Gold Price Forecast: XAU/USD scales above $1,820 as DXY corrects, Fed policy buzz

- Gold price is auctioning around the $1,823.54-1,825.40 range, downside is expected on firmer DXY.

- A minor correction in the DXY has supported the precious metal.

- Investors should brace for an extreme hawkish tone by the Fed.

Gold price (XAU/USD) has displayed a minor reversal after hitting a low of $1,812.24 in the Asian session. The precious metal has witnessed exhaustion on the downside as the US dollar index (DXY) is facing offers after a juggernaut rally. A minor correction was highly expected to take place in the DXY as a perpendicular rally is followed by a correction but that doesn’t warrant a bearish reversal.

The DXY has faced selling pressure at the open, which has supported the gold prices. The former has slipped to near 105.00 after remaining rangebound in a 105.14-105.29 area. The upside bias in the DXY is solid as the Federal Reserve (Fed) is expected to sound extremely hawkish in its June monetary policy. The households in the US are facing hurdles in handling price pressures as the higher inflation rate is depreciating their paychecks, which is resulting in lower purchases and less confidence in the economy.

The market participants have started considering a rate hike announcement by 75 basis points (bps) as stiff quantitative measures will aim for containing the soaring inflation.

Gold technical analysis

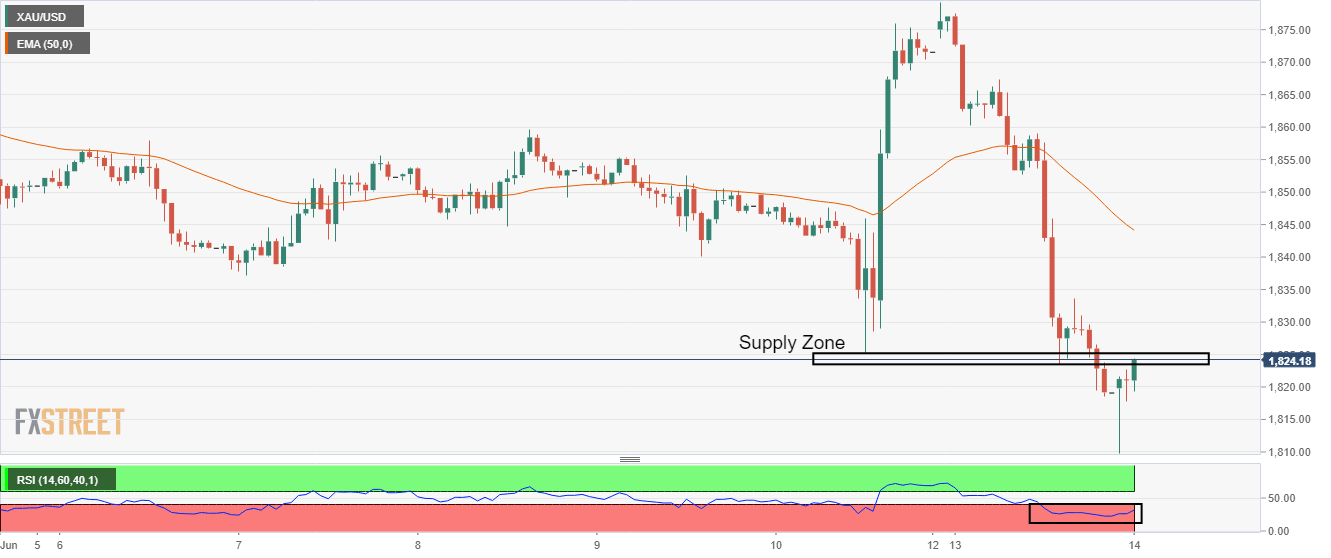

On an hourly scale, the gold prices are hovering around the supply zone, which is placed in a narrow range of $1,823.54-1,825.40. The prices of the precious metal are extremely lower than the 50-period Exponential Moving Average (EMA), which is trading at $1,844.10. Also, the Relative Strength Index (RSI) (14) has shifted into a bearish range of 20.00-40.00, which adds to the downside filters.

Gold hourly chart

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.