gold price.

China reported an all-time high of COVID-19 daily cases with nearly 40,000 new infections on Saturday. The dragon nation has been using the stringent policy to limit the virus spread but the outcome hasn’t been a positive one so far. On the contrary, a deadly fire in a building was allegedly linked to the strict virus-inspired lockdown measures and resulted in mass protests in Beijing and Shanghai.

Considering China’s status as one of the key Gold consumers, negatives from the dragon nation won’t hesitate to push back the metal buyers.

It’s worth noting that the People’s Bank of China (PBOC) cut the Reserve Requirement Ratio (RRR) by 25 basis points (bps) effective from December 5 but failed to impress the Gold buyers as the news was already priced in. Alternatively, downbeat prints of China’s Industrial Profit seemed to have favored the XAU/USD bears. That said, China’s Industrial Profit dropped to -3.0% during the January to October period versus -2.3% marked for the January-September era.

US Dollar struggles ahead of the key catalysts

Although the risk-aversion wave should have ideally underpinned the United States currency, which in turn could have been more bearish for the Gold price, the US Dollar Index (DXY) prints mild losses around 106.20 by the press time. The reason for the USD's downbeat performance could be linked to the cautious mood of the Greenback traders ahead of a speech from the Federal Reserve (Fed) Chairman Jerome Powell and the United States monthly employment data for November.

It should be noted that Fed Chairman Powell’s speech will be the first after the US central bank’s latest Monetary Policy Meeting and hence will be observed closely for clear directions, especially after the recently dovish Federal Open Market Committee (FOMC) Meeting Minutes.

Additionally, the US employment data for November keeps the Gold buyers hopeful as the headline Nonfarm Payrolls (NFP) is likely to ease to 208K versus 261K whereas the Unemployment Rate may remain unchanged at 3.7%.

Other than the aforementioned catalysts, the second readings of the United States Gross Domestic Product (GDP) Annualized for the third quarter (Q3), expected to confirm the 2.6% initial forecasts, will also be important to clearly predict the Gold price.

Gold price technical analysis

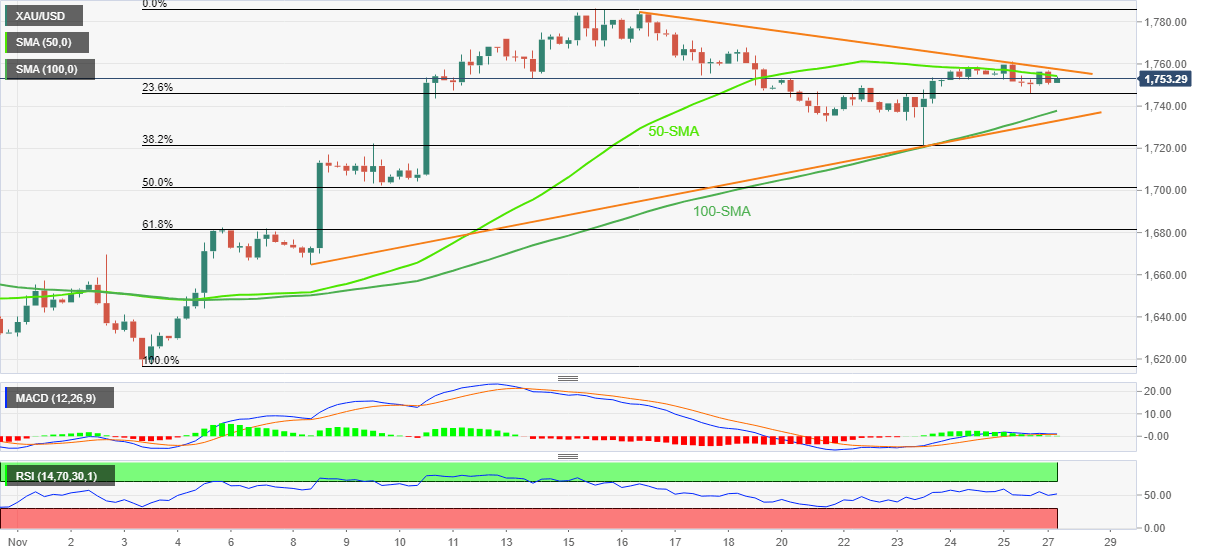

Failures to cross the 50-Simple Moving Average (SMA) join the impending “bear cross” on the Moving Average Convergence and Divergence (MACD) indicator to keep the Gold sellers hopeful.

It’s worth noting that a two-week-old descending trend line and an absence of oversold signals on the Relative Strength Index (RSI), located at 14, also suggest a further downside of the Gold price.

That said, the 100-SMA level surrounding $1,737 appears immediate support for the XAU/USD bears to watch.

Following that, the Gold price will have to conquer an upward-sloping support line from November 08, close to $1,733 by the press time, to keep the sellers on the table.

In a case where the Gold price drops below $1,733, the odds of witnessing the $1,700 theshold on the chart can’t be ruled out.

Alternatively, an upside clearance of the 50-SMA and the aforementioned resistance line, close to $1,760, appears necessary for the Gold buyers to retake control and aim for the fresh high of the monthly, currently around $1,787.

Gold price: Daily chart

Trend: Further downside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.